What’s the one key player that e-commerce platforms rely heavily on for success? That’s right, the payment gateway. In this blog, we’ll delve into the intricacies of e-commerce payment gateways, helping you understand their importance, the best options available and how to choose the right one for your online store.

What’s in this article?

At its core, an e-commerce payment gateway is a technology that facilitates the secure transfer of payment data between a customer, an online store and the financial institutions involved, such as the bank, card scheme or payment provider. It acts as a virtual bridge, ensuring that sensitive information such as credit card details is encrypted and transmitted securely, safeguarding both the buyer and the seller from potential fraud.

When it comes to choosing the best payment gateway for your e-commerce venture, several factors should be considered. The market is flooded with options, but some stand out for their reliability, security, customer support and ease of integration.

There are a number of factors to consider, and which ones you focus on will depend on your business model and future goals. Let’s go through what to look out for to help you find the payment gateway for your e-commerce store.

Payment gateways must follow strict rules known as the Payment Card Industry Data Security Standard (PCI DSS) to ensure card information is handled safely. But depending on your transaction volume and business model, different compliance levels apply. So you’ll want to assess what levels of security your business needs. For example, high-risk businesses, like those in the CBD industry, will require extra security measures to protect customer data and reputation.

For optimum security, prioritise payment gateways that employ robust security measures, such as SSL encryption, and can offer additional tools, like chargeback alerts, IP blacklists and smart dynamic routing to keep your authorisation rates high and fraudulent activity low.

There are a range of different e-commerce platforms, plugins and third party providers to choose from. You’ll need to assess the capabilities of all the technology and software involved to see if they are compatible with each other, as well as with the payment gateway.

For example, if you’re using WordPress, then you’ll need the WooCommerce plugin to accept payments. This is a great option for small businesses; its user interface is simple and integration is a breeze. However, there are some compatibility issues with other plugins, so you’ll need to conduct a test to see which ones you can or can’t use.

Alternatively, there’s Magento which can offer a much more bespoke experience. However, its integration is more complex and you’re likely to need a developer to navigate it.

These are just two options of many. You can find out more about e-commerce plugins here.

Which platform and plugin you opt for, and their compatibilities, will be a big influencer of which payment gateway is right for you to ensure you can offer local payment methods, accept cross-border transactions, easily grow the volume of transactions, etc.

There are many fees associated with payments, so finding one that doesn’t break the bank and works for your processing volume is important. But it’s not just the fees you need to be aware of, there are also two pricing structures to think about: Interchange++ and blended.

The blended pricing structure is a fixed price. It’s the simplest structure of the two which can make it an attractive option for small businesses and startups. However, because the price doesn’t alter depending on how much you actually process, it can work out more expensive.

Whereas the interchange++ pricing structure is a little more complex. It will split out each fee so you know exactly what you’re paying for. Although you will need to have a stronger understanding of the fees to use this structure, it can often work out the better option when it comes to cost.

For a more detailed explanation, we have a blog dedicated to interchange and blended pricing.

A payment gateway that provides a smooth user experience for your customers can contribute significantly to your online store's success. But it’s not just the customer’s experience you’ll want to consider, you may also want to bear in mind the experience for you as the merchant.

For example, in-depth reporting and full visibility of each transaction is increasingly important, especially if you want to leverage your data to fight fraud and analyse customer behaviour.

Having access to these insights can open up a whole host of opportunities, such as revenue prediction and automated tasks to boost sales and reduce resource costs. But it all starts with an easy-to-use interface that the payment gateway can provide.

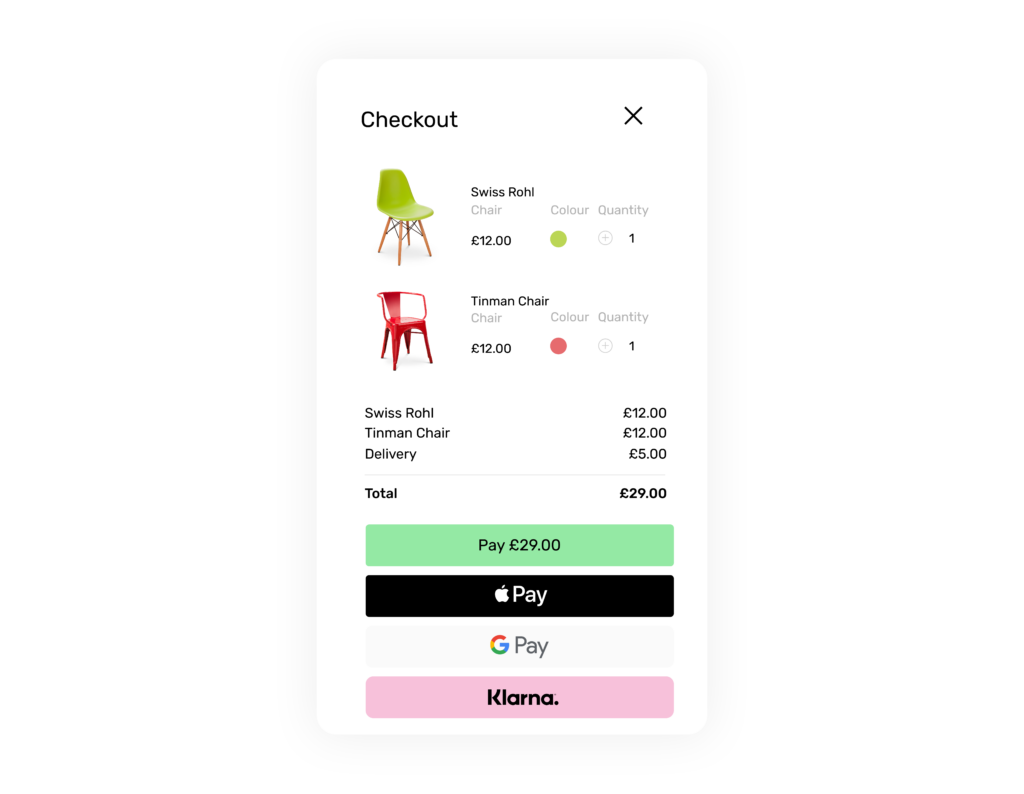

If you plan on expanding internationally, opt for a payment gateway that supports a wide range of currencies and payment methods. There are so many alternative payment methods available these days and each region will have their preferred choice. For example, Alipay and WeChat Pay are huge in China, whereas iDEAL is the go-to in the Netherlands.

A payment gateway that can access local acquires and integrate a range of payment methods is crucial if you want a global presence and to expand your consumer base. Here at Total Processing, our gateway has access to more than 198 alternative payment methods.

Issues can occur no matter which payment gateway you choose, whether that’s failed payments or processing downtime, so opting for a gateway that has 24/7 support will be invaluable.

Having on-hand support will ensure issues are resolved quickly and efficiently, so you can continue to take payments without a hitch. Sure chatbots can help with quick and easy questions, but knowing you have that human support on the other end of the phone or email can make a huge difference.

To integrate a payment gateway into your e-commerce website, you’ll first need to work out what your business needs. With Total Processing, there are a few options to choose from; our payment platform is compatible with a range of e-commerce platforms such as WordPress and Shopify. It also offers a selection of plugins that cater to different business types and content management systems (CMS). You have the flexibility to choose the most suitable option based on your specific business needs and the CMS you utilise, for example, you could opt for WooCommerce which serves as an e-commerce plugin designed for WordPress.

For more information, check out our blog on how to integrate a payment gateway.

Selecting the right e-commerce payment gateway service is a critical decision that directly impacts the success of your online business. By understanding your business requirements, researching available options and considering factors such as security, ease of use and global reach, you can make an informed choice. Remember that the best payment gateway for your e-commerce website is one that aligns with your business goals and provides a secure, seamless and reliable payment experience for your customers.

Want to know more? We have a more in-depth blog that tells you everything you need to know about payment gateways.