Your All-In-One Merchant Account

Accept payments in-store and online with Total Processing. Get started with your merchant account today.

Take Payments

Start Accepting Payments With One Integration

Our plug-ins support a huge range of existing ecommerce platforms and in-app solutions.

Why Do I Need A Merchant Account?

A merchant account is necessary to allow your business to accept electronic credit and debit card payments. Your merchant account is a type of business account made to hold payments from your customers. It is held with an acquiring bank while waiting for payments to be approved by the customer's bank, before being sent to your business bank account.

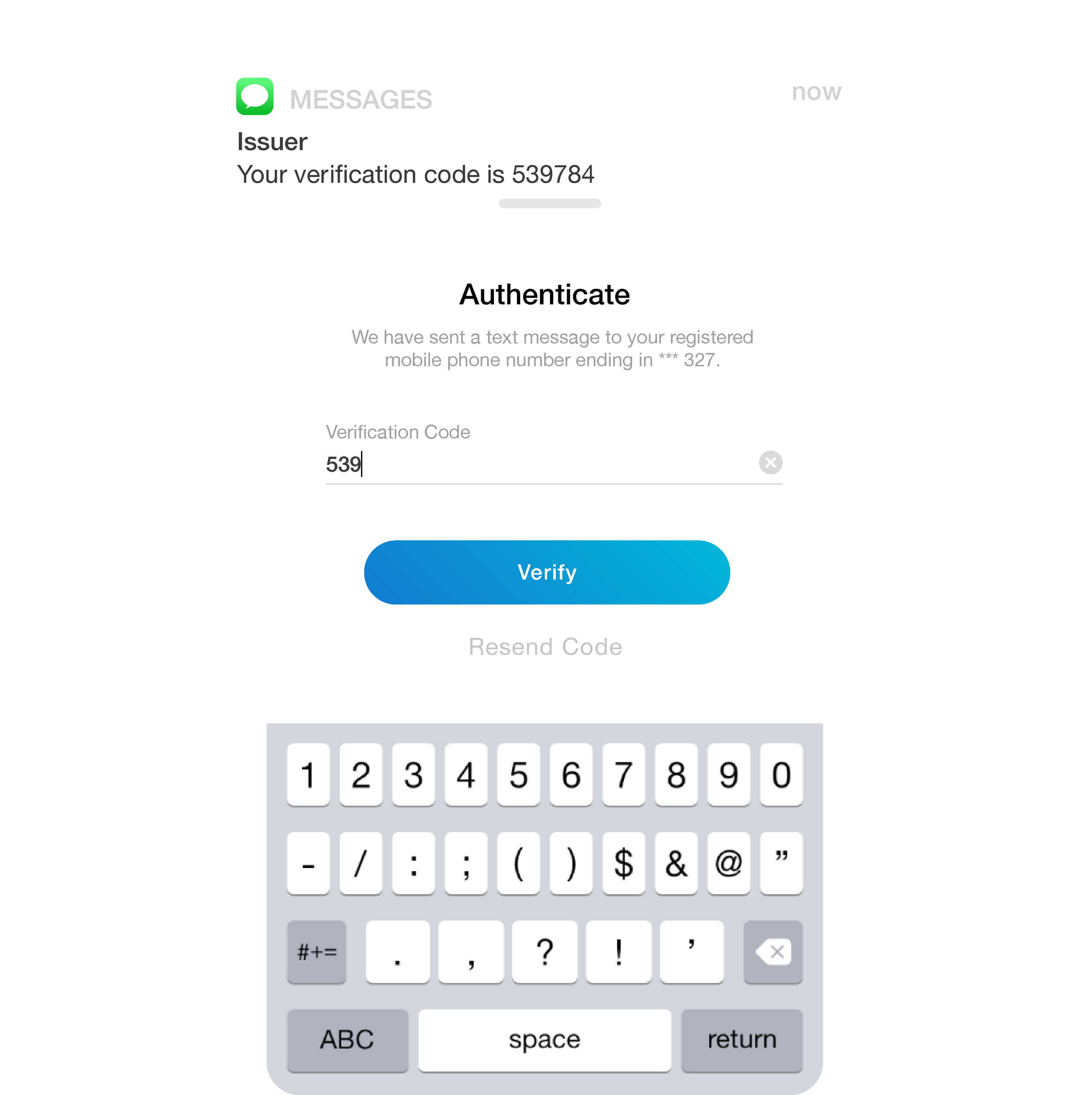

Merchant Account KYC

Know your customer (KYC) is the process that a business must go through in order to verify the identity of its clients. Many financial organisations are governed by a regulatory body, which states that each and every organisation has to be fully verified. KYC regulations are in place to protect both you as a customer, and the bank that you are using.

What Does A Merchant Bank Typically Ask For?

Banks can vary in their KYC requirements, but you can expect to be asked for some of the following KYC documents during the verification process:

- Passport or driving licence for the major shareholders and directors

- Utility bill or some form of address verification for the key shareholders (Personal ID)

- Utility bill or some form of address verification for the business (Business ID)

- Business bank statements

Each Merchant Bank has its own KYC process, and the way in which things are done will differ slightly from bank to bank; however, the above list details the basic supporting evidence that you’ll need to provide to ensure KYC compliance.

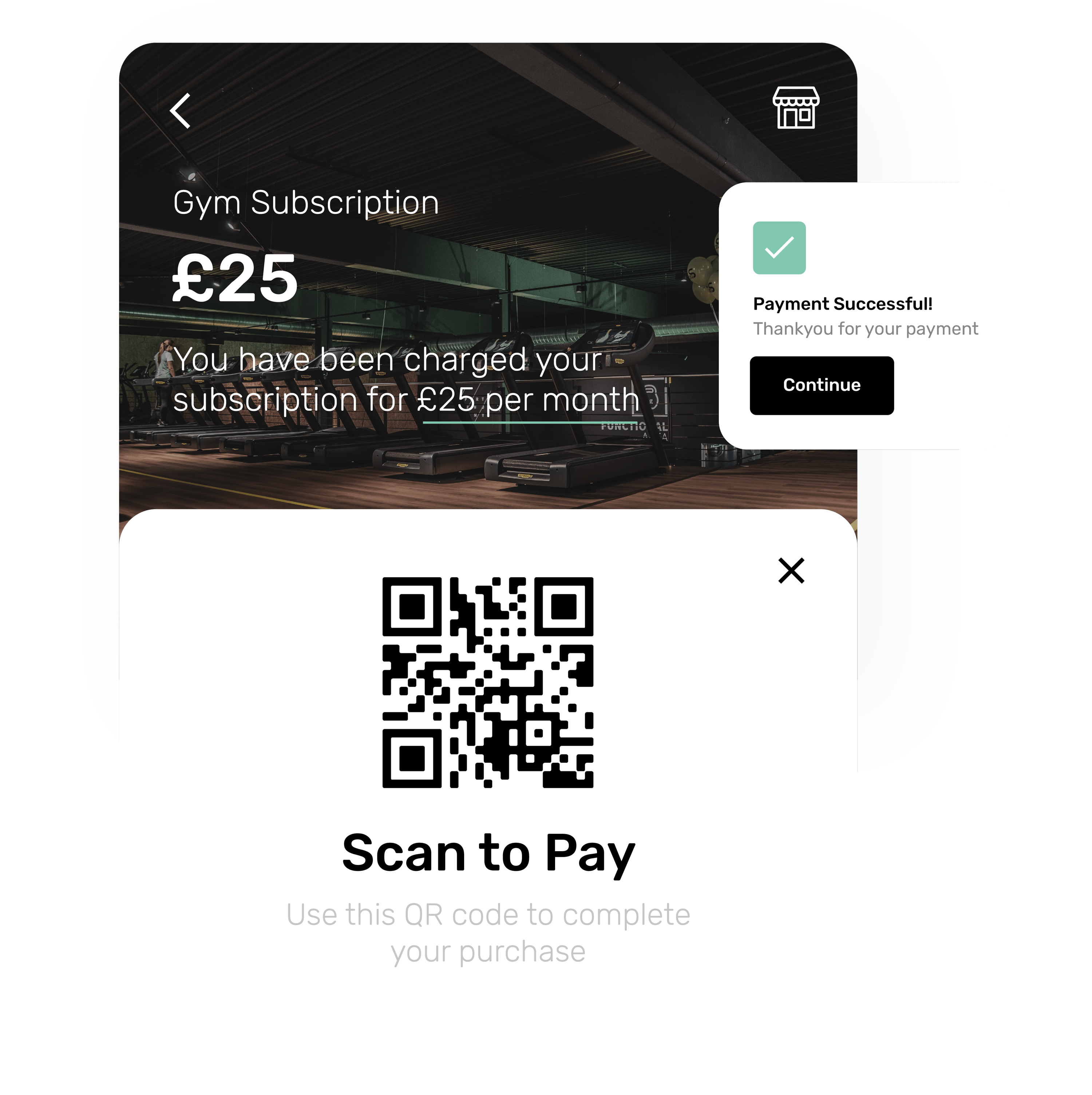

Accept Subscription Payments with Total Control Today

Acquiring

Freedom

Match with the best bank from our global partner network and get the best payment processing solution and rates.

Real-Time

Insights

Total Control’s dashboard shows an overview of your commercial activity, with actionable data insights and reporting.

Total

Control

Reconcile and manage transactions directly from your Total Control business dashboard.

Industry-Leading

Security

Verify transaction data and settle disputes conveniently and securely with industry-leading payment tools.

Get Started

Compare Rates From Multiple Banks With One Application

Frequently Asked Questions

To get a merchant account, all you need to do is get in touch with one of our specialists to get the ball rolling. You will need to provide relevant details about your business, then we will do the rest to get your merchant ID and get you onboarded so you can start accepting card payments.

There are no set-up fees with Total Processing. There are also no cancellation fees. The running costs, however, such as the monthly rental fees and per transaction processing fees, depend on various factors such as the type of industry and the level of risk involved in your business. A high-risk merchant account would cost more than a low-risk merchant account.

The amount of merchant accounts your business needs will depend on a ariety of factors. If you have several brick-and-mortar stores and are using POS systems (card readers) to accept card payments in person, then it’s recommended to have at least one merchant account for each location. You may even need multiple card machines at each site. You'll also need a separate account to take online payments, and you may need more depending on how you want to take flexible payment options. For example, you’ll need an additional account to take payments online by phone (a virtual terminal). This might sound confusing, but it doesn’t have to be. We will carefully review your business and help you figure out how many accounts you'll need to operate as smoothly and cost-effectively as possible. Then we will set it all up for free.

Yes. The two are not the same thing. You will still need a payment gateway to accept card payments, as well as many alternative payment methods such as Apple Pay, PayPal, American Express and more. We offer all-in-one packages that include a merchant account, payment gateway, payment processor and more.