The most successful cryptocurrencies of 2023 | New Insights

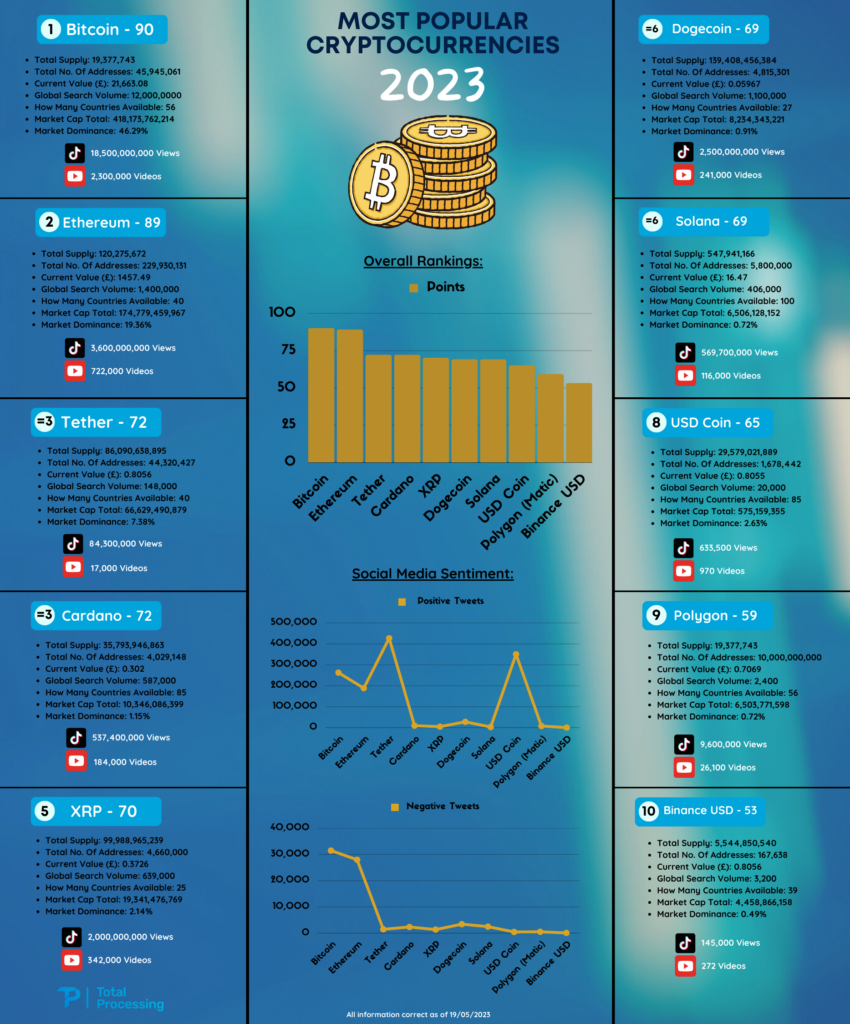

The most successful cryptocurrencies are all:

What this essentially means is they are reliable and practical. For example, a coin that is scalable can process transactions very quickly, using the fastest and most secure blockchains.

Unsurprisingly, these qualities can make a cryptocoin more popular, expedient and valuable.

Read more in our article: Cryptocurrency Around The World.

Let’s take a look at the most popular coins on the cryptocurrency market to see why they’ve been successful so far:

As this coin was literally the first ever cryptocurrency, it’s not hard to see why it enjoys such an advantage on the contemporary market. This coin shook the global economy, becoming instantly recognised and accepted.

Shrewd planning has also worked in Bitcoin’s favour. It’s known to be transparent and easy to use, benefits from the latest and most robust security and technology, and is a scarce asset thanks to limitations on the amount of Bitcoins that can exist.

This cryptocurrency owes its success to technological innovation, including a programmable and developer-friendly blockchain, smart contracts and a decentralised finance (DeFi) ecosystem.

Ethereum’s spectacular technological successes have given it a well-earned seat as the second-most popular coin around, which in-turn has facilitated more trading, investment and helped it to stay reliable and stable.

Tether is what’s known as a “stablecoin”. Its value is pegged to the US dollar, meaning one dollar is equal in value to one Tether (USDT) coin. This stability makes it somewhat reliable as it offers reassurance to investors and businesses who do not want the uncertainty/price fluctuations that come with other cryptocurrencies.

Tether can also be quickly converted into other types of cryptocurrencies and even fiat currencies. Despite its popularity, some confidence has been shaken in stablecoins and Tether, especially since the shaking of the foundations of other supposedly ‘stable’ stablecoins in 2022.

This coin has really taken off over the past year because it is very fast at processing transactions, comfortably beating Bitcoin and Ethereum. “Very fast” is actually an understatement. Cardano can process one million transactions per second (TPS), in comparison to Bitcoin’s three (yes that’s the single-digit number “three”) per second.

It also operates under what’s known as a “proof-of-stake” consensus which is understood to be an environmentally-friendly way to mine coins. These factors, along with more technological innovations, are largely behind the recent success of this type of coin.

What makes this coin unique is that it’s already “premined” — meaning that there are a total of 100 billion tokens and no more can be made. Selling-points of XRP include its touted cost-effectiveness, scalability and environmentally-friendly nature of operations.

It has one of the fastest blockchain-based payment systems, and XRP’s speed and scalability have made it a favourite for cross-border transfers and business transactions.

A bit of an anomaly amongst the others, this “meme coin” was started as a joke, only to be catapulted to crypto royalty thanks to social media. There is no cap on the number of dogecoins, which is probably why so many younger people are attracted to it and why it’s accessible to a wider audience. A beginner can buy a large amount of dogecoins with little actual financial investment.

Benefits of dogecoin include the charitable and community-driven work it has carried out in the past, helping to generate a favourable public image. However, dogecoin’s success is more of a mirage, as its upward swings are largely determined by social media trends rather than any real technological innovation.

This cryptocurrency utilises an innovative blend of proof of history and proof of stake, which allows validators on the blockchain to decide on the timestamps along the different blocks in the chain. This keeps the chain decentralised while also keeping it secure.

But perhaps Solana’s biggest recent breakthrough was in the success of its Degenerate Ape Academy, otherwise understood as the first big NFT (non-fungible token) project on the market. Bold technological innovations, such as the Wormhole Project, have also kept Solana at the forefront of successful cryptocurrencies.

Similar to Tether, this stablecoin is pegged to the US dollar. Importantly, its auditing process has been described as one of “true financial and operational transparency”, helping it to build trust, confidence and authority amongst investors.

USD coin is also fairly well regulated, and has a competent suite of technological features, making it a favourite for users who don’t like the volatility and uncertainty that may arise from other cryptocurrency investments.

Polygon succeeds where Ethereum fails. In fact, it was largely developed to address the downsides with Ethereum. For example, Polygon can process up to 7,000 TPS (whereas Ethereum can only manage 14 TPS). The result is that everything built on Polygon’s blockchain is cheaper and quicker in comparison. Polygon also has lower fees that are attractive to developers.

Another undoubtedly big factor in Polygon’s success is that it is more scalable than Ethereum, and more developer-friendly, therefore encouraging more innovation.

Another stablecoin, Binance USD is also pegged to the US dollar. It is well-audited and adheres to strict regulatory standards, adding a reliability and trustworthiness to its name, which all serves to inspire confidence in investors.

Binance USD’s continued success has also seen it adopt new technologies (such as NFT products) and innovative partnerships.

By looking at these top ten most successful cryptocurrencies, a clear pattern emerges. They are all thought to be secure, stable and scalable — with, perhaps, the exception of dogecoin.

All of the coins mentioned above are successful, but some are more successful than others. Let’s take a close look at the bottom three for a clearer understanding:

You can earn a lot of money in crypto, but there are concerns about a lack of regulation in the industry, market manipulation, and of course market volatility. Like most sensible investors, it’s best to only put in amounts of money that you can afford to lose.

—

Keep in mind

The information in this article is not intended as financial advice or recommendations for investment.

—

There are a few unsurprising and surprising findings to conclude with.

Unsurprisingly, Bitcoin remains (by some distance) the most successful cryptocurrency on the market today. Yes, it has a ‘winter’ in 2022 but those gloomy forecasts are now giving way to sunnier days, and growth is yet again predicted.

What is surprising is how popular Tether remains. This stablecoin was rocked by controversy last year when it lost its stability, and dipped below the dollar value. This may also account for its relatively high (the highest in our sample) of negative sentiment on Facebook. And yet here it is, the third most popular, beating out other stablecoins that have not suffered the same fate.

It’s important to understand the crypto market, as it’s growing in popularity and is likely to be one of the preferred methods of payment for the so-called ‘Generation Z’. This includes knowing what type of crypto to accept, which type your customers will prefer to pay in and getting your business optimised and set-up to accept crypto payments.

Read more: ‘How to accept crypto payments as a business’.

Take payments anywhere, including crypto — with our payments platform