PayPal

What Is PayPal?

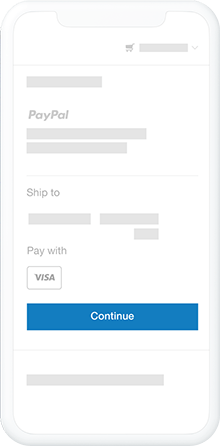

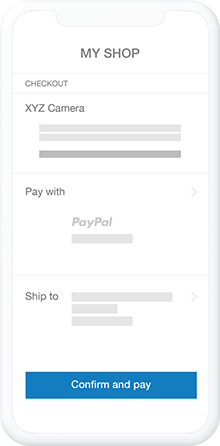

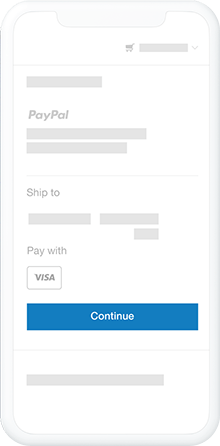

PayPal is a household name in the west that is also beginning to diversify the payments landscape within European markets. With a strong brand authority, the presence of a PayPal checkout option on a merchant storefront should be considered. Whilst the payment method does redirect the customer, PayPal credibility and consumer protection schemes are worth considering in terms of an ROI.

View More In Our Developer Documentation

| Payment Type | Commerce Channel | Chargebacks | Recurring | Refunds |

|---|---|---|---|---|

Payment TypeDigital Wallet |

Commerce ChannelE-commerce |

Chargebacks |

Recurring |

Refunds |

How Does It Work?

Ready To Start Accepting Payments?

The all-in-one solution for your business. Get a quote or schedule a call to demo our powerful suite of features.

Frequently Asked Questions

To get a merchant account, all you need to do is send us an application. You’ll be partnered with one of our banking partners in order to provide you with the best merchant account options that are cost-effective and suit your business best.

A merchant account is a business bank account. It’s used to receive payments from debit and credit cards for your products or services. Payments are held in your merchant account until they are settled into your bank account.

The cost of your merchant account will depend on various factors such as the type of industry and/or the level of risk involved in your business. For example, a high-risk merchant account would cost more than a low-risk merchant account.

Once a customer has made a payment, those funds are sent to the acquiring bank that the merchant is partnered with. Each of these payments is then released within a pre-agreed upon amount of days and transferred to the merchant’s nominated business bank account. This length of this period is known as settlement days and varies depending on your acquirer.