Taking your business to the next level to go global can be a pretty daunting move to make. But one area of the strategy that can be much simpler than you think is accepting cross-border payments.

As long as you’ve chosen the right payment provider that has the capabilities to scale with you, then there shouldn’t be any issues.

One payment method that will help you grow internationally is pay by links, also known as request to pay. Global links can be sent to anyone, anywhere and are simple to manage with Total Processing.

Let’s take a look at how global pay by links work and how they can help your business grow.

Let’s first cover how you can use global links for payment. There are many ways a pay by link can be used, including a variety of channels in which they can be sent, making them a suitable method for a whole host of businesses in any industry. But here are the most common ways:

To make the process even easier, we’ve teamed up with Zoho, an invoicing software provider making it effortless to create and send invoices.

Next, let’s talk about why you should accept them. By having the capability to accept global payments by pay by link, you’re opening up your business to a whole range of benefits, including:

Remember, while global payments offer many benefits, it's important to choose reliable and secure methods and stay aware of potential fees and exchange rates.

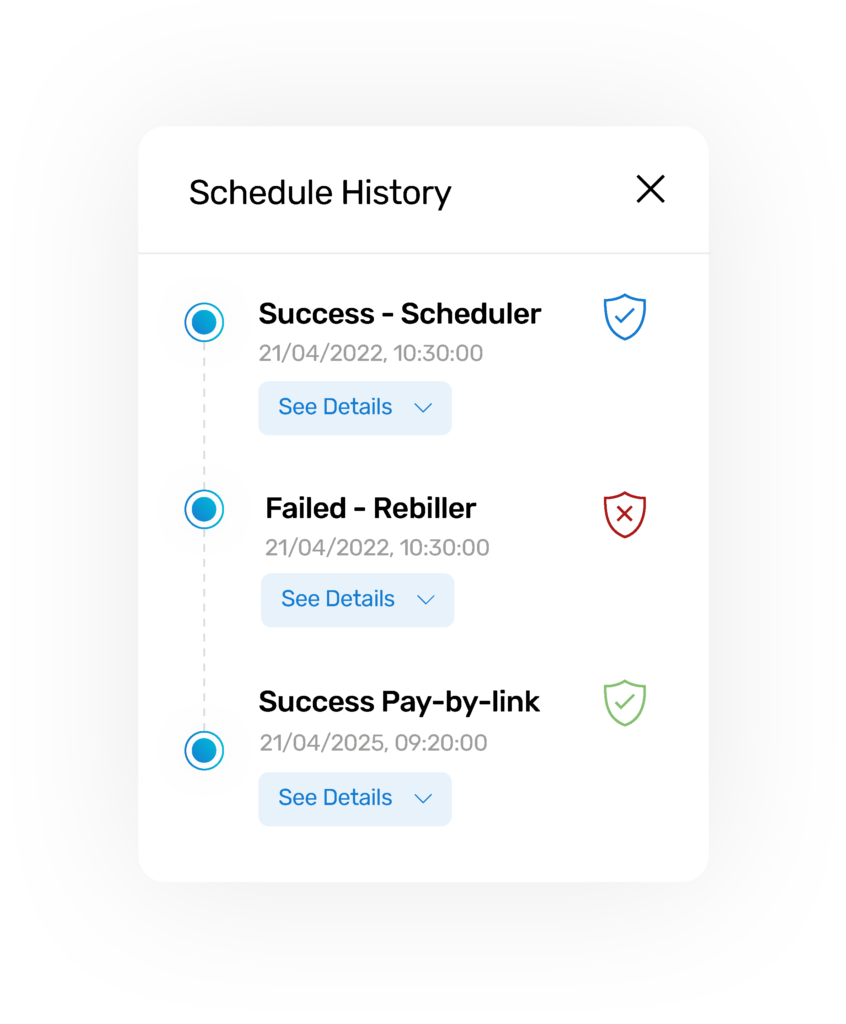

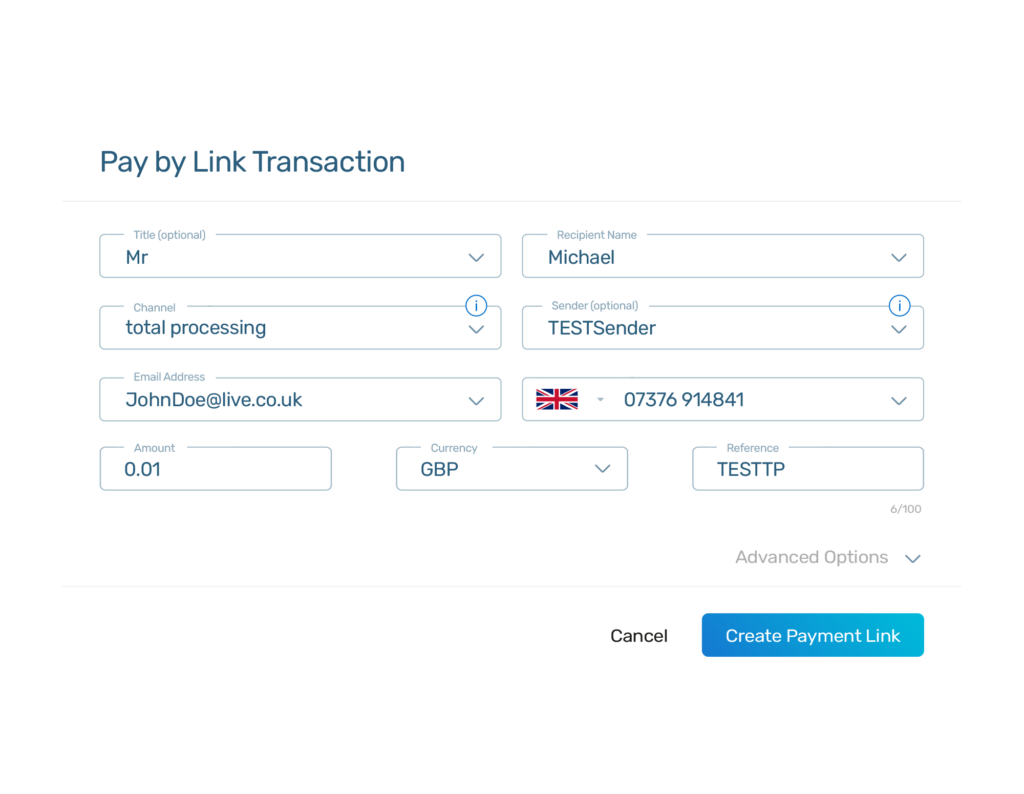

With the right payment service provider creating a request to pay is easy. With Total Processing, it can all be done via the Total Control platform in just a few simple steps:

With tokenisation, a customer’s card details can be securely saved making the payment even more convenient, which is ideal for loyal customers who won’t have to keep inputting their details every time they go to pay. What do we mean by tokenisation? It’s when the customer’s card’s Primary Account Number (PAN) is replaced with a unique token so that the details can’t be decrypted. We’ve got a tokenisation guide that will tell you everything you need to know.

Once you’ve created the request to pay, your payments provider will handle the rest. The link will be sent to the chosen channel based on the details you provided, most commonly via SMS, email or social media.

Then the payment will be made just like any other payment type; the funds will be sent and processed via a secure international payment gateway. So if your business can accept payments worldwide via your current gateway, then you can accept global payments via a pay by link too.

Finding a payment service that can support your business model is critical to its success. Selecting the wrong one can lead to limitations to scalability and a poor customer experience.

One thing to note is that a payment provider based in the UK doesn’t limit your business to only accepting payments in the UK. With the right service, you should be able to take your business worldwide. A few things to consider when choosing your pay by link provider to ensure global success include:

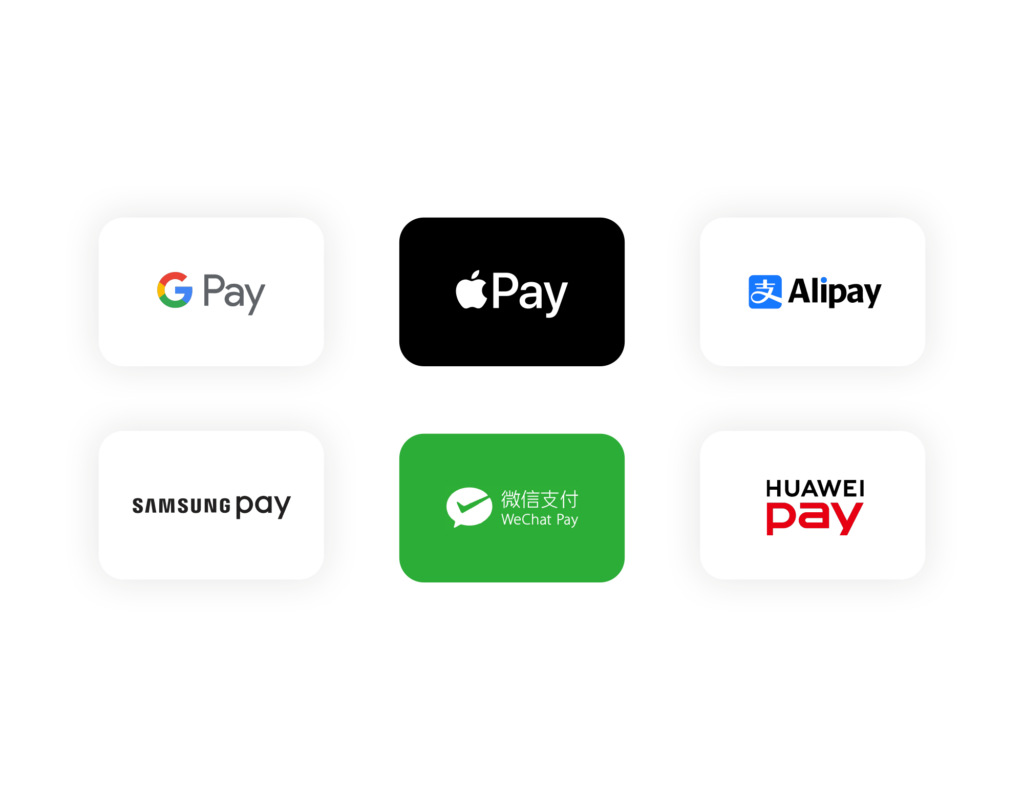

The preferred payment method differs per country. For example, AliPay is popular in China and iDeal is popular in the Netherlands. If your provider doesn’t offer a range of payment methods, you could lose out on a lot of sales and your cart abandonment could increase.

Your customers should be able to pay in their local currency. By offering this solution, you’ll be improving the customer experience, and ultimately boosting your conversions.

By being able to use local acquirers in the countries your business is processing in, you can increase the approval rate of your payments as well as the speed at which they are processed and decrease the processing costs.

Security should be your number one priority when it comes to accepting payments. With the right provider, they will use a secure payment gateway and offer a range of risk tools and data analytics so you can stay on top of any fraudulent activity.

You’ll want to choose a service that allows you to customise your pay by links to look and feel more like your website, for example, adding your business logo. This can help to increase customer trust, and therefore, your conversion rate.

Are you ready to take your business global? Get in touch with a specialist today and get pay by links added to your payment solution.