Find The Right Partner. It Pays.

Our Solutions

Our expert team will help you avoid complex and unnecessary issues when taking payments. We make processing payments as seamless and secure as possible.

+

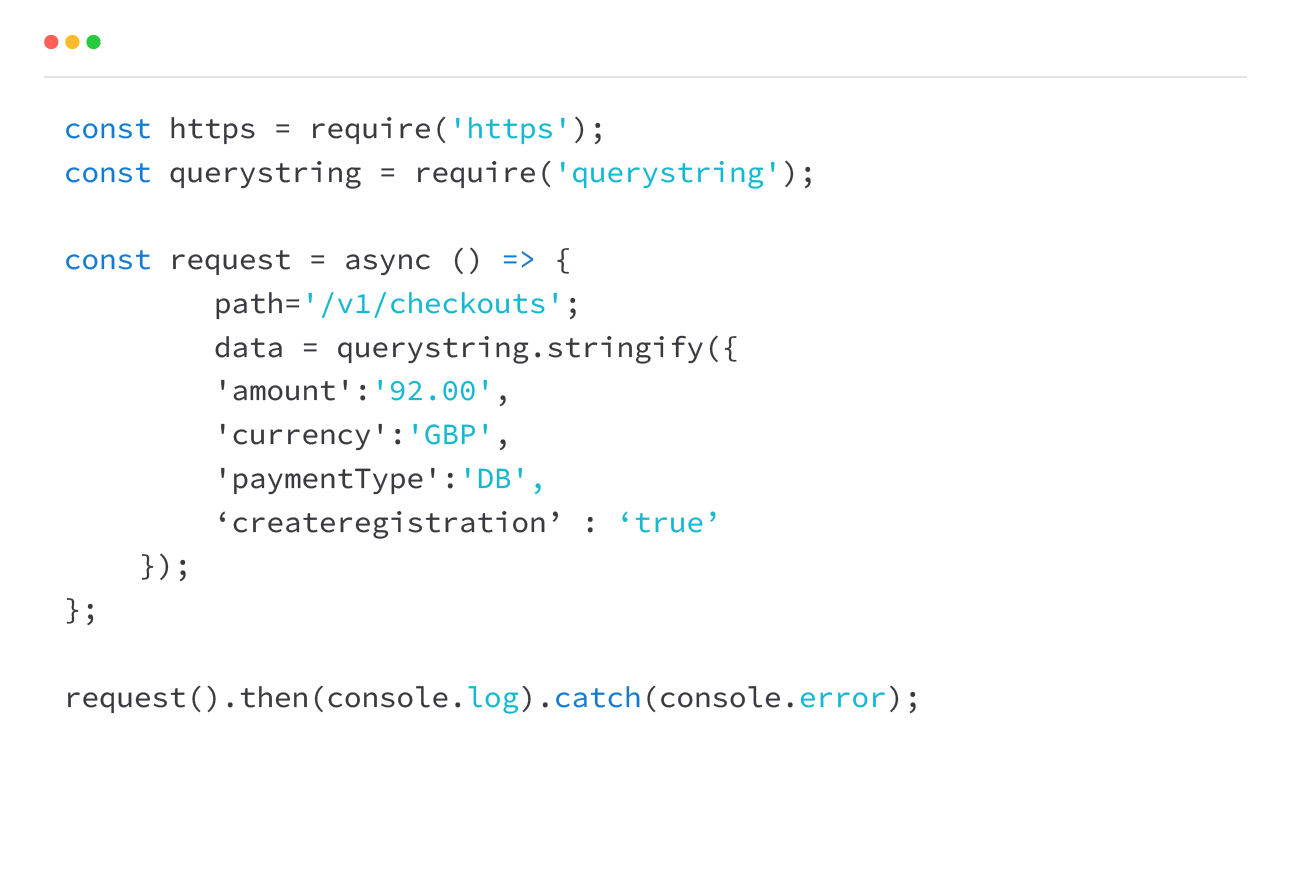

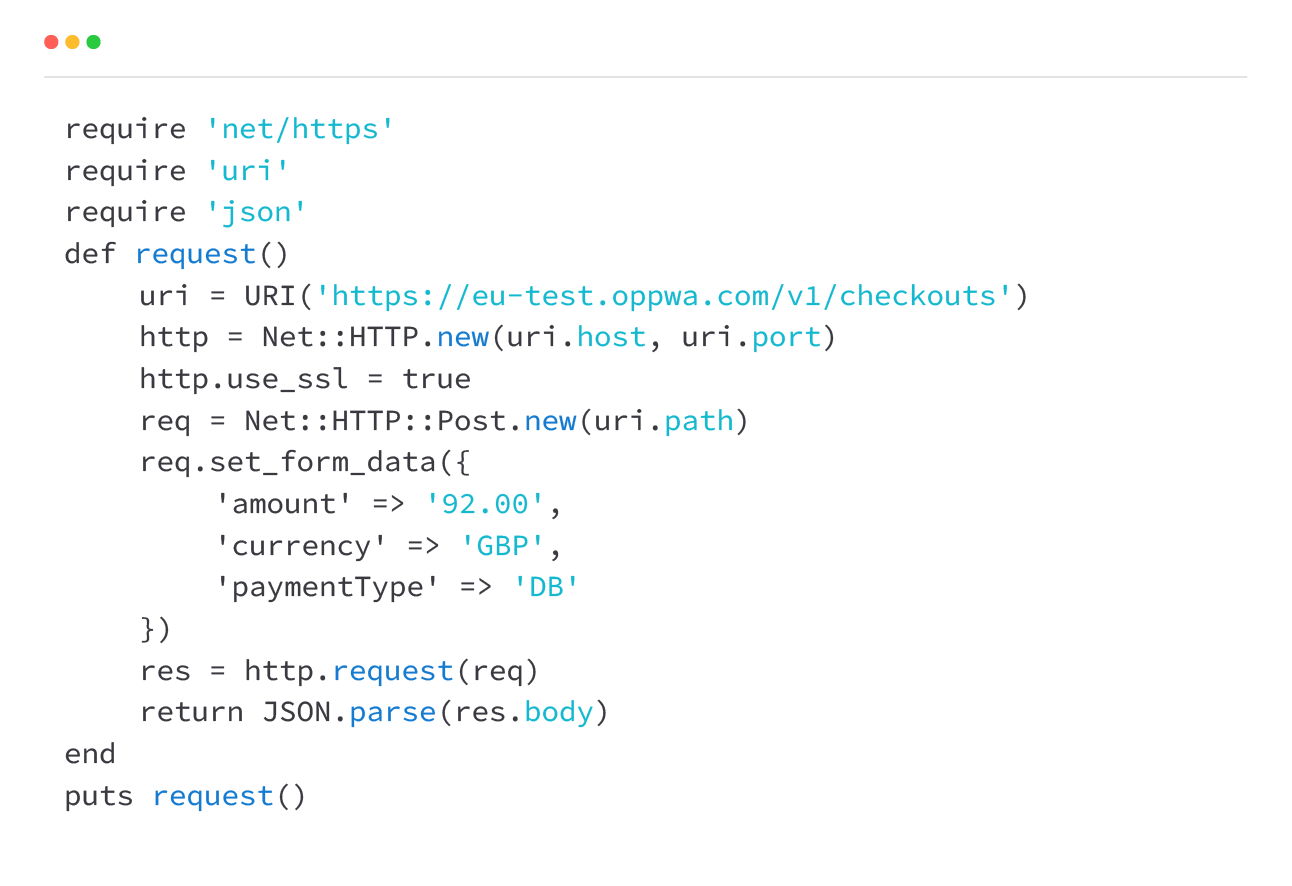

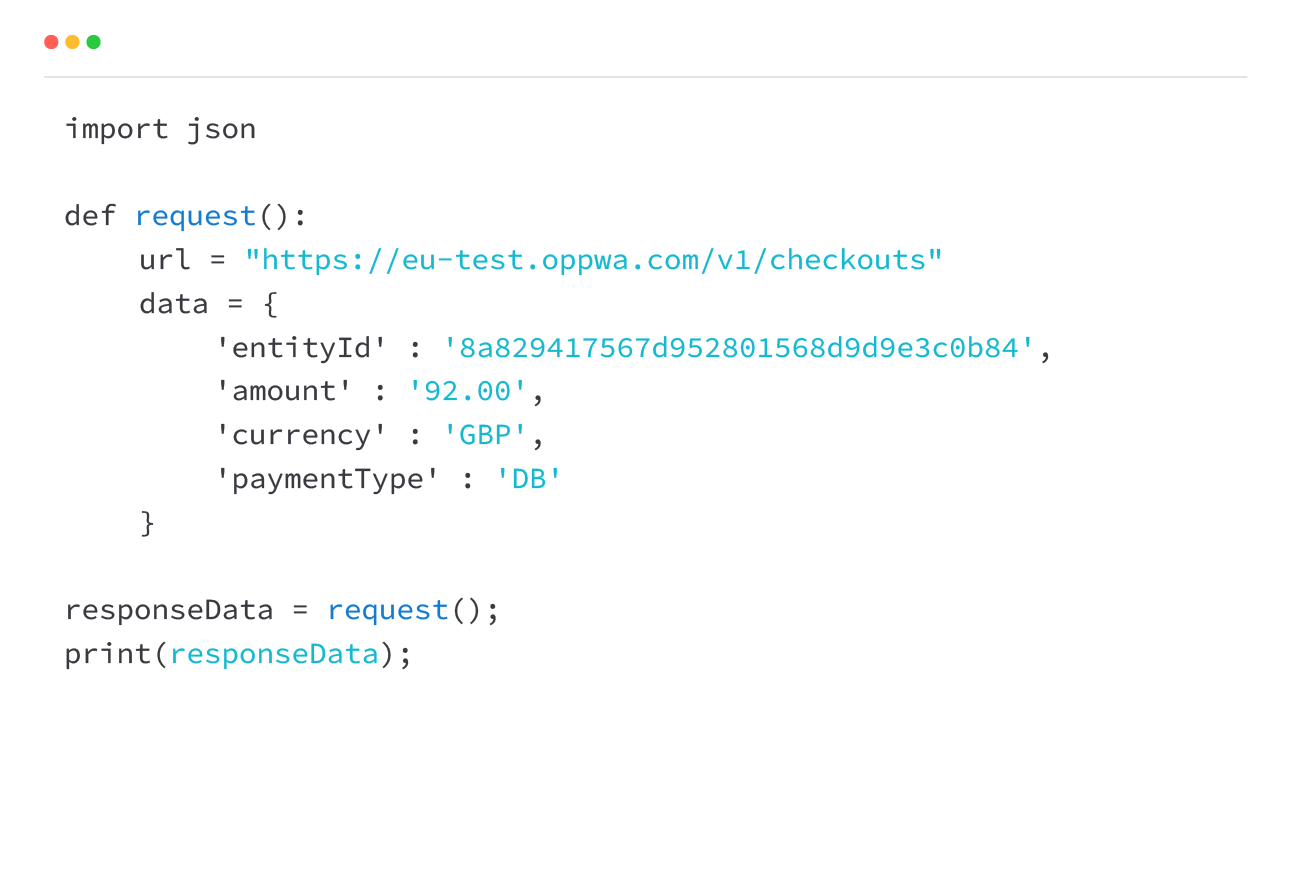

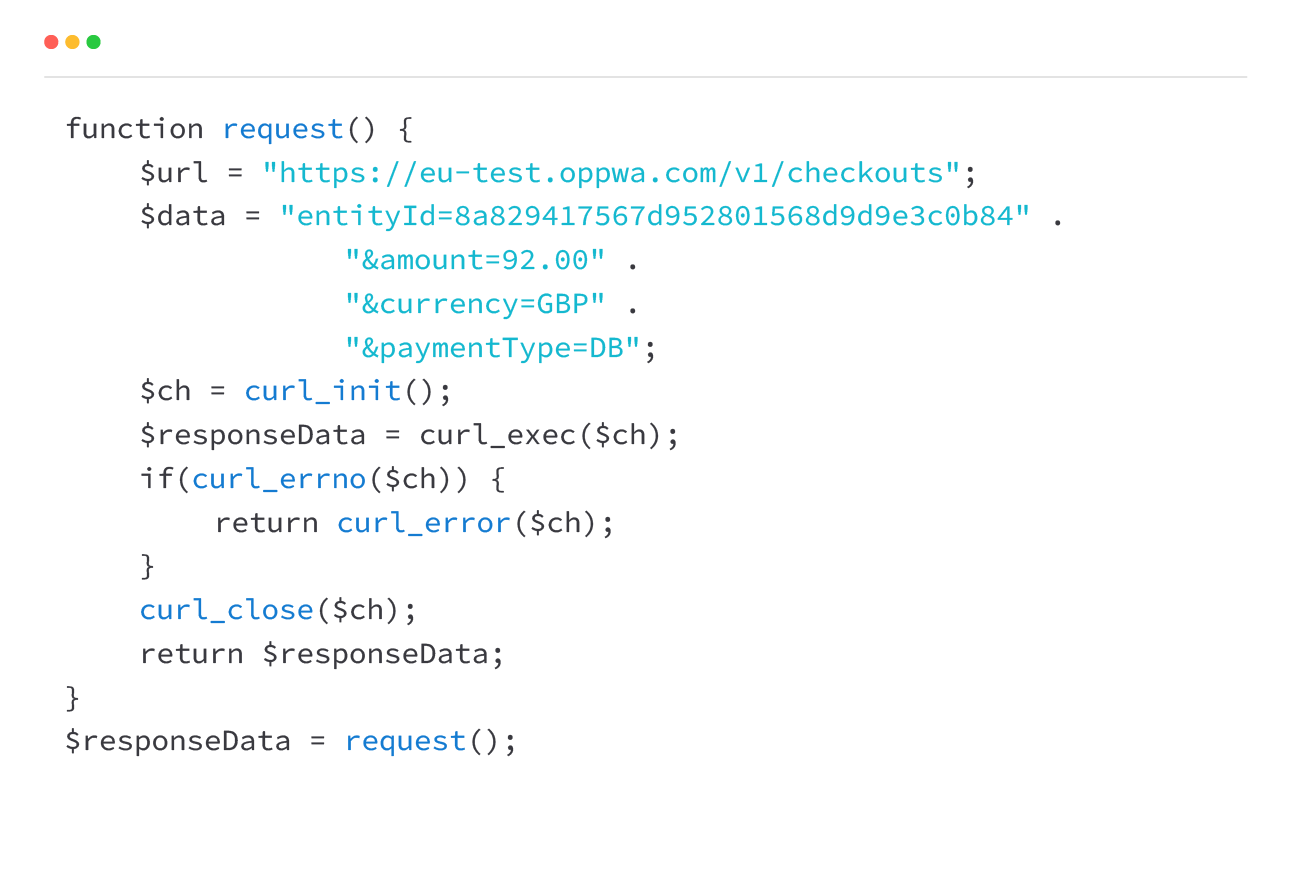

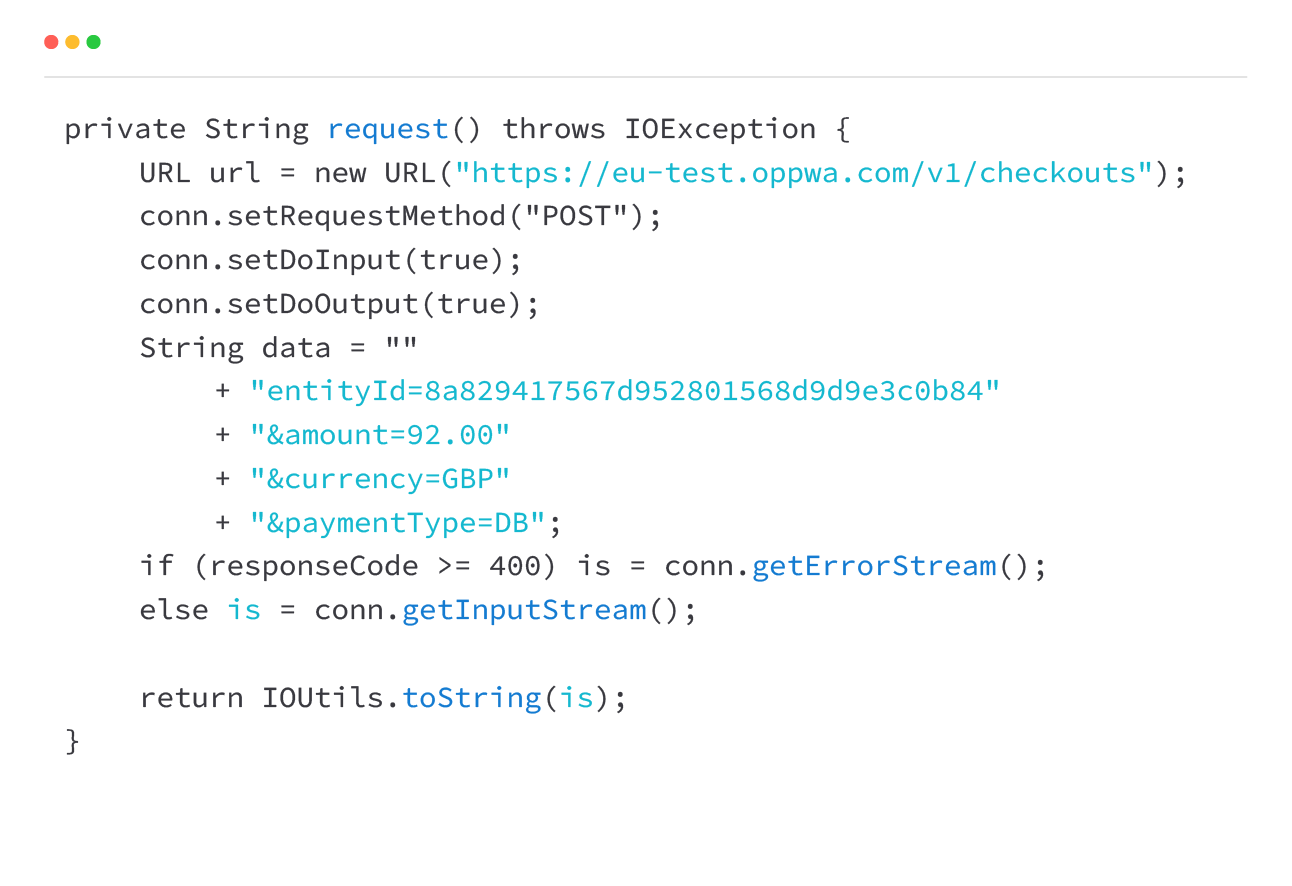

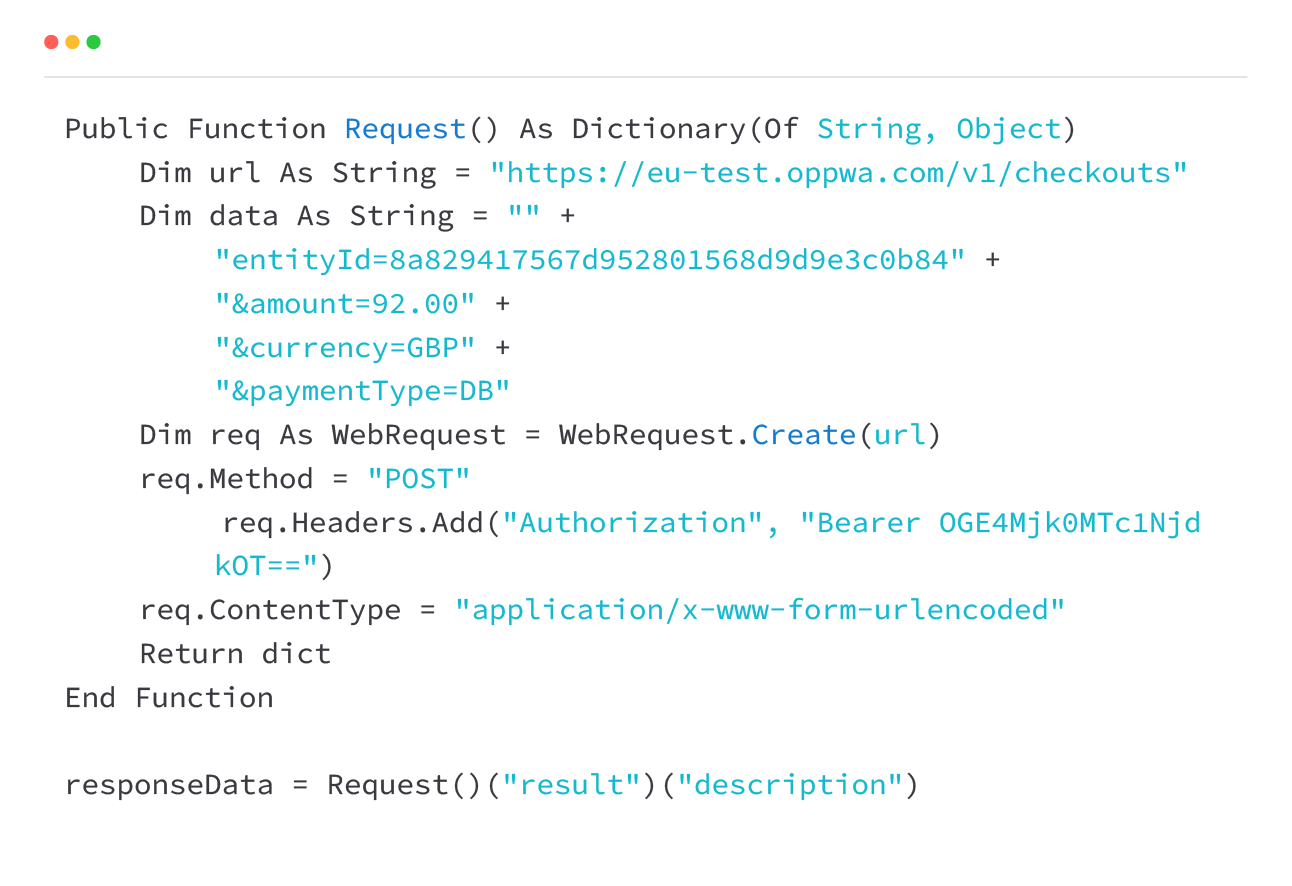

Easy Integration

+

Cost-Effective

+

Global Coverage

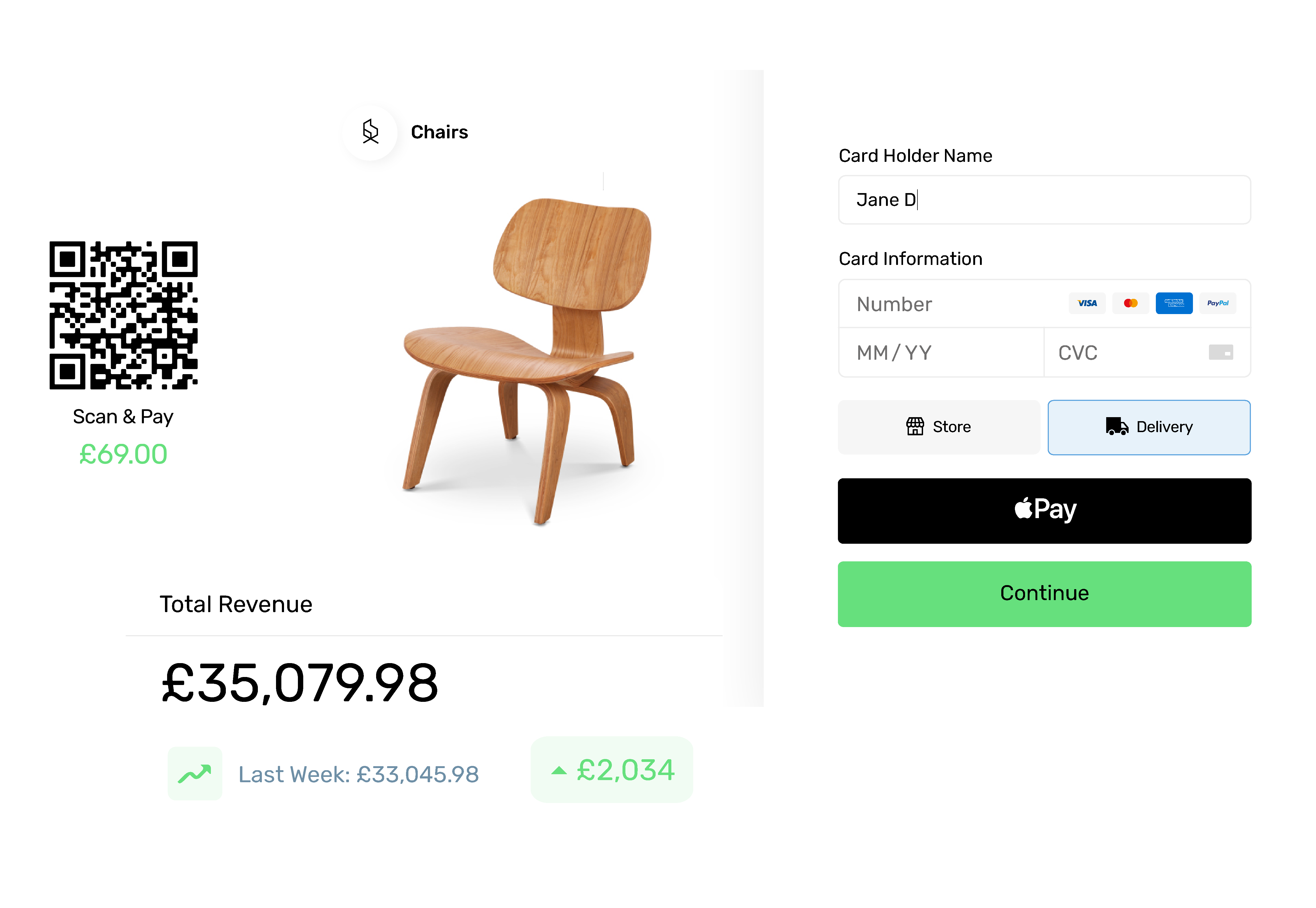

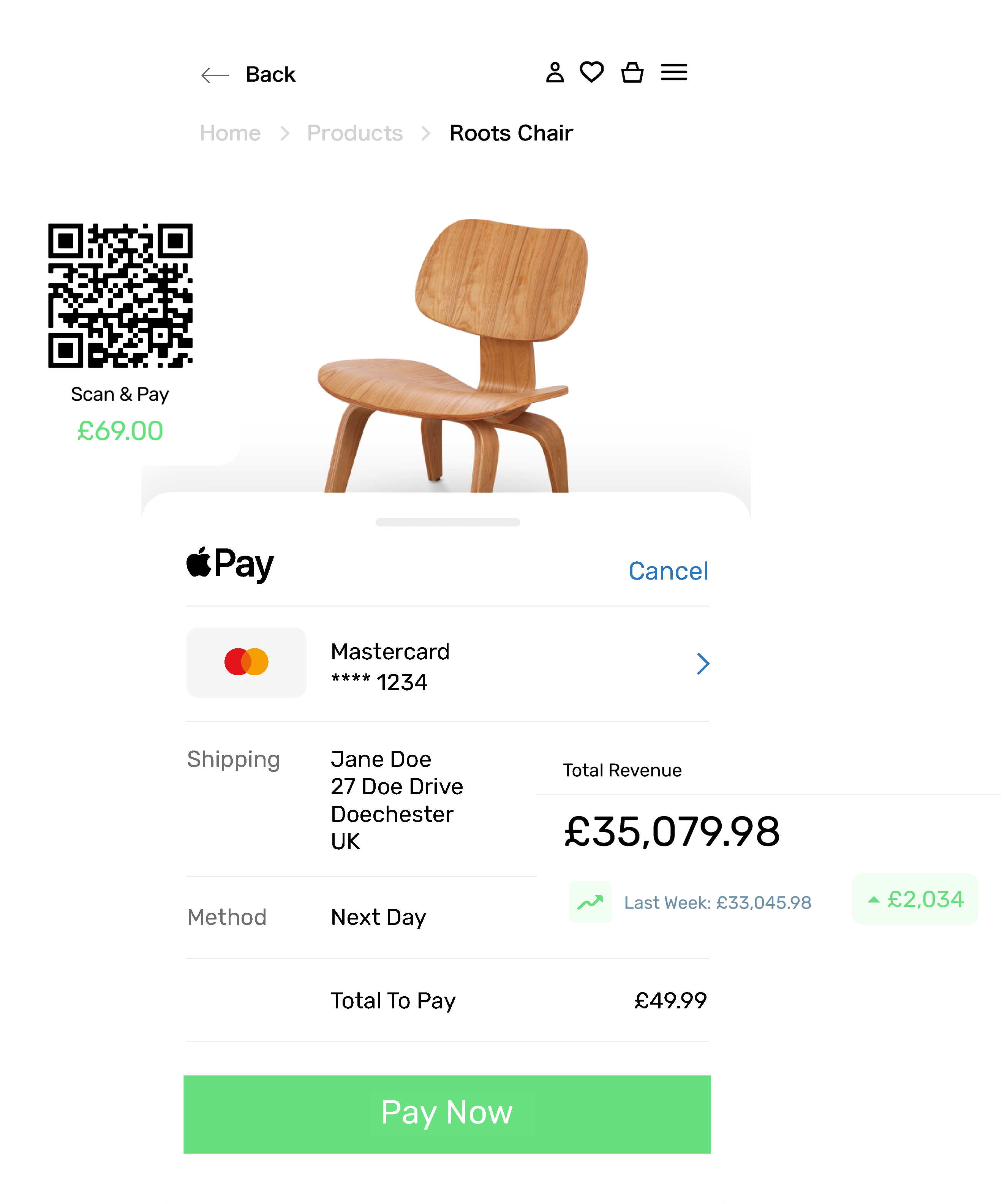

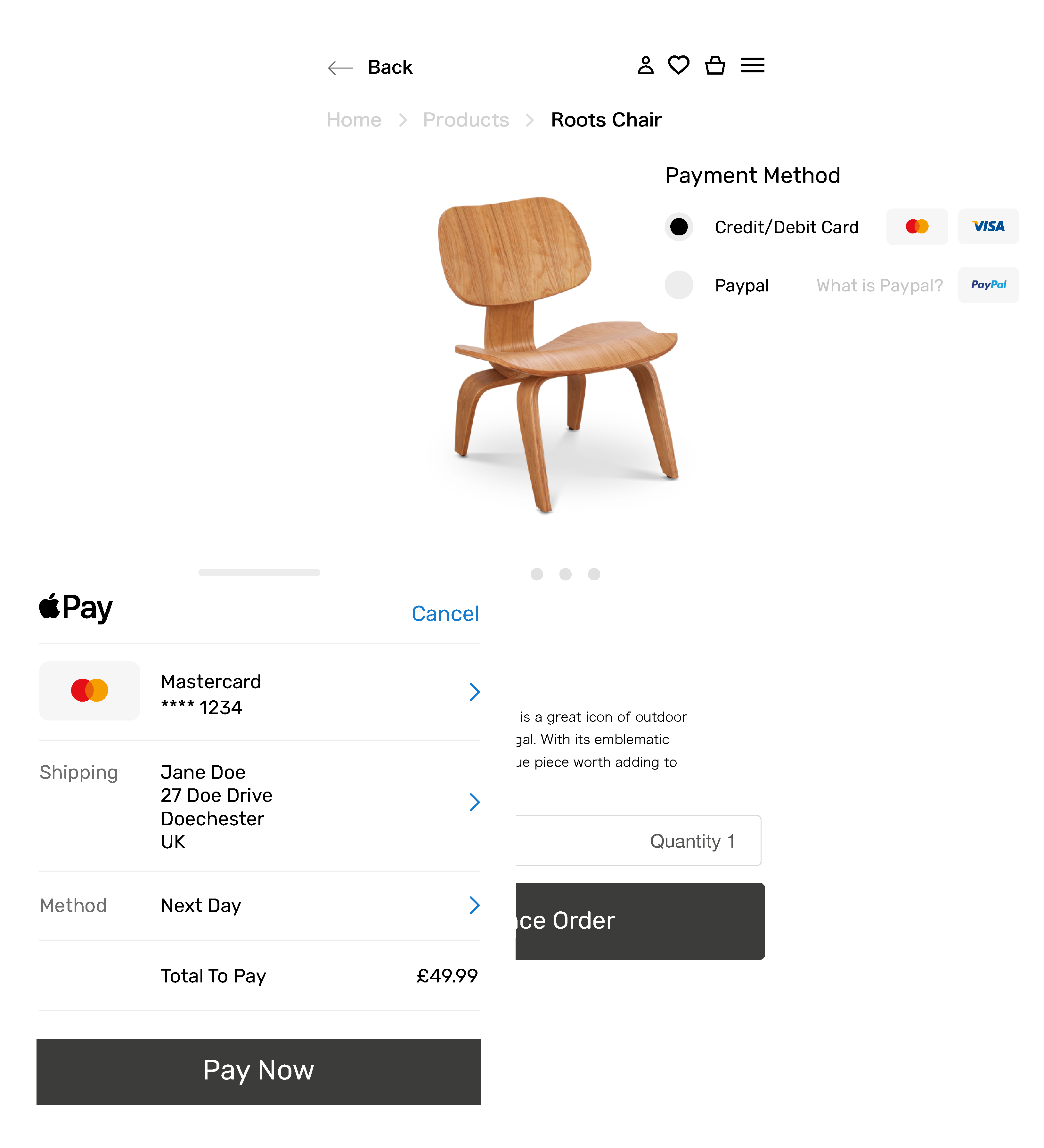

Seamless Integration – For Any Use

Discover a wide range of popular developer documentation for e-commerce interfaces including WordPress, Magento and Shopify.

Start accepting popular payment methods including Apple Pay, Amazon Pay, Visa and American Express.

Ready To Start Accepting Payments?

Total Control is the all-in-one solution for your business.

Get a quote or schedule a call to demo our powerful suite

of features.