SOFORT

What Is SOFORT?

SOFORT is a leading online banking method used across 8 countries in Europe including Germany, Austria, Switzerland and Belgium. With over 85 million active users, SOFORT is a staple checkout option for merchants looking to take payments in Europe.

SOFORT Banking is a European-wide payment method that allows shoppers to pay for their purchases or make donations without having to create an account. Customers use their personal online banking credentials to log in and transfer money from their bank accounts. SOFORT Banking has a TÜV certificate which guarantees the safety of using it as a payment method.

SOFORT Banking can be used by shoppers from 8 countries in Europe. This makes it the ideal payment method to allow for Europe-wide expansion, which will drive conversions. SOFORT Banking is available in Germany, Austria, The Netherlands, Switzerland, Italy, Spain, Belgium and Poland. It works with most consumer banks from these countries.

View More In Our Developer Documentation

| Payment Type | Commerce Channel | Chargebacks | Recurring | Refunds |

|---|---|---|---|---|

Payment TypeBank Transfer |

Commerce ChannelE-commerce |

Chargebacks |

Recurring |

Refunds |

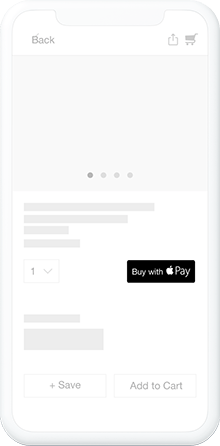

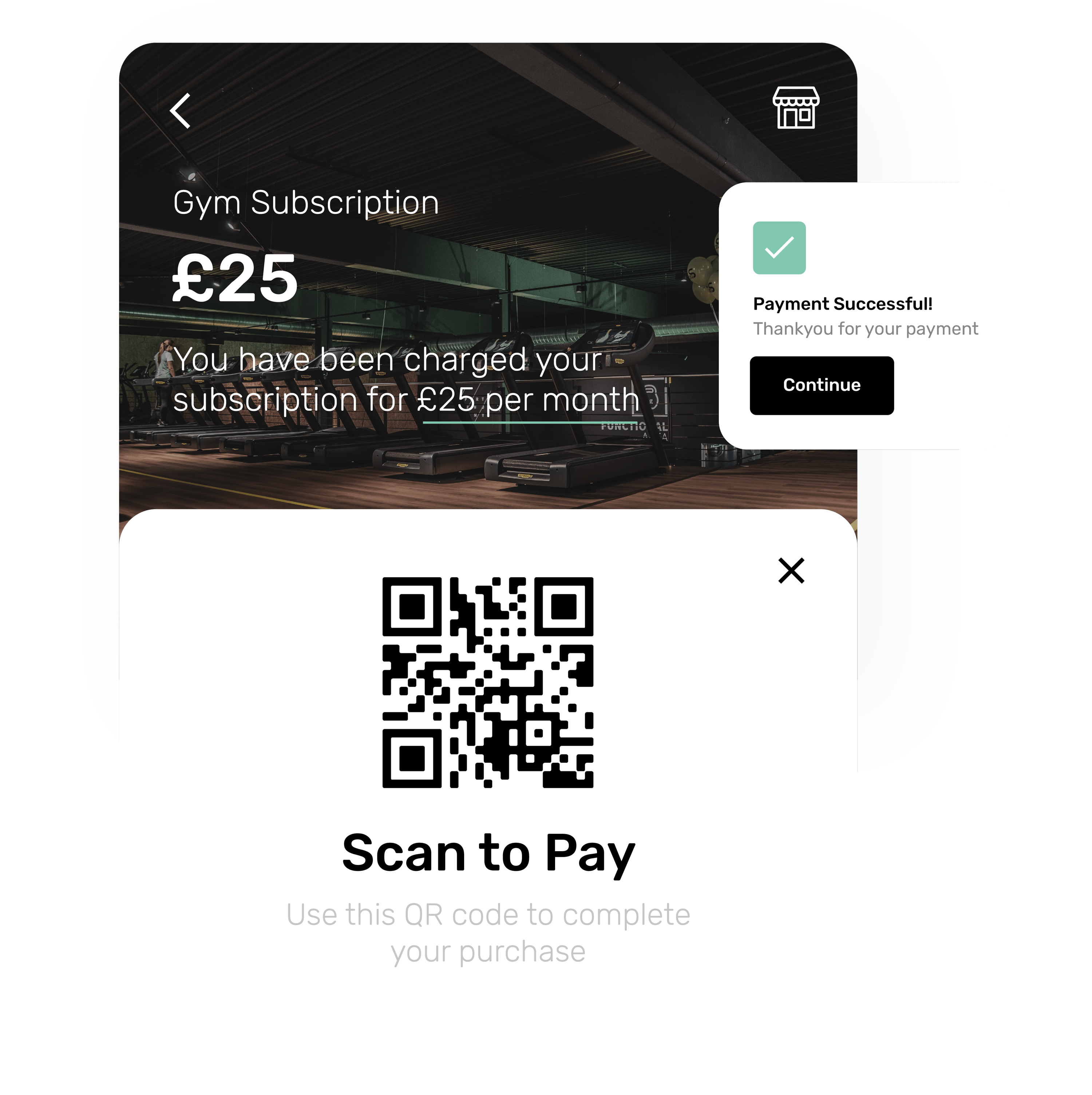

How Does It Work?

Ready To Start Accepting Payments?

The all-in-one solution for your business. Get a quote or schedule a call to demo our powerful suite of features.