High-Risk Merchant Accounts & Processing

Secure, accessible payment solutions and card processing for high-risk industries.

Do I need a high-risk merchant account?

Struggling to get a merchant account? Any business that falls into a ‘high-risk’ sector will find it more difficult to obtain one due to the increased chance of:

fraud

chargeback

volatility

But having a merchant account is essential if you want to accept credit and debit card payments online. So, what do you do? You get a high-risk merchant account designed for these types of businesses.

At Total Processing, we’ve got your back! We’ve established long-term, trusted relationships with more than 300 acquiring banks, so we can easily find the best high-risk account provider for your business.

We specialise in high-risk merchant accounts

There are so many industries that are classed as ‘high-risk’, some that you may not even realise. But you can get secure payment solutions for your business with Total Processing, no matter what sector you’re in.

Examples of high-risk sectors we work with include:

Hemp Oil

Dating Services

Foreign Exchange (Forex) Merchant Account/Services

Online Gaming and Gambling

Adult Entertainment

Credit Repair and Debt Management

Domain Registration

Events and Tickets

Software Downloads

Prepaid Phone Cards

Tobacco and E-Cigs

Insurance

Money Transfer

Vehicle Sales and Car Parts

Tattoo Studios

Investment Schemes

Lender Merchant Account & Services

PPI Merchant Accounts & Services

Nutraceuticals

Travel and Tourism

Payday Loans

Online Auctions

Health and Wellness Products

ISP and Hosting Services

Direct Sales and Pyramid Selling

Alcohol Products

Technical Support & Web Development

Jewellery, Watches & Accessories

Nightclubs and Bars

Cryptocurrency

Phone Locking Services

Get a high-risk merchant account with ease

Leading high-risk merchant

services providers

Secure payment gateway

With a standard high-risk merchant account, you will often receive:

- higher setup, annual and transaction fees,

- a longer settlement period,

- increased account security.

But with Total Processing, you’ll get so much more than that.

We provide a number of very secure payment solutions that will protect your business from risks, including a secure payment gateway. This will protect both you and your acquiring bank from the potential losses associated with chargebacks and card fraud.

The gateway we provide features high levels of control, enhanced security and many beneficial features:

Smart dynamic routing – Soft payment declines can instantly be retried with a fallback acquirer.

Integration with multiple acquiring banks – The acquirer agnostic gateway allows the merchant to partner with any bank and to have multiple Merchant IDs (MIDs) all within the same integration.

Chargeback alerts – Receive early warnings of any chargebacks raised with our chargeback defender tool so you have time to turn it into a refund, reducing costs.

Create blacklists – Deny payments from specific emails, IPs, countries, devices and addresses to prevent fraudulent activity.

Extra security controls – Powerful and flexible card verification and security tools that allow you to confirm details such as security cards and customer addresses.

Enhanced reporting functions – Track your transactions and defence in real-time with direct updates.

High-risk merchant account application & set-up

Tired of being turned down by banks? You won’t have the same struggle setting up an account with Total Processing.

Building reliable relationships over the years with multiple acquirers has left us in a strong position. They’re more likely to consider opening accounts for high-risk businesses who are processing payments using our high-risk merchant account payment gateway with its specific risk management tools.

We can also negotiate with the acquiring banks on your behalf to offer payment security solutions such as:

Fixed bonds

Rolling reserves

Deferred payments

Accept recurring payments with Total Processing today

MCC 6012

If you’re running a credit or financially regulated activity, like accepting recurring payments, then this merchant code is required.

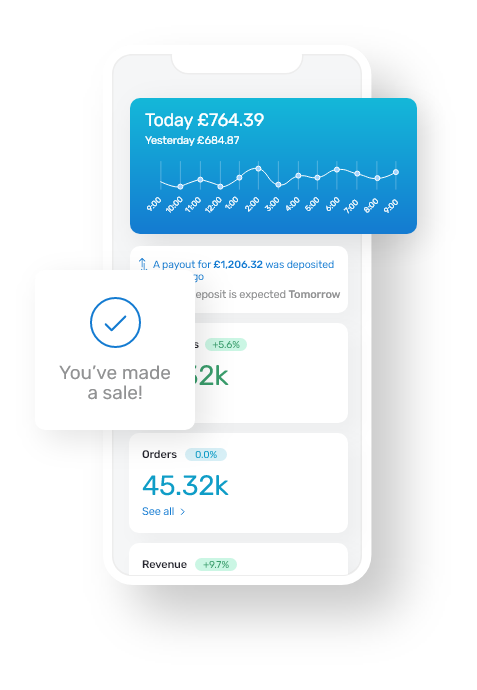

Real-time insights

Receive in-depth payment data for your business directly in Total Control – your bespoke business dashboard.

Total Control

With complete transaction visibility in real-time, you can manage your payments, receive a detailed report of your commercial activity and predict your revenue.

Fraud prevention

Keep ahead of fraudulent transactions with our suite of risk management services and chargeback defender designed to protect your business.

Get started

One integration to start accepting payments.

Our plug-ins support a huge range of existing e-commerce platforms and in-app solutions.