Digital payments have been transforming the financial world for years, making the industry more accessible, convenient and streamlined for both businesses and consumers. But it doesn’t end there!

New innovations are continuously being introduced, including automated payments and voice commerce. The latest development that has blown up this year and, love it or hate it, has been the biggest topic of conversation within technology, is Artificial Intelligence (AI).

Since OpenAI launched ChatGPT, so many other platforms have followed suit. There’s an AI for all corners of life, including content creation, retail product recommendations, speech recognition and, most importantly to us, digital payments.

But how is AI changing the payments industry?

Firstly, let’s take a look at the role of AI in digital payments and how it works. We all know how important data is for a business, especially when it comes to payments, and being able to leverage that data is the key to success. This is where AI comes in.

The technology can process and manage data on a mass scale on a daily basis. By using AI, you can identify patterns and gain insights into consumer behaviour much more quickly and efficiently than doing so manually.

This will help streamline the payments process and improve the overall experience for your customers.

Let’s look more specifically at the areas AI can benefit payments and your business as a whole.

Fraudulent activity is a big issue within the payment space, especially digital payments. But generative artificial intelligence has already proven to greatly improve fraud rates.

Its ability to self-learn from each transaction makes it an efficient fraud detector, picking up on the suspicious behaviours of a fraudulent payment. The AI-powered fraud detection system has shown to cut down false decline rates in half.

It can be hard to keep up with the new methods fraudsters use, but with AI analysing large amounts of data every day, the machine learning tool can detect new behaviours and un-seen fraudulent examples to stay ahead of the game. By leveraging this information, financial services can provide even better fraud prevention and security.

Although human touch is essential to provide a great customer service, AI can help to enhance it. With the use of a chatbot operated by AI, you can truly offer 24/7 support. The technology can identify common issues and use this information to develop solutions, saving time for the customer support team so that they can help with more complex queries.

Customers won’t have to wait in long queues or call during opening hours, they can quickly get answers to frequently asked questions helping to increase customer satisfaction.

With so much competition out there, how do you stand out from the competition? Many consumers want the personal touch these days to feel like they are being spoken to directly. And AI can give them that experience through the use of data.

By analysing a customer’s behaviour and transaction history, AI can provide suitable recommendations, including payment methods and financial products such as loans and investments. We’re already used to product recommendations from our favourite retail brands, so why not financial recommendations?

When a customer feels valued they are more likely to remain loyal and convert, so give your customers the attention they desire and they’ll stick around.

AI can also make the overall process and management of taking payments so much slicker and easier. Its analysis of transaction data in bulk and machine learning algorithms allow it to quickly identify discrepancies, compare data, input data, spot trends, etc.

By speeding up these manual tasks, AI can automate reconciliation with more accuracy, reducing the amount of errors and increasing the conversion rate.

Considering AI hasn’t been around for long, it has already made waves in the business and fintech world and is very quickly developing more and more functions.

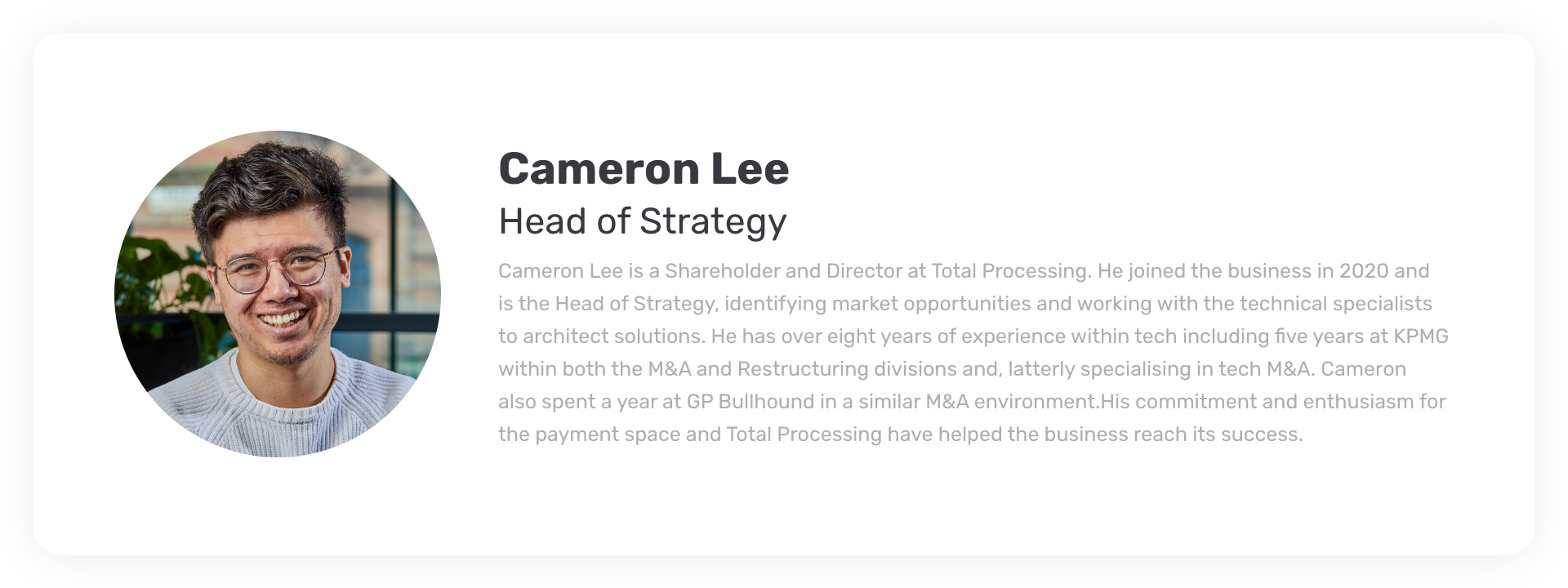

Cameron Lee, Director and Head of Strategy at Total Processing, said: “What AI can achieve so far is impressive and is only going to get better. And it’s not just in payments and customer service that the technology can help businesses, it can also enhance marketing and e-commerce; its potential is endless.”

So if you’re wondering whether to introduce AI into your e-commerce website, payments management or another area of your business, we definitely think it’s worth looking into. AI is the future and it’s a technology we’ll be keeping an eye on.