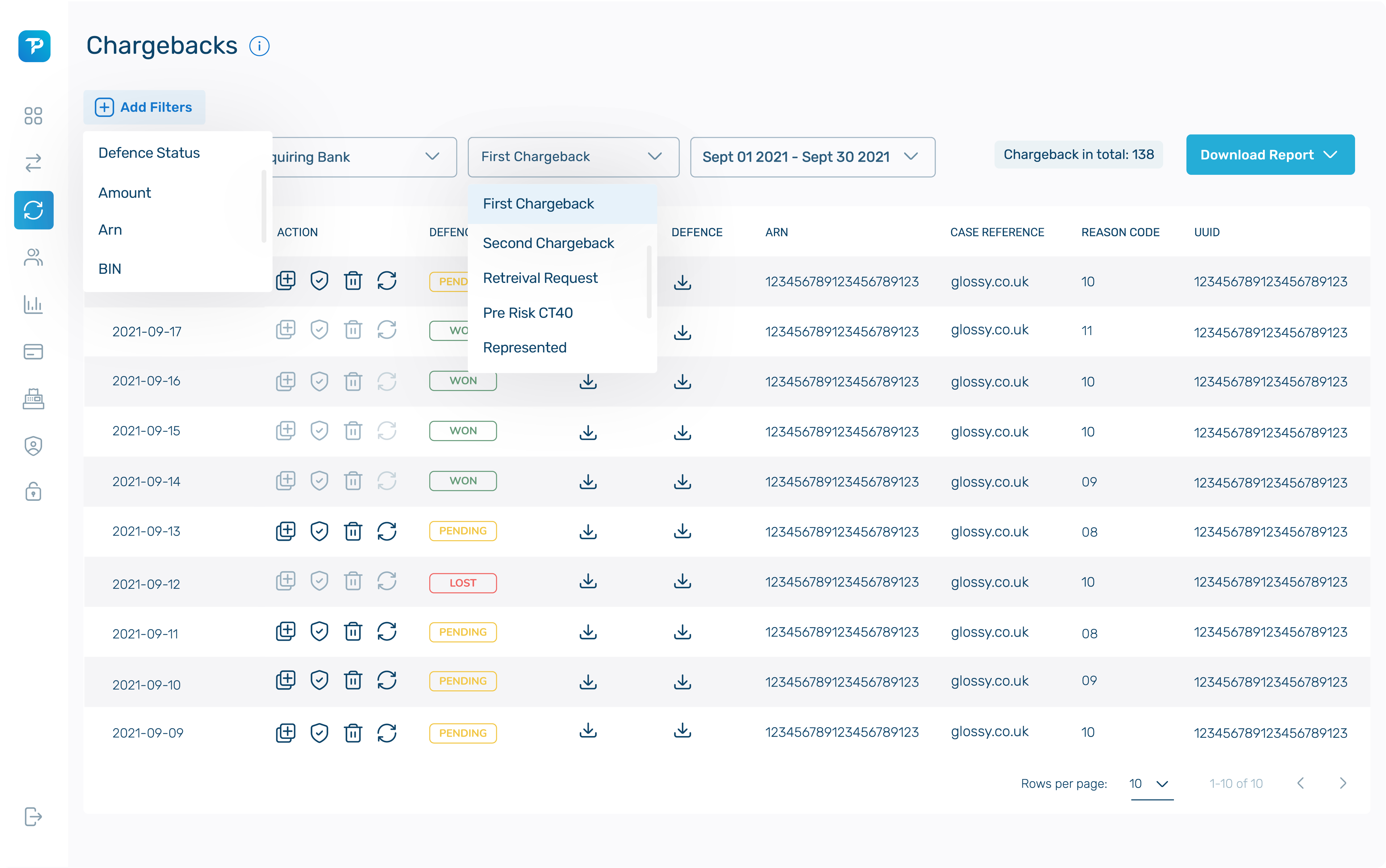

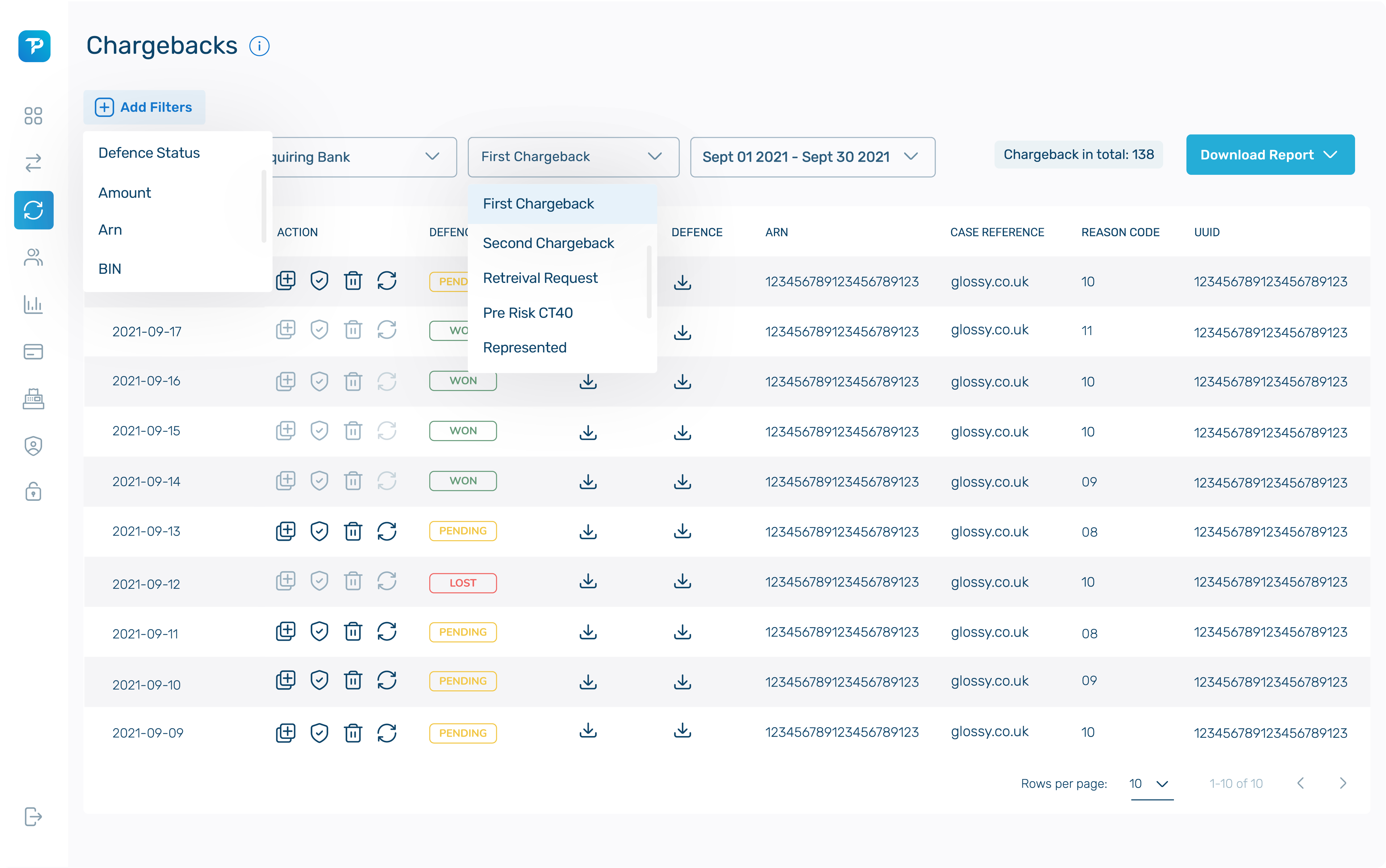

Defend Chargebacks

Defend chargebacks directly with Total Control – your single-platform solution for taking payments and risk management.

Take payments 24/7 and easily with a safe, secure payment gateway for your website.

Looking to switch your payment provider? Join Total Processing to instantly get access to quick and secure payments with a 99.99% processing uptime. Whether it’s a standard or high-risk payment gateway, with our customer-focused approach, our team of experts will guide you through the whole process from integrating the payment gateway and choosing the best payment methods to help you make savings on payment fees.

Go global with 198+ payment methods available for customers worldwide.

Defend chargebacks directly with Total Control – your single-platform solution for taking payments and risk management.

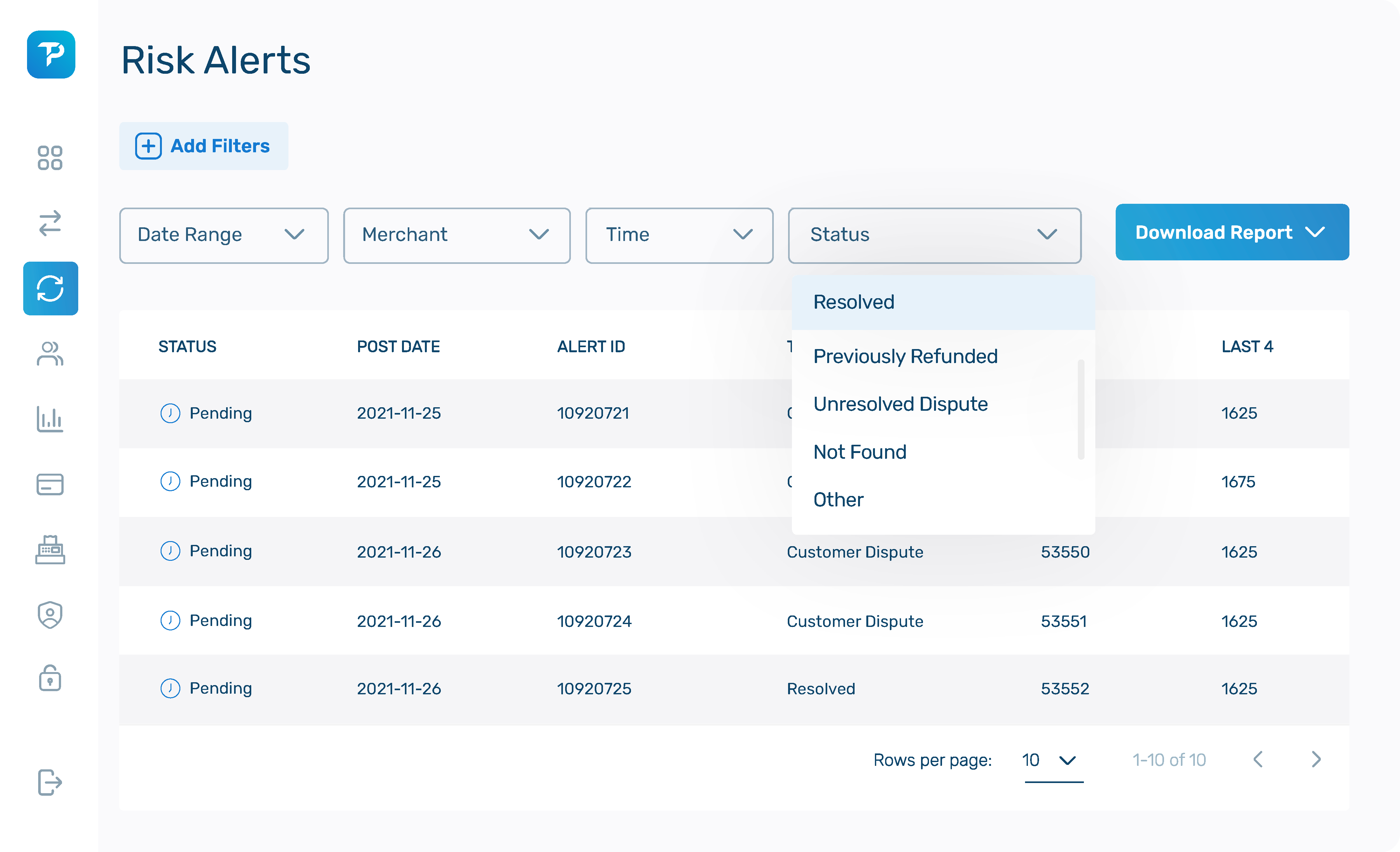

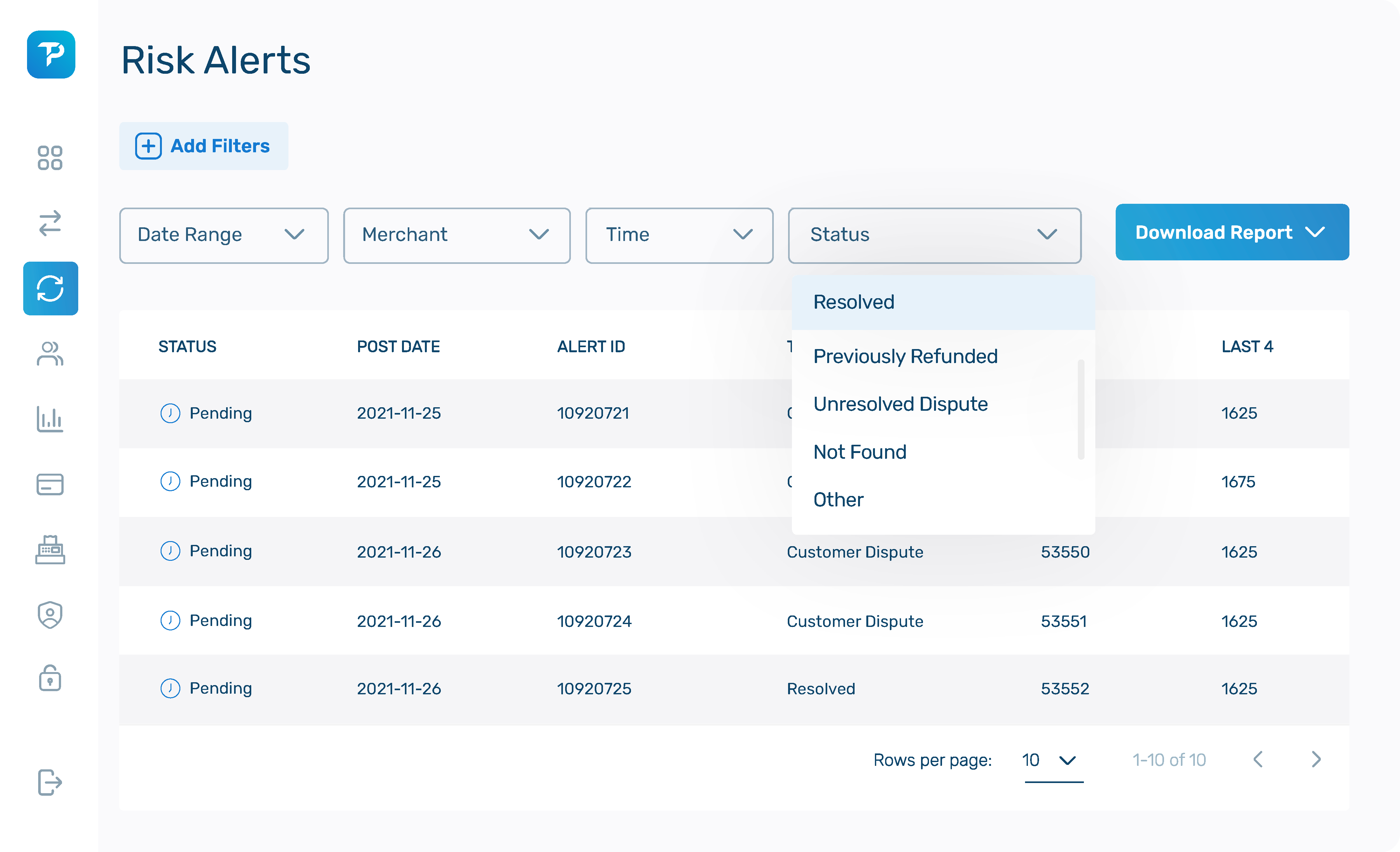

Manage risk with our customisable fraud suite. Implement industry-leading risk tools and custom rules to monitor and prevent fraud with ease.

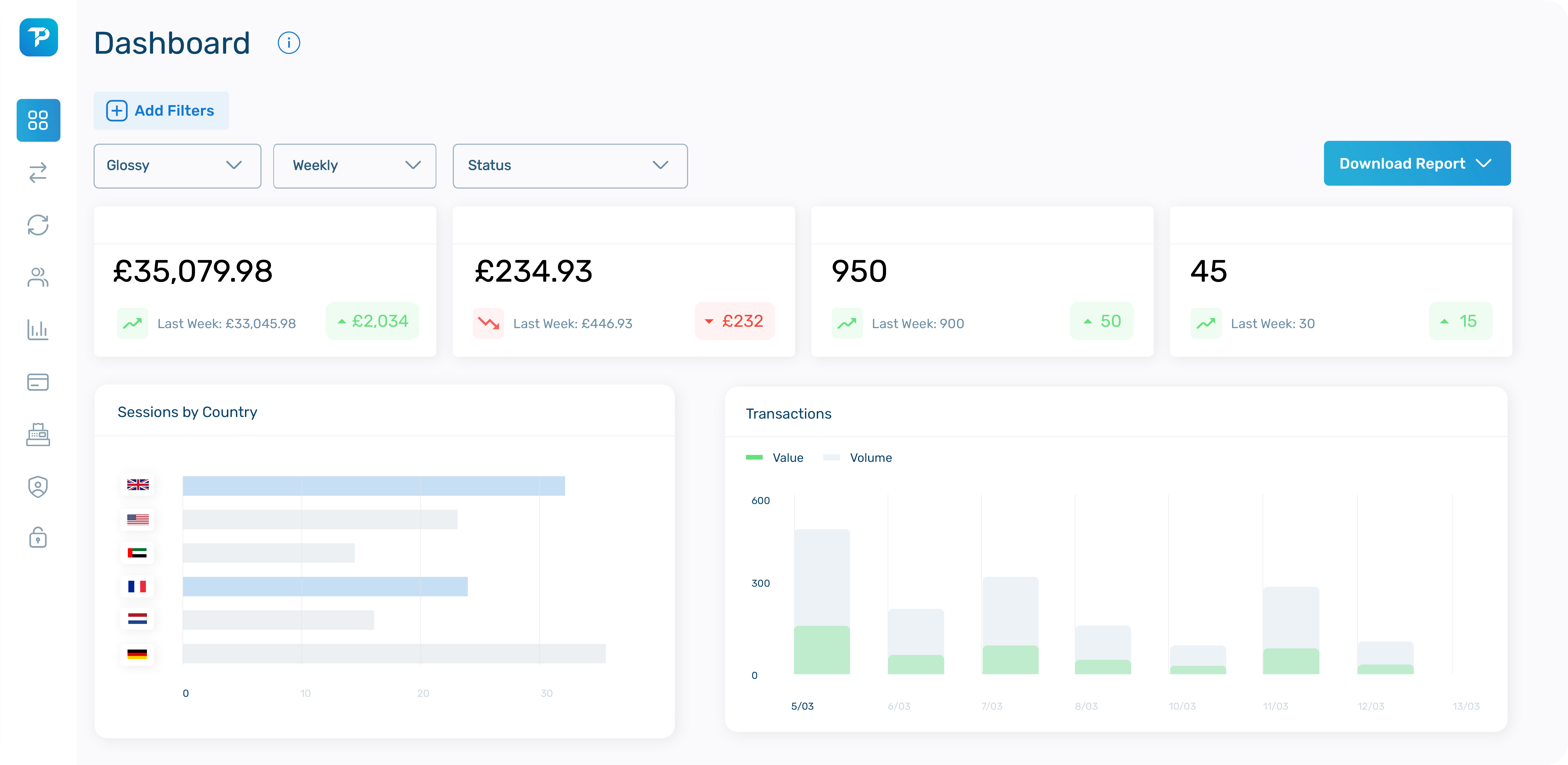

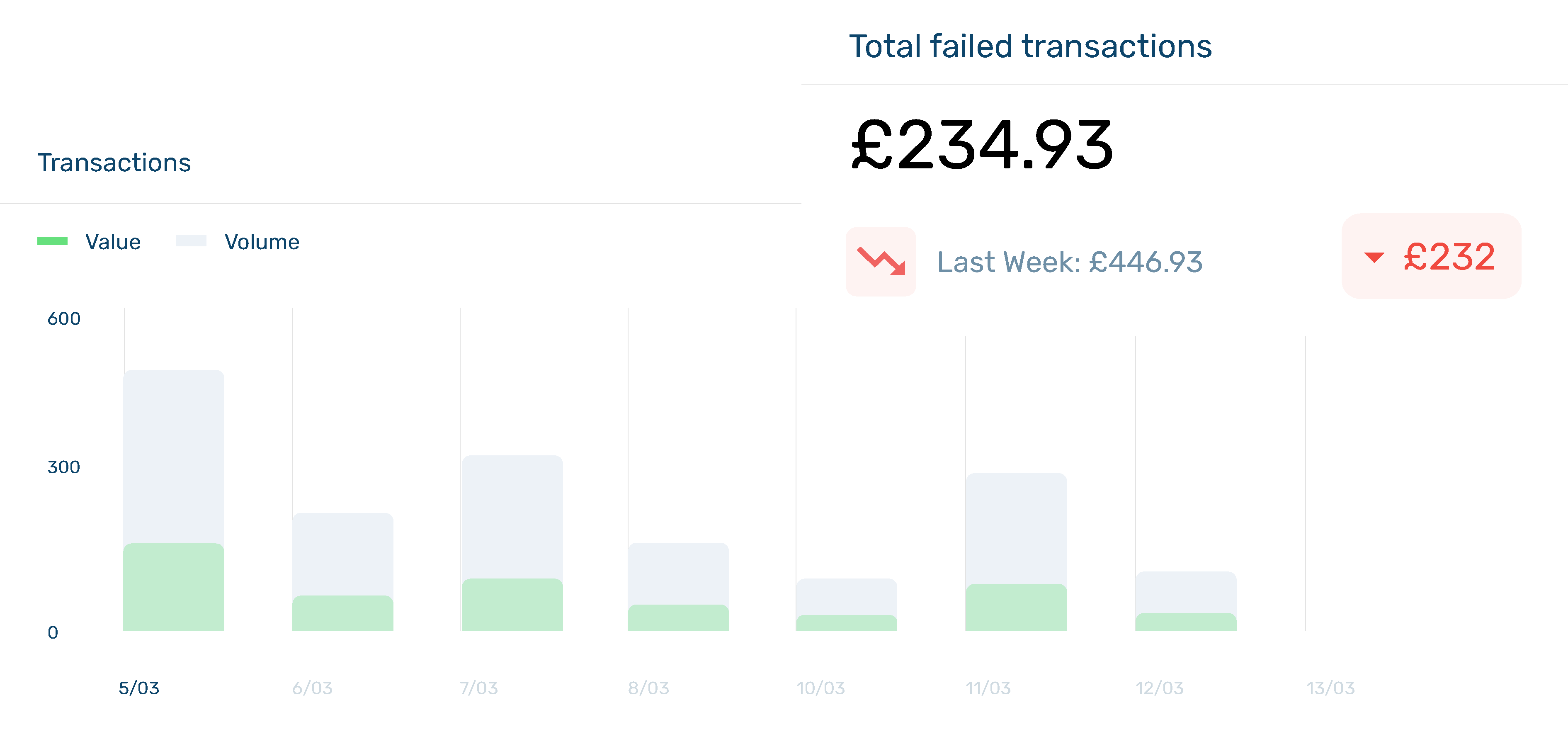

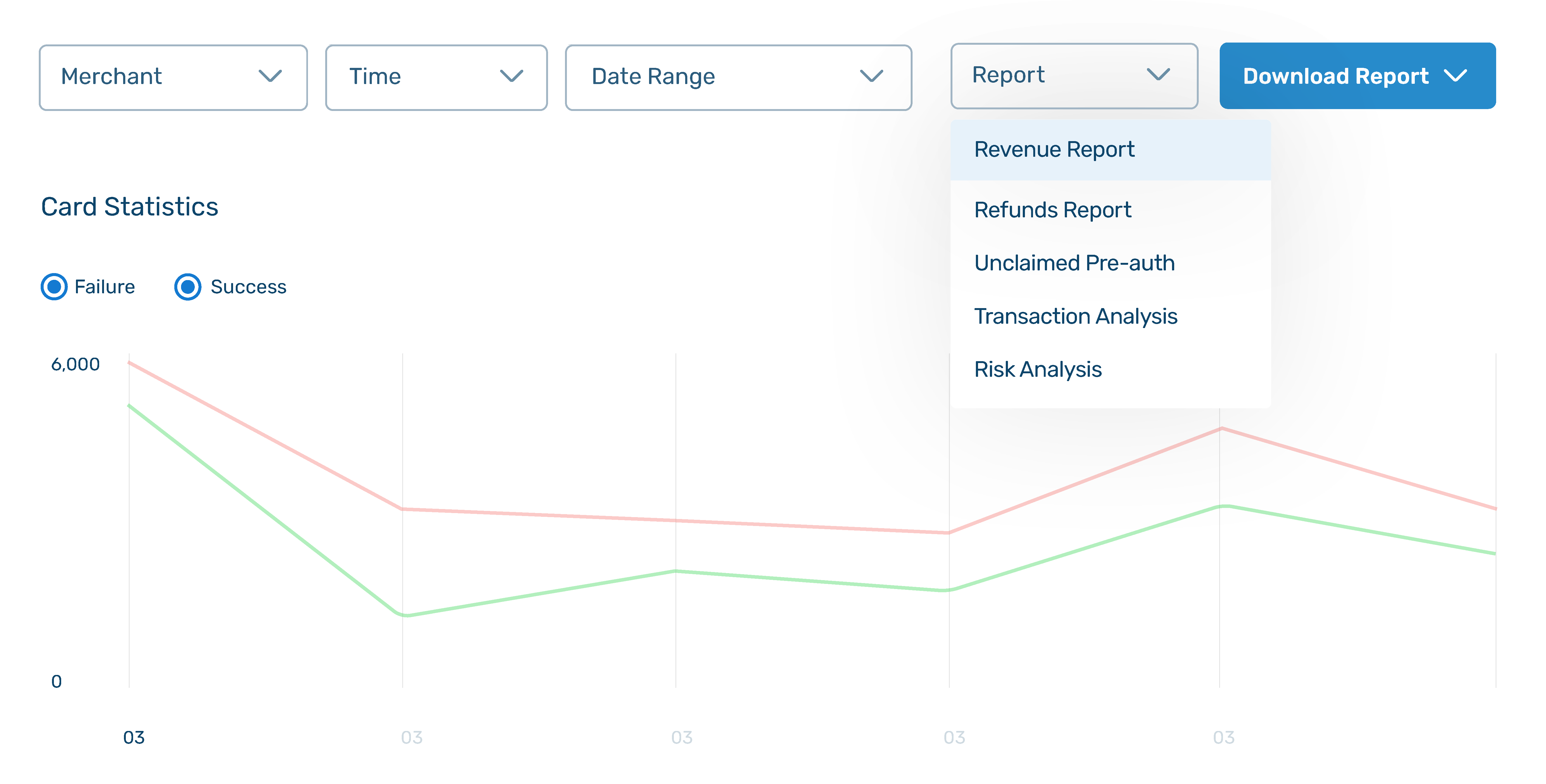

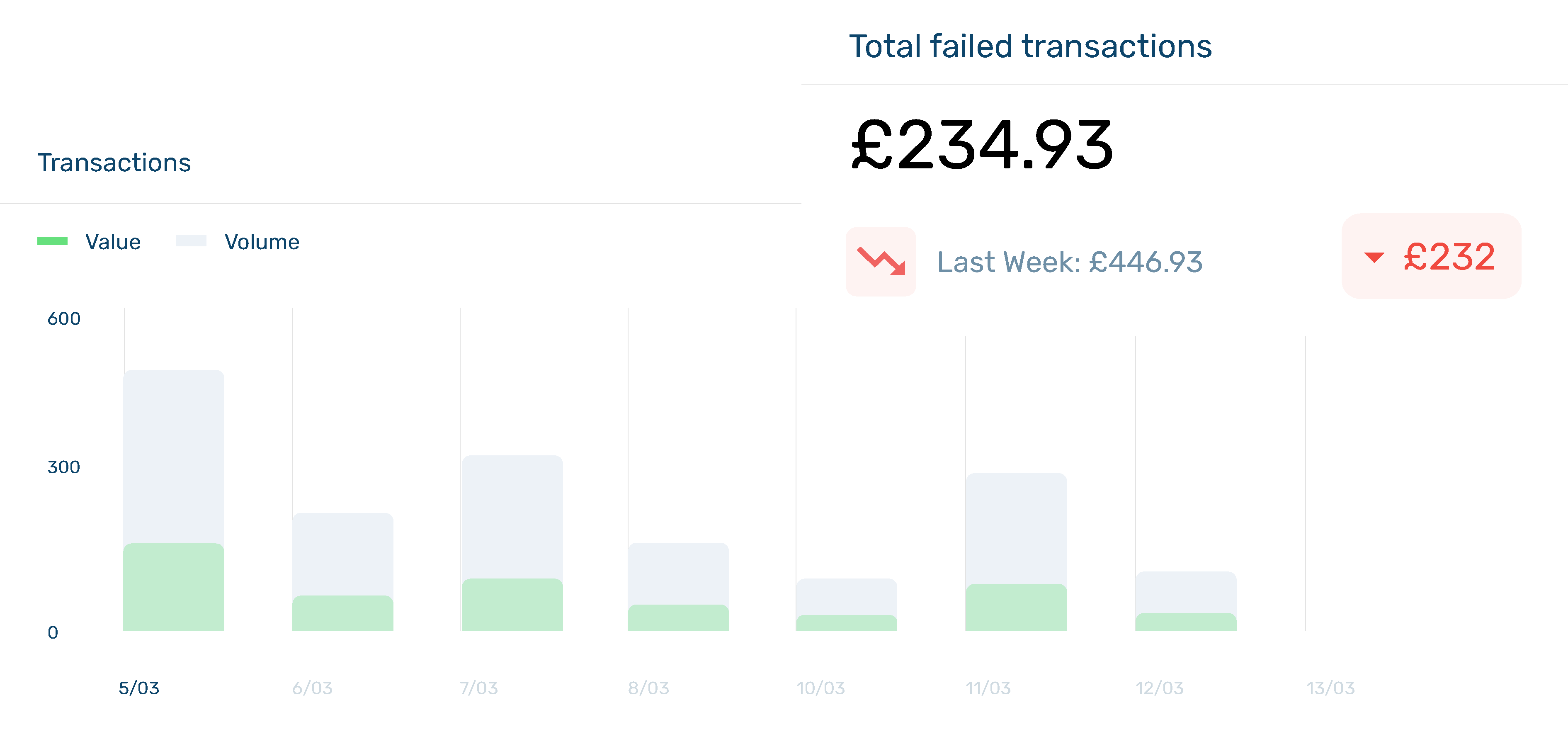

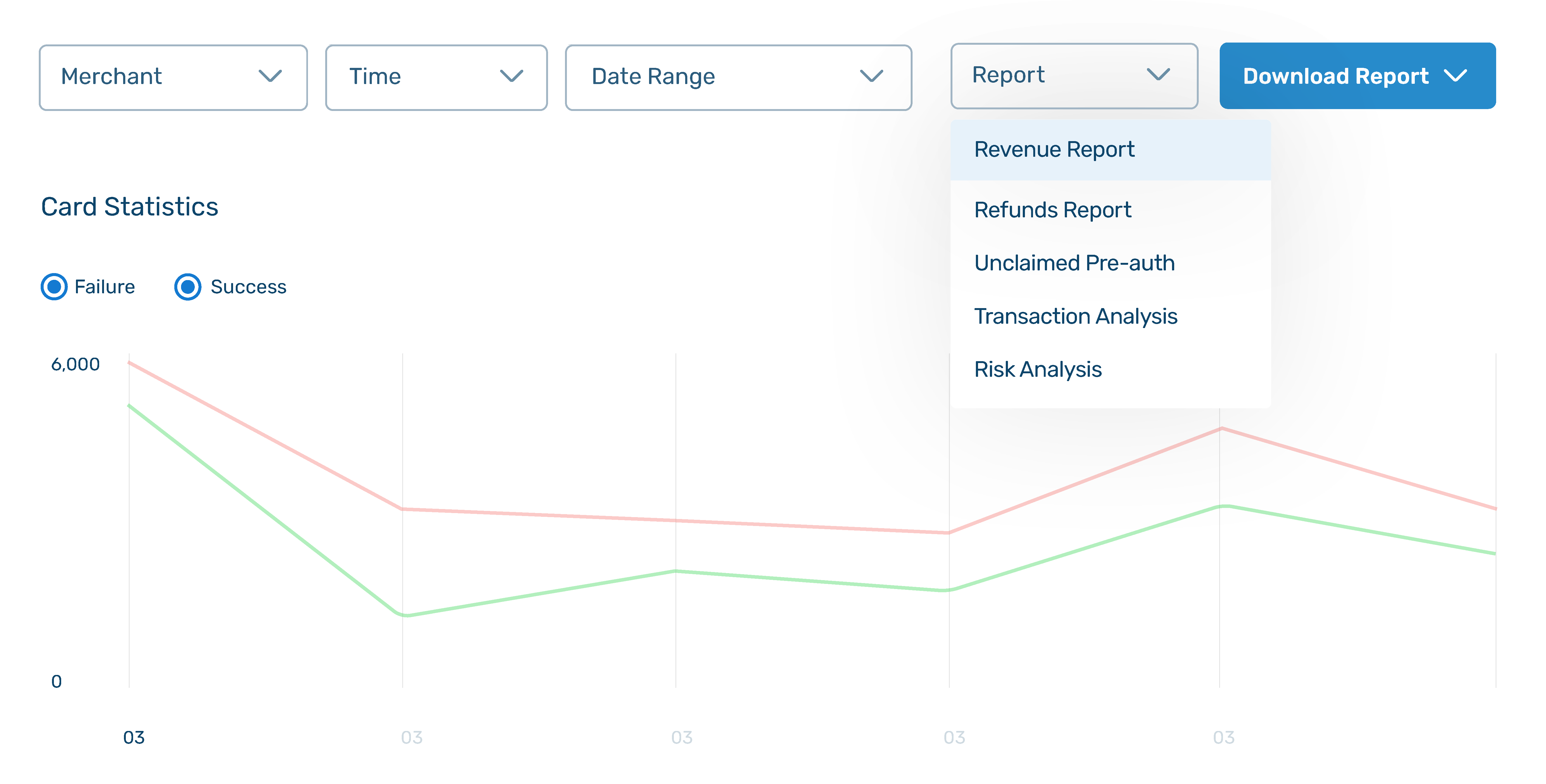

Monitor Risk with in-depth reporting – Real-time transaction analysis is taken from multiple data touchpoints.

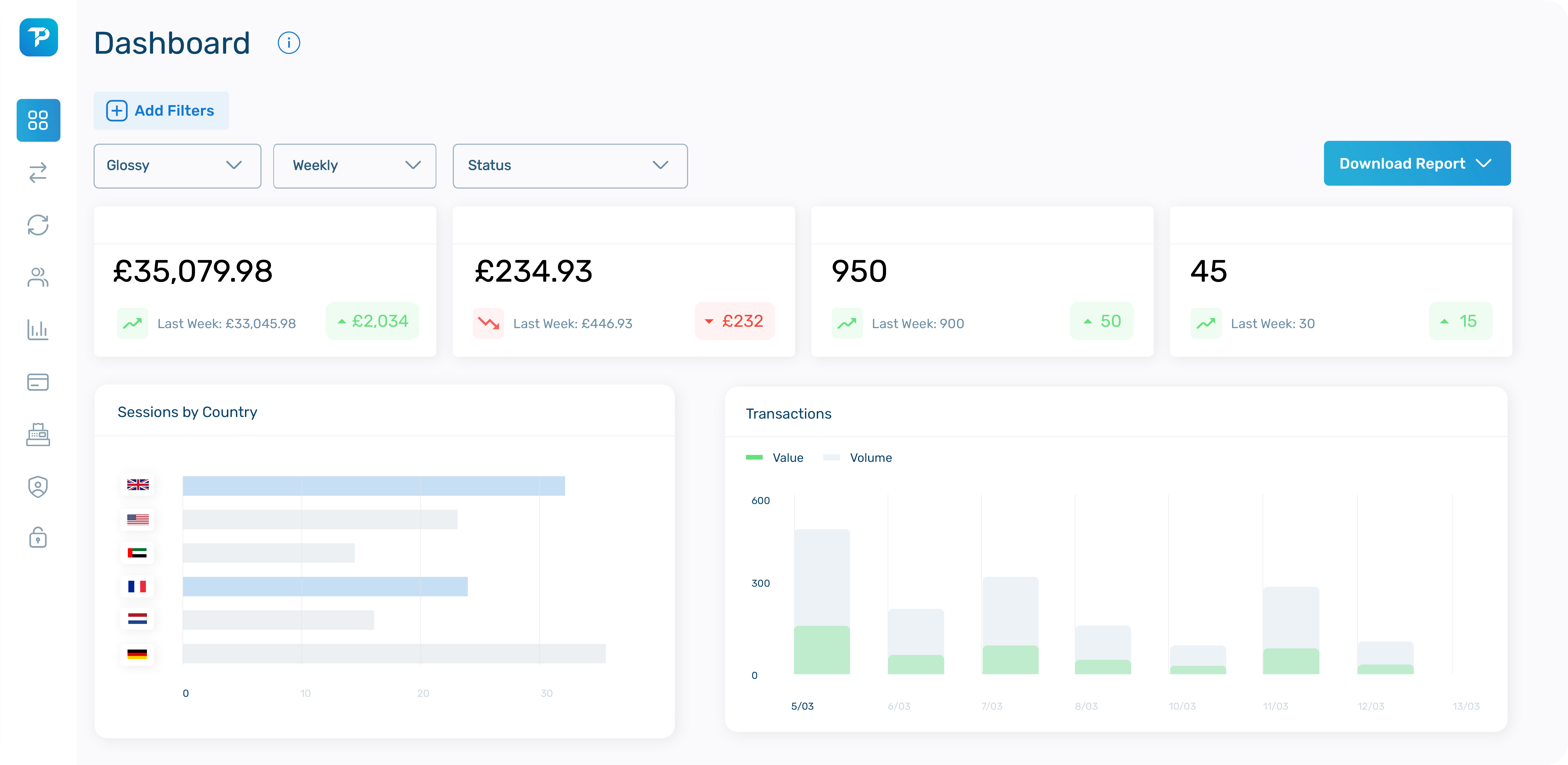

Get complete oversight of your transactions with full visibility of your processing history.

Filter and refine your transactions through a variety of search parameters available in Total Control.

Accept payments on a huge range of e-Commerce platforms and in-app services with our range of payment plug-ins. Our wide range of developer documentation is readily available to assist merchants using WordPress, Magento and Shopify. Start taking payments through Apple Pay, Alipay, Visa and all other popular payment methods today.

Connect with multiple acquiring banks and accept a range of payment methods by finding the right payments solution for your business.