Subscription-based businesses are becoming more and more popular. The amount of entertainment subscriptions, like Netflix and Disney+ you can sign up for these days is crazy. But it’s not just services like these that are available now, you can also purchase your regular products on a subscription basis. In fact, the global subscription e-commerce market is expected to reach $2.64 trillion by 2028.

So with the huge amount of businesses that are receiving recurring revenue, it’s important to know how to calculate it and make the most of the predicted income.

What's in this article?

Recurring revenue is exactly what it says it is; revenue that you receive on a regular basis, often through recurring payments or subscription-based models. You can either receive monthly recurring revenue (MMR) or annual recurring revenue (ARR), and both will help businesses create realistic forecasts to make smart strategic decisions.

MRR and ARR are very similar in that they both predict recurring revenue. But it’s important to understand the difference between them and how they should be used.

The main difference is pretty obvious, and that’s the time frame they cover; MRR looks at revenue on a monthly basis and ARR is annual. Due to these metrics, different business models may find it more beneficial to focus on one type of revenue, for example, SaaS businesses that deal with yearly contracts will find ARR more suitable than MRR.

One thing is for sure, your monthly recurring revenue isn’t always going to be the same. In an ideal world, it will go up, but there are a few different types of MRR that businesses will need to be aware of when calculating recurring revenue to determine whether your forecasts are going up or down.

This is the extra money you make from new customers who just joined. It shows how much your business is growing.

This is the added income from your current customers who decide to upgrade or add more products to their subscription. In an ideal scenario, this is potentially more beneficial than new MRR because there are no customer acquisition costs and it shows customer loyalty, therefore, a revenue you’re less likely to lose.

Sadly, this is the money you lose when customers say goodbye and cancel their subscriptions. It's revenue that slipped through your fingers, which is why it’s so important to focus on your current customers and offer a seamless and convenient experience.

Good news! This is the money you earn from customers who once left but came back. These could potentially turn into loyal customers since they couldn’t find a better product or service elsewhere.

This is the money you lose when current customers downgrade or remove some services. This could either be because the additional features aren’t good enough, and is something you may need to focus on, or the customers are tightening their belts due to personal financial reasons, either way, consider what you can do to prevent this from happening.

This is the total change in your monthly revenue. It's like a scorecard for how you're doing. It’s the sum of the money from new customers and those who upgraded (New + Expansion MRR), with the sum of money from cancelled subscriptions and downgrades subtracted (Churn + Contraction MRR). The result shows if you’re growing or not.

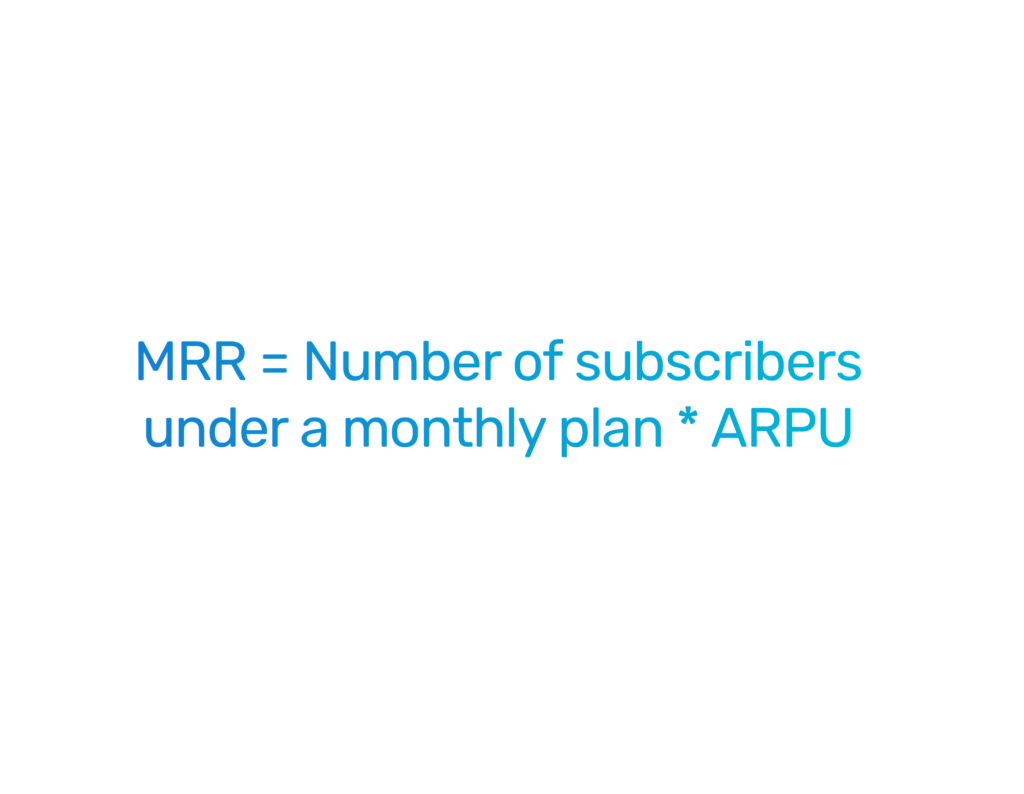

The formula for calculating your recurring revenue is pretty simple. There are also two options, depending on how accurate you want to be.

For an average figure, you can multiply the number of monthly subscribers by the average revenue per user (ARPU).

MRR = Number of subscribers under a monthly plan * ARPU

Alternatively, if you want to be more specific or if the price of your plans varies quite drastically, you can calculate the MRR by summing up every customer’s subscription plan. This can easily be done automatically with the right platform.

If you’re calculating your MRR, you might as well calculate your annual recurring revenue (ARR) too, since they are very closely linked. Getting a calculation for your business’ ARR is just as simple, but this prediction presumes there will be no changes to your consumer base over the next 12 months.

You can calculate your annual recurring revenue with the following formula:

ARR = MRR * 12

You might want to use ARR as more of a guidance if your customer base often fluctuates

Having a steady income creates a strong foundation for any business. And being able to predict this stream of revenue so that you can make smarter financial decisions, identify trends and painpoints, assess the health of your company's revenue and establish opportunities for growth is an ideal situation to be in. That’s why knowing your monthly recurring revenue is so important.

For example, if you can see a steady growth of 10% month-on-month, you can utilise that knowledge to expand your business. This can include new hires, improved software or a bigger budget for your marketing strategy, etc. Without this insight, you’ll be taking a stab in the dark and could make decisions that are detrimental to your business.

Having the right strategies and tools to increase your monthly recurring revenue can boost your business's financial health. Here are some ways to make it happen:

By optimising payment processing and reducing churn due to failed payments, businesses can enjoy a more stable and predictable income stream. Offering flexible payment methods, seamless checkout experiences and robust subscription management can attract and retain customers, ultimately boosting your monthly or annual recurring revenue. Additionally, our solutions come with advanced analytics and reporting tools, allowing businesses to better understand customer behaviour and tailor their strategies for maximum revenue growth. In short, we can be a powerful ally in the quest to collect recurring payments, increase MRR and drive business success.

Remember, it's not just about the money you make today but also about the sustainability and long-term success of your business. So, if you’re ready to boost your monthly recurring revenue, get in touch with a specialist today.