Nearly 12 weeks on from our 1st post regarding Coronavirus, we’ve made the decision to create a ‘part 2’ in a reflection of how things have since changed in relation to business support within the UK.

Finding ourselves tired, and perhaps overwhelmed, from the numerous updates and timestamped amendments made in part 1 of this post, the creation of ‘part 2’ serves to recap part 1 to the latest standing; adding in any new information that has been rolled out since it was last updated.

For the sake of clarity, the UK government has compiled a comprehensive hub where all available areas of support can be sourced here.

This hub was released alongside their support tool, that allows SMEs to determine what support is available to them via a small questionnaire.

As the UK government begins its staged easing of lockdown measures, let’s look at where current support measures stand and what has been changed since March.

In an initial response to the coronavirus, the Bank of England reduced their interest rates twice to generate capital for financial support for British residents and businesses; ultimately cutting their rates to 0.1%.

As the weeks of lockdown went on, numerous loans and grants were made available by the Bank of England and partnered accreditors. As support was given to small and medium-sized enterprises, a further call of support for sole-traders and other paused sectors was met through various relief systems.

As detailed in part 1, the CBILS scheme grants loans for SMEs through more than 40 accredited lenders. Whilst SMEs are still 100% liable for the repayments of the loan, no personal guarantees are taken for loans under £250,000.

Any guarantees made for loans exceeding this amount must cap recoveries at 20% of the outstanding balance.

Loans will be repaid by the government for the first 12 months, and are repayable over 6 years up to a limit of £5 million.

The scheme is available to businesses that turnover less than £45 million a year.

A micro-business loan can be accessed within 24 hours of approval. With a 100% governmental guarantee - in comparison to the 80% guarantee provided on loans through CBILS - SMEs can apply for loans worth up to £50,000 or 25% of their turnover. The minimum loan provided will be £2000 with no interest or repayments due in the first 12-months.

£10,000 grants are available to businesses within the hospitality and retail sectors that have a rateable value less than £15,000.

The Government has pledged £1.25bn to continue innovation through start-up companies that would otherwise be affected by the coronavirus.

Companies can access funding between £125,000 - £5 million that is to be matched by private investors; for resultant equity in the business later on.

Additionally, through to September 2020, start-ups can access another £250 million in grants via the Future Fund.

Business rates were initially reduced by 100% through to 2021 for sectors dependant on their rateable value. This was later applied to all verticals regardless of value.

The self-employed income support scheme was made available to both sole-traders and partnerships through a grant that allowed people to claim up to 80% of their average earnings in one instalment.

The payment which covered a 3-month salary was, however, taxable and only accessible if the claimant had filed a tax return in the previous tax year.

The grants were capped at £7500 until the scheme was extended, allowing claimants to make a second and final claim through to the end of August with a cap of £6,570.

Perhaps, the biggest form of support offered to businesses in the UK, was the support that was offered to business employees. Known as furlough, or the Job Retention scheme, the government would now pay 80% of the salaries of any employee using the PAYE scheme, as long as they had been on the payroll from March 19th.

Whilst the salary was capped at a taxable £2500, the government urged employees to additionally claim Universal Credit if their salary had been reduced as a result of the coronavirus.

Subsequently, the standard Universal Credit rate has been increased by £20 per week in response to the pandemic.

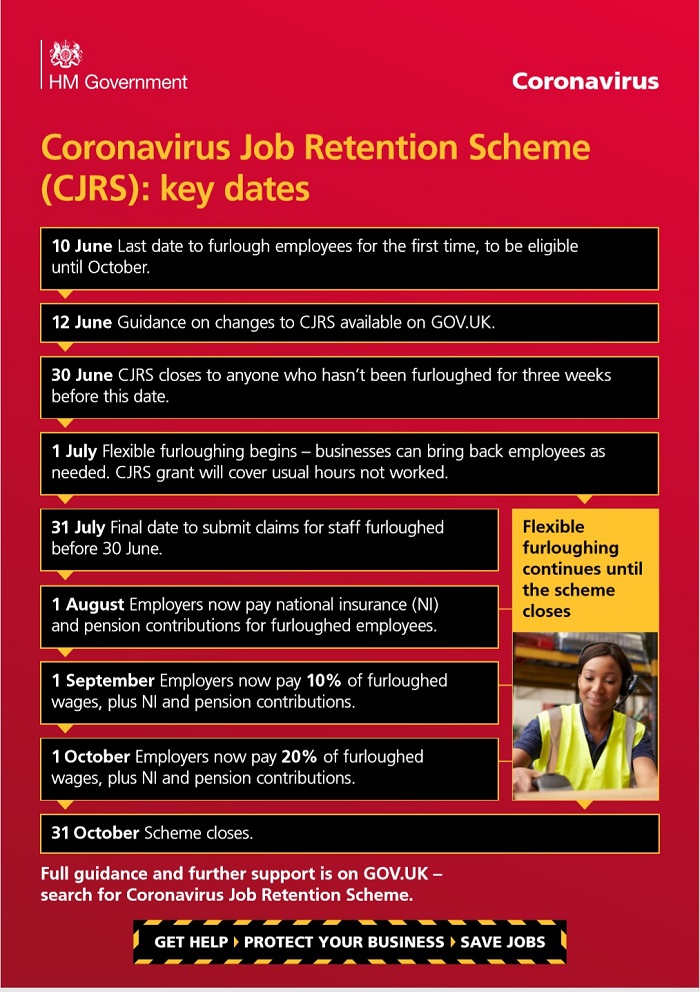

The job retention scheme has been extended through to October 31st. However, changes to the scheme will allow employers to bring employees back part-time from July 1st.

The scheme will call for employers to pay 5% of employee wages from August (attributing to National Insurance and Pension contributions) raising subsequently to 10% in September and finally, 20% in October.

The biggest change in statutory sick pay regulations meant that employees could claim statutory sick pay from day 1 of illness or self-isolation, instead of day 4. A fit note from a GP is also no longer required as a mandatory element of the claim.

So far, 7.5 million employees across 1 million businesses have been protected through the government’s coronavirus support measures.

Through the official ONS data, we get a grasp of how these figures are continuously changing:

Latest figures also reveal that more than £14 billion in loans have been accessed to support businesses nationwide, including 268,000 micro-business (bounce back) loans easily accessed and worth up to £8.3 billion.

Additionally, £359 million has been accessed through the Coronavirus Large Business Interruption Loan Scheme, which offers support up to £200 million for businesses turning over more than £45 million a year.

As stage 1 of measures to ease lockdown have begun, the UK has begun to apply ‘COVID secure’ practices to businesses nationwide.

The most important stage for business will arguably arrive in England on June 15th when all non-essential shops can open; with hairdressers to follow on July 4th.

With face coverings also becoming a mandatory measure in essential spaces and on public transport on June 15th, it’s up to businesses to utilise a hybrid of practices that will perhaps become a permanent measure in society.

Whilst we’ve all become accustomed to not using cash, the retention of consumers will be a another concern, as public safety will not only call for business preparedness, but for consumers to act less on impulse and to predetermine where they want to go, and what they want to do before going out.

Stressing this concern, Helen Dickinson, chief executive of trade body the British Retail Consortium (BRC), added:

‘Safety is the fundamental concern for all retailers …Now that we know which shops can open and when retailers can begin communicating their plans with their workforces and customers.’

Using their own transaction data, Mastercard has launched ShopOpenings.com, to identify whether a store is open or not.

Continue to check out all of our processing advice - ready to help you during this time:

See why subscription payments are on the rise!

Check out part 1 to learn more about processing throughout COVID-19 and Get in touch to learn more.