Ah, the holiday season—a time of joy, celebration and, unfortunately, the lurking challenge of chargebacks. As a savvy business merchant, you're probably gearing up for the bustling shopping season. But are you ready for the potential uprise in chargebacks that often accompanies the festive frenzy? Fear not! In this guide, we'll walk you through the ‘whys’, ‘hows’ and ‘whats’ of chargebacks during the holiday season, and equip you with strategies to triumph over them.

The holiday season is often a double-edged sword for merchants. While the influx of eager shoppers can boost sales, it also brings about an unwanted increase in chargebacks- sometimes up to 50%. Understanding the reasons behind this surge is paramount:

1. Increased transaction volumes

With the holiday rush comes a surge in transactions. The sheer volume can lead to oversights, misunderstandings and a higher likelihood of chargeback disputes.

2. Impulse purchases and buyer's remorse

The festive spirit often leads to impulsive buying. However, once the glitter settles, buyers may experience remorse, triggering chargebacks as they attempt to undo their impromptu decisions.

3. Friendly fraud on the rise

Not everyone embraces the season of goodwill. Some individuals exploit the holiday fever through friendly fraud—false claims of unauthorised transactions, leading to unwarranted chargebacks.

Before we deep dive into the nitty-gritty of managing chargebacks, let’s quickly run through key trends to be aware of in the ever-changing world of commerce. Here's what to expect in the upcoming shopping scene:

1. Rise of e-commerce dominance

E-commerce has been on a consistent upward trajectory for years. However, in 2023, it’s not just risen but dominated the retail landscape. In 2022, online sales accounted for 26.5% of overall retail sales in the UK, and this number is only expected to grow. As consumers continue to embrace online transactions, it's vital to align your strategies accordingly.

Merchant top tips:

2. Mobile shopping takes center stage

With 60% of online sales expected to take place on mobile devices this year, it's undeniable that smartphones have become an integral part of the modern-day shopping experience. Consumers now lean on these devices for everything, be it researching products or sealing the deal with a purchase.

Merchant top tips:

3. Demand for seamless payment experiences

Consumers today crave convenience and speed, especially when it comes to payments. The demand for smooth payment experiences is expected to drive changes in how merchants handle transactions.

Merchant top tips:

Now that we've grasped the expectations of shoppers, let's not forget the flip side that can have a major impact on your bottom line. It's just as important, if not more so, to build robust chargeback-proof protection for the upcoming festive season, safeguarding your hard-earned revenue.

In the ever-changing world of e-commerce, having a chargeback defence suite is akin to wearing a suit of armor. Ethoca alerts, Verifi alerts and Rapid Dispute Resolution (RDR) mechanisms will serve as your trusty shields and swords in the ongoing battle against chargebacks:

Ethoca Alerts

Ethoca alerts provide real-time notifications of customer disputes, giving you a head start in addressing issues before they escalate into full-blown chargebacks. By tapping into a vast network of issuing banks, Ethoca enables you to resolve disputes swiftly, saving time, money and, most importantly, preserving customer relationships.

Verifi Alerts

Verifi alerts offer an additional layer of defence by notifying merchants of potential chargebacks before they officially hit. This preemptive strike allows you to proactively engage with customers, resolve issues and prevent chargebacks from tarnishing your business reputation.

RDR

Speed is of the essence when it comes to chargebacks! Implementing RDR mechanisms ensures that you can respond promptly to disputes, presenting compelling evidence and resolving issues before they escalate. This not only saves you money but further enhances customer satisfaction by demonstrating your commitment to swift issue resolution.

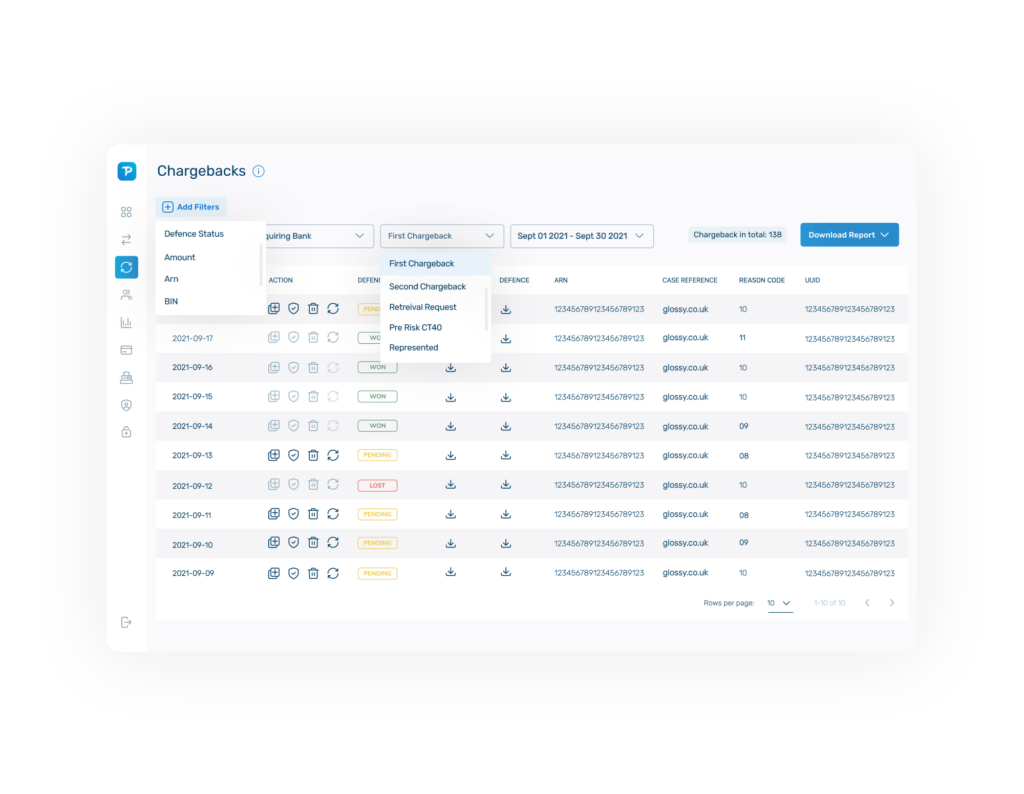

Information is power, and in the battle against chargebacks, a comprehensive tracking platform acts as your strategic intelligence center through:

Transaction monitoring

Monitoring transactions in real-time allows merchants to quickly pick up on unusual patterns, high-risk activities or discrepancies. These can be flagged immediately, prompting proactive measures to prevent easily missed chargebacks.

Customer interaction tracking

Recording and analysing customer interactions will help you to build comprehensive customer profiles. Understanding consumers habits, preferences and communication history empowers you to address disputes more effectively, often preventing chargebacks through personalised resolution.

When it comes to tackling chargeback disputes, evidence is your legal ammunition. The latest tool for merchants in combating unfair chargebacks is Compelling Evidence 3.0. It revolves around constructing a persuasive narrative that requires you to collect:

Detailed transaction records

Thorough documentation of transactions, including timestamps, product details and customer information. The more comprehensive the records, the stronger your case against unjustified chargebacks.

Customer communication history

Records of all communication with customers. From order confirmations to post-purchase support, a detailed history can help refute claims and showcase your commitment to customer satisfaction.

Remaining on high alert for potential fraud is crucial, given the connection between increased chargebacks and a rise in fraudulent cases. Here's how to stay vigilant:

Implement fraud detection tools

Invest in advanced fraud detection tools to identify and prevent suspicious transactions. Machine learning algorithms can analyse patterns and flag potentially fraudulent activities, giving you a proactive edge.

Continuous staff training

Educate your team about evolving fraud trends and prevention strategies. A well-informed staff can act as an additional line of defence, spotting red flags and taking preventive measures.

Regularly update security measures

Stay one step ahead of fraudsters by regularly updating your security measures. From encryption protocols to secure payment gateways, ensuring that your infrastructure is up-to-date. This minimises vulnerabilities and reduces the risk of fraudulent chargebacks.

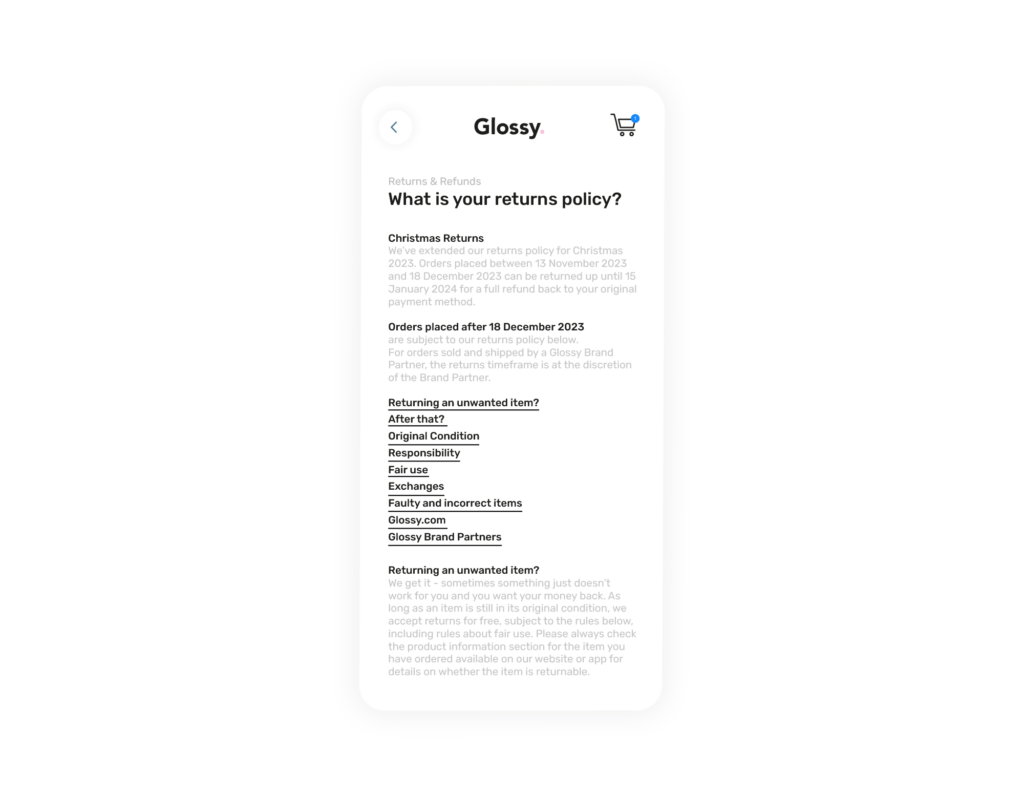

A transparent and customer-friendly returns policy not only keeps your customers happy but also acts as an additional layer of protection against unwarranted chargebacks. Consider the following:

Clear and concise policy

Ensure that your returns policy is easily accessible, clearly communicated and written in a language that customers can understand. Ambiguity often leads to frustration, which can result in chargeback requests.

Hassle-free returns

Simplify the returns process to minimise customer dissatisfaction. The easier it is for customers to return items, the less likely they are to resort to chargebacks out of frustration.

Effective communication

Maintain open lines of communication regarding returns. Provide status updates, acknowledge returns promptly and ensure that customers feel heard and valued throughout the process.

Ready to arm your business against chargeback threats this holiday season? Total Processing is here to help! With a comprehensive suite of tools and services designed to tackle the nuances of chargeback management, our job is to help you overcome these challenges and come out on top.

Chargeback prevention isn’t just about protecting your bottom line; it's about fostering trust with your customers. By incorporating these strategies into your holiday season preparations, you'll be well-equipped to face the chargeback season head-on, protecting your business and fostering customer loyalty. Good luck for the busy season ahead!