Giropay

What is Giropay?

Giropay facilitates more than 51% of all online transactions in Germany; providing customers with access to more than 1,500 banks via direct transfer. Customers using giropay receive real-time payment confirmations and the service is considered virtually risk-free as a result.

View More In Our Developer Documentation

| Payment Type | Commerce Channel | Chargebacks | Recurring | Refunds |

|---|---|---|---|---|

Payment TypeBank Transfer |

Commerce ChannelE-commerce |

ChargebacksNot in the instance of fraud |

Recurring |

Refunds |

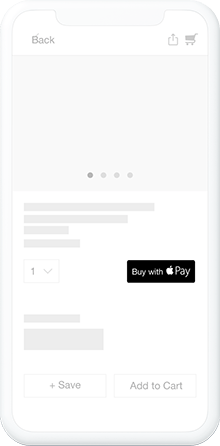

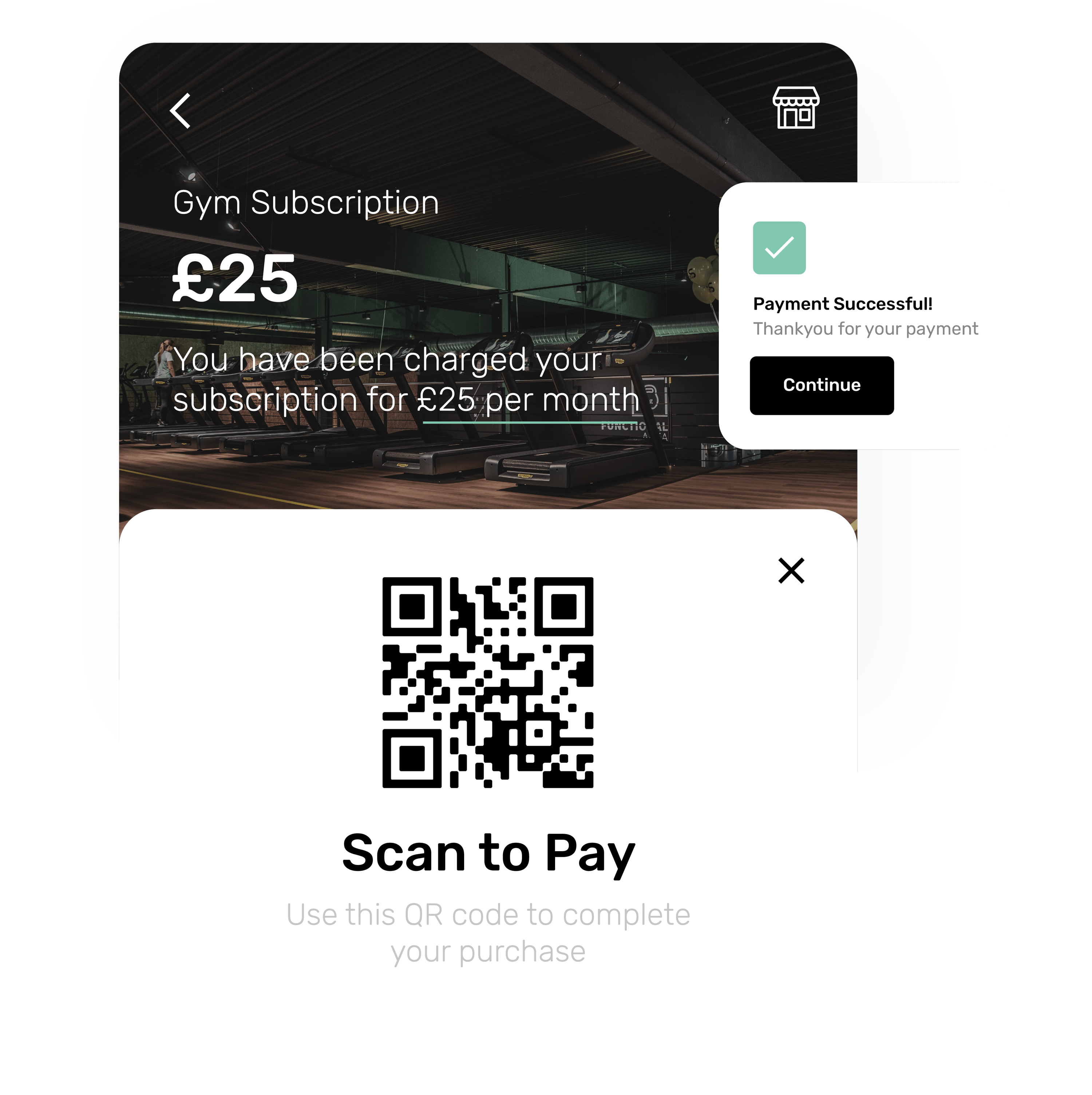

How Does It Work?

Ready To Start Accepting Payments?

The all-in-one solution for your business. Get a quote or schedule a call to demo our powerful suite of features.

Frequently Asked Questions

To get a merchant account, all you need to do is send us an application. You’ll be partnered with one of our banking partners in order to provide you with the best merchant account options that are cost-effective and suit your business best.

A merchant account is a business bank account. It’s used to receive payments from debit and credit cards for your products or services. Payments are held in your merchant account until they are settled into your bank account.

Once a customer has made a payment, those funds are sent to the acquiring bank that the merchant is partnered with. Each of these payments is then released within a pre-agreed upon amount of days and transferred to the merchant’s nominated business bank account. This length of this period is known as settlement days and varies depending on your acquirer.