If you're looking to boost your business and streamline your cash flow, accepting recurring payments might just be the key. Whether you're running a subscription-based service, selling membership plans or offering monthly services, setting up recurring payments can make your life a whole lot easier. Let's dive into the world of recurring payments and learn how to implement them effectively.

What’s in this article:

First things first, let’s quickly recap what we mean by recurring payments. Simply put, they're payments that occur on a regular basis, like weekly, monthly or annually. Instead of your customers having to manually make a payment each time, recurring payments automate the process, saving time for both you and your customers.

For a more in-depth explaining, you can check out our ‘What is a recurring payment?’ blog.

Before you accept recurring payments online, there are a few important things to consider:

Before adding a payment solution, it’s important to consider all these factors to make sure you offer the most effective and seamless plan for your business and your customers.

Do you think this solution is right for your business? Let’s move on to how to take recurring payments including best practices and set up tips.

If you’re already accepting online payments, then you’ll already have these in place. But, if you’re a new business, to accept recurring payments online, you'll need a:

Once you have these setup, it’s time to start accepting recurring payments.

On top of the fundamentals that you need, there are some best practices to efficiently accept recurring payments to ensure seamless transactions and customer satisfaction.

Transparency is key

Clearly communicate the frequency, amount, duration of the payments and any relevant terms and conditions. One of the biggest reasons for churn is hidden costs. Lack of communication to begin with can cost you customer retention and loyalty.

Customers appreciate knowing exactly what to expect upfront, reducing the likelihood of misunderstandings, followed by dissatisfaction. Highlighting potential changes or fluctuations in charges can also bolster transparency and customer trust.

Prioritise security

Protecting sensitive customer data should be a top priority. Utilising reputable payment processors that adhere to strict security standards, such as PCI-DSS compliance, helps safeguard against data breaches and fraud. Investing in robust encryption technologies will enhance the security of payment transactions, instilling confidence in customers and mitigating potential risks.

Utilise your data

Leveraging your data can produce valuable insights into customer behaviour, payment trends and potential areas for optimisation. Regularly analysing this data and reviewing billing processes will allow you to identify and address any issues promptly, minimising disruptions and maximising customer satisfaction. Automation tools that also utilise your transaction data can help to streamline billing procedures, reducing manual errors and enhancing efficiency.

Be flexible

Offering flexibility in billing options empowers customers to manage their subscriptions according to their preferences and needs. Providing easy-to-use interfaces for updating payment methods, adjusting subscription plans or pausing/cancelling services fosters a positive user experience and reinforces trust in your brand. Flexibility also includes accommodating various payment methods to cater to diverse customer preferences and global markets.

By adhering to these best practices, businesses can effectively manage recurring payments while prioritising customer trust and satisfaction. This approach not only enhances the overall customer experience but also strengthens customer retention and loyalty in the long run.

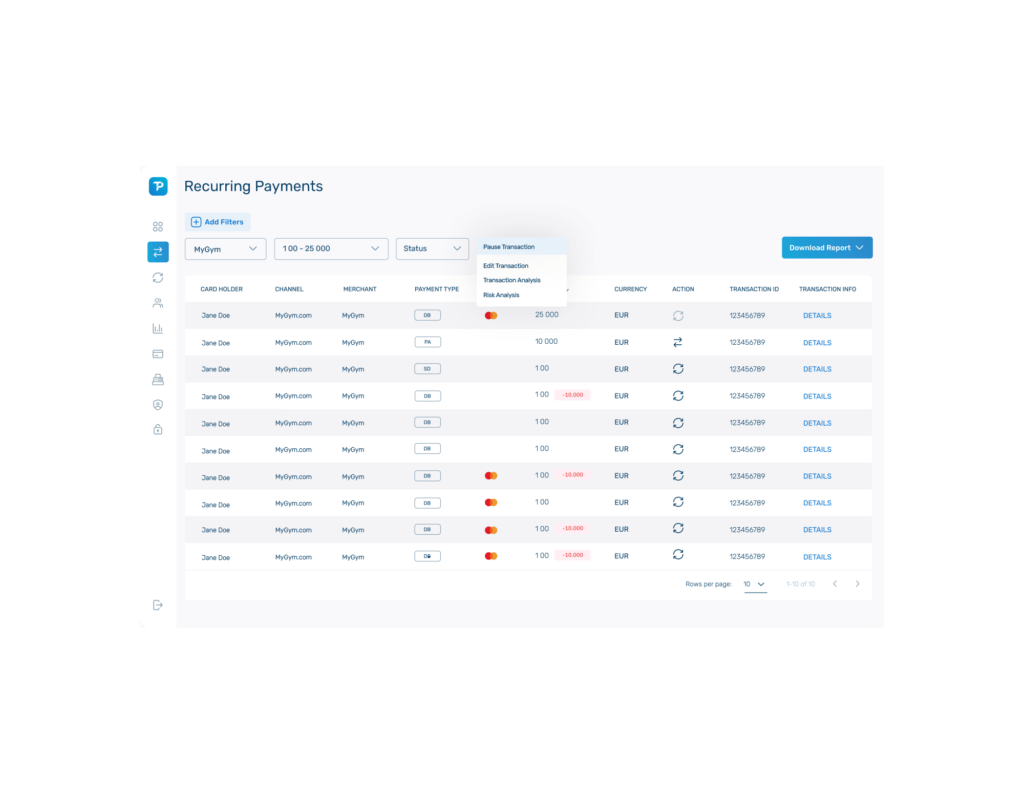

Now that we’ve covered the best practices for accepting recurring payments, next it’s all about the setup. If you're looking for a hassle-free way to set up recurring payments, Total Processing has got you covered. Here's how you can do it:

Accepting recurring payments is a game-changer for merchants looking to streamline their revenue flows and provide convenience to their customers. By following these simple steps and choosing the right payment partner like Total Processing, you'll be well on your way to success. So, are you ready to start a conversation?