How to increase conversions rates

What’s the most important factor for any business to succeed? Conversions! If your conversion rate takes a hit, then all areas of your business will struggle. But don’t fret, there are many ways to optimise your website to increase sales, and it all begins with data.

Transactional data is there to be leveraged; the key is in how merchants use it to retain both revenue and consumer loyalty for long-term growth.

We’ll guide you through the key avenues where a transaction could be gained or lost, whether that be in how you accept online payments with the methods you offer, checkout page friction or lack of data to understand your demographic.

Before we take a look at the strategies used to increase sales, first let’s see what could be holding you back. When a customer goes to make a purchase, the number of elements that can cause them to abandon their basket can happen before the customer even clicks ‘go to checkout’. Even after that, the threat to your bottom line hasn’t gone yet.

The main elements that can have the biggest effect are site optimisation, checkout flow and fraud. They’re variables that occur at different stages of the customer journey but can all affect merchant revenue and customer retention.

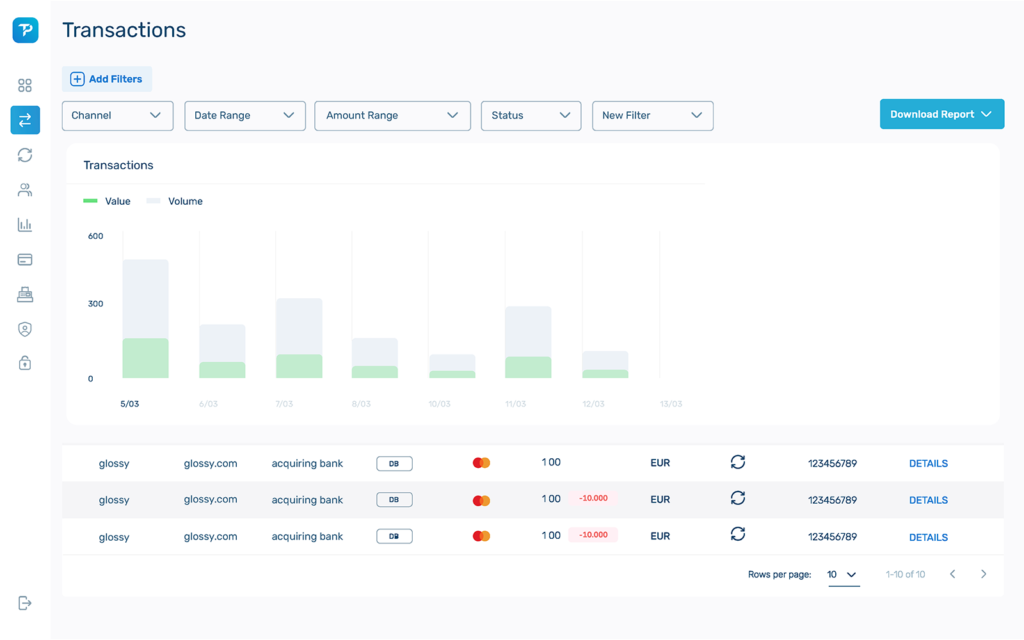

As we’ve mentioned, leveraging transactional data for every completed and abandoned purchase can give a very telling picture of both the success and downfalls of your processing; and how it can further be used in marketing campaigns.

Data can dictate where your customers are dropping off in the journey, but here are some of the key elements that you likely need to optimise.

Let’s begin by looking at cart abandonment, focusing on getting products through the checkout successfully, without friction, to increase consumer retention and loyalty.

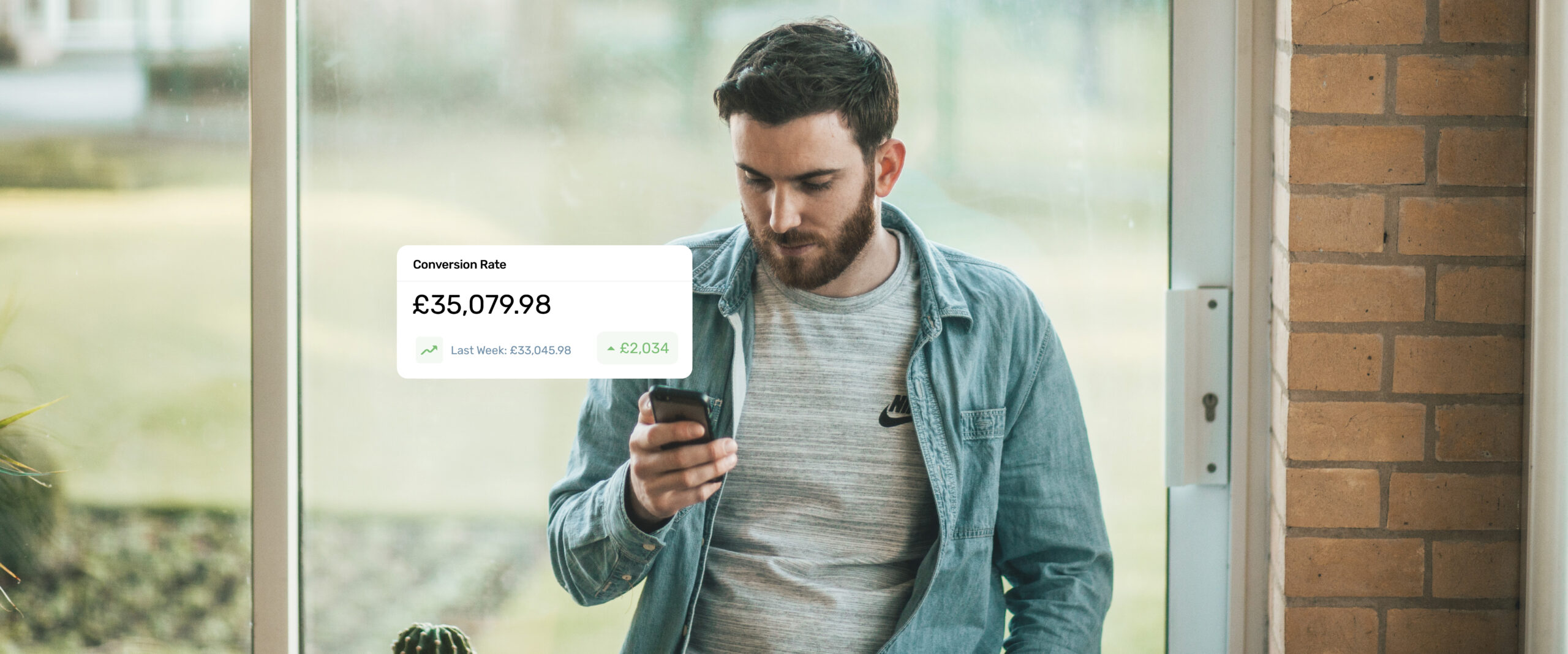

Only last year, cart abandonment rates were at 72.86%. Whilst this figure has come down slightly in recent years, it is much higher for mobile and tablet devices. Due to a lack of alternative payment method offerings and optimisation, the friction created through checkouts on these smaller devices spikes cart abandonment rates to 85.65% and 80.4% respectively.

Working out the main cause for your consumers to abandon their cart will lead you in the right direction to see which element you should optimise first.

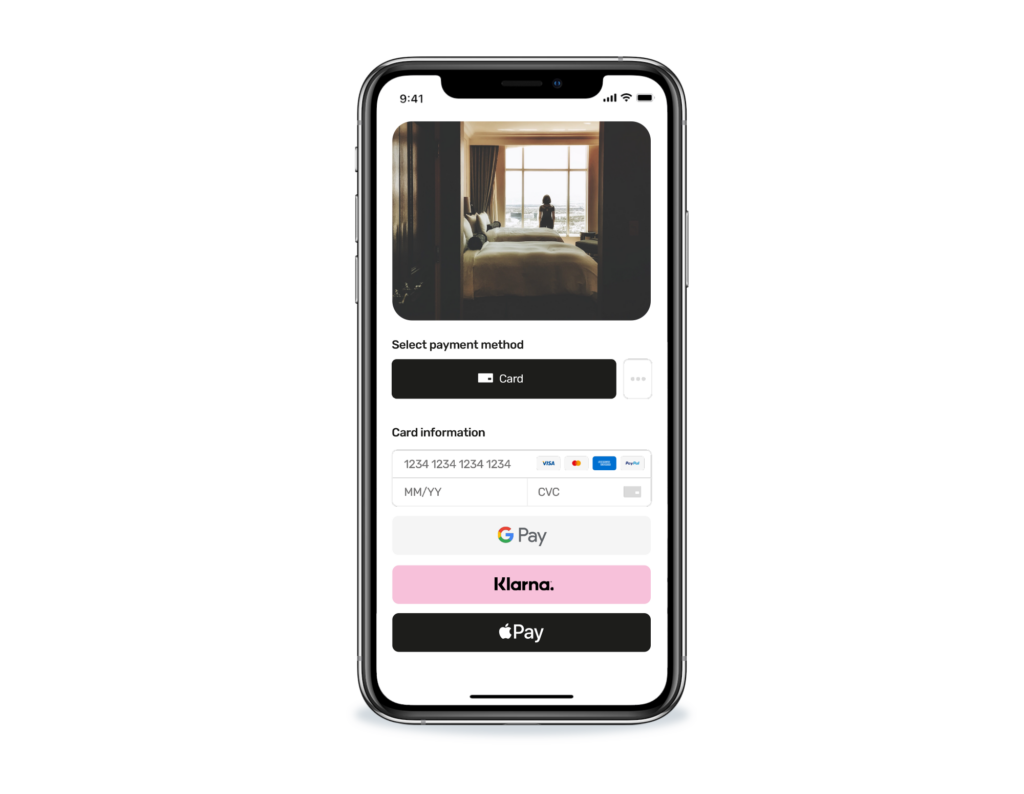

The list of alternative payment methods (APM) available these days is pretty long, but does that mean you should offer all of them? Not necessarily.

If we look at devices on a surface level and just take size into account, it’s obvious that trying to fit everything from the desktop checkout into smaller screens doesn’t always work. Simply, one size does not fit all – at the checkout or in traditional marketing.

Instead, use data to see which payments are the most popular in the market to add them to your offering, and then which ones amongst those are mostly used by your consumers to implement into your mobile checkout.

Since we’re used to speed and convenience these days, striking a balance between providing a range of payment methods that can fulfil a one-click checkout without slowing down the loading speed by offering too much is key.

So, digital wallets are a good place to start. In the US alone, Apple Pay users have been forecasted to hit 48.7 million in 2023, so that’s a lot of consumers you’re targeting. A case study from Google also found that offering Google Pay as a default for new users increased conversion by 20x.

Optimising the checkout flow with APMs can also help resolve friction that occurs from security compliance. The additional security steps at the checkout can often dissuade genuine customers from making the purchase.

Shoppers were often declined at the checkout due to a false decline (where valid card information is incorrectly rejected) caused by overzealous fraud parameters. However, since the use of biometrics has become the norm when using smartphones these authentication steps feel like second nature these days. Therefore, with the right APM, security measures can be met in a way that reduces the number of do not honours and false declines that a merchant has to deal with.

Another way merchants can ease friction at the checkout is by providing the option to save the customer’s card details; it’s a PCI-compliant way to make the checkout flow even quicker. By securely tokenising their card, the customer can use a one-click checkout journey without the need to verify the payment during every transaction.

One of the most important objectives for any business to obtain a profitable revenue is to reduce fraud. Friendly fraud, like chargebacks, can make a big dent in a business’s revenue due to a rise in refunds, wasted shipping costs and fines from the banks and card schemes.

Due to chargebacks alone, merchants lose an average of $3.75 for every $1 lost due to the added fees. So ensuring you have the right tools in place to combat this will help your bottom line.

Rather than offer a one-size-fits-all approach to fraud, like a lot of services, our suite of tools gathers information from every data point and assesses where and how it can be utilised. This insight can highlight how different demographic elements are suited to different strategies; just like differing marketing campaigns.

Fraud checks performed as a standard across the payments space are:

A trio of tools we offer are as follows:

Comparing this data against other data sets will help to detect discrepancies. Not only that, the more insights you gather, the more Machine Learning tools can use algorithms to perform predictive analysis on consumer spending, which helps to determine whether a transaction is likely to be fraudulent or not.

From this data, you can set rules on how to proceed to trigger methods such as 3D authentication or to set warnings for when a merchant is likely to receive a chargeback. Basically, data can be used to keep you ahead of the game when it comes to fraud so that you can limit the damaging costs and keep your revenue up.

Without insights you might as well build out campaigns with a blindfold on. It’s fundamental when it comes to understanding your consumer base so that you can create an effective marketing strategy to increase your website conversion rate. The mass market is more fragmented than you think, so you need to be able to target multiple markets whilst maintaining a cohesive brand message.

Keeping pace with actual purchase behaviour allows marketers to redirect campaigns to specific behaviour, such as an abandoned cart email campaign. The key here is to use insights from transaction data over time, to measure the flow of behaviour and add this to the current demographics.

All of the data you gather, including from the standard fraud checks combined with the regularly acquired data such as consumer demographics, a retention score and the RFM score (Recency, Frequency and Monetary Value) can be used to provide a solid picture of your consumer base. By determining the consumer’s purchasing behaviour, you can tailor marketing messages, explain motives behind these changing patterns and give methods as to how to maximise individual response rates.

The goal? To identify promising areas of growth and enhance direct response rates to marketing campaigns to ultimately, improve customer retention.

Here at Total Processing, we offer solutions that target the pain points and friction in processing and reconciliation that causes a drop in your conversions.

Our smart fraud suite provides the tools to track and manage the risks to your business, alongside chargeback alerts, IP blacklists, verification processes and more. Combined with 198+ alternative payments to choose from, 300+ local acquirers to increase authorisation rates and in-depth reporting and analytics, all integrated within a unified dashboard, you’ll have all the answers you need to hand so that you can implement an efficient strategy to grow your business.

Are you ready to get access to all the analytics you need to create strategies to increase your sales, improve your customer retention and reduce the risk of fraud, ultimately increasing your conversion rates? Get in touch with a payment specialist today.