Payment gateways explained | Everything you need to know

If you’re looking to start taking payments online, getting a payment gateway for your website is an essential part of this process. Without it, you simply won’t be able to accept online payments so understanding what it is, why you need it and how to integrate the gateway into your website and payment process is a must for any business.

That’s why we’ve put together this guide to tell you everything you need to know about payment gateways.

What’s in this article?

A payment gateway is the foundation of your online payment process. When a customer enters their card details on your secure checkout page, the gateway takes the lead in communicating the payment information to any other third-parties involved.

It predominantly acts as a liaison, verifying payment details with the bank to safeguard your business from fraudulent activities and costly chargebacks. The gateway automatically accepts or declines payments based on factors such as whether or not funds are available or if the customer has entered the card details correctly.

On top of that, a payment gateway automatically encrypts your customer’s card details, making sure you’re meeting the required standards in customer data protection. This ensures your checkout process is safe and secure for both parties – and that’s why a website payment gateway is necessary for any e-commerce site.

Although easily confused, payment gateways and merchant accounts are actually two distinct parts of your payment process, and you’ll need both to take payments online. Once a payment gateway has accepted a payment, the funds will be transferred to your merchant account. Once an agreed period has passed, the money will be deposited into your nominated business bank account.

Many providers (including us) offer a complete payment processing package, including a payment gateway, merchant account and secure checkout page. This helps merchants by integrating all processing tasks and speeding up fund settlement into your business bank account.

Find out more about how they differ in our payment gateway v merchant account blog.

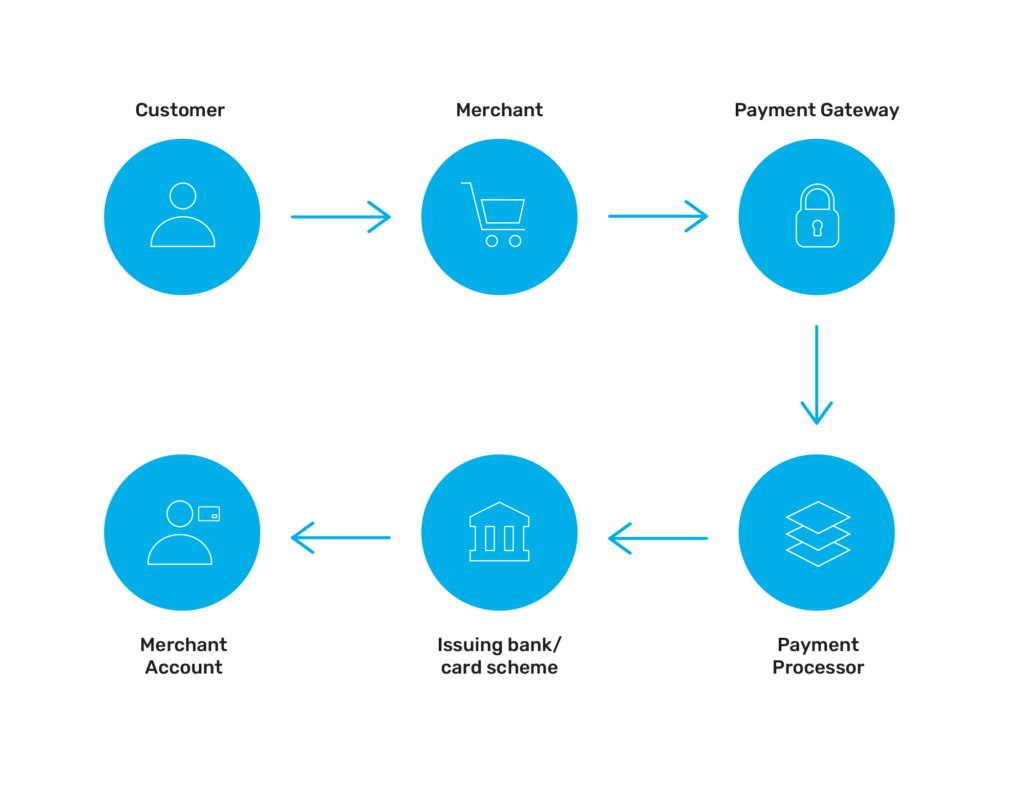

As we’ve mentioned, the payment gateway essentially acts as a middleman between merchants and customers, transmitting the information and encrypting sensitive customer data.

But let’s take a look at the payment gateway process step by step:

1. Payment page

The payment process begins with the checkout page, where the customer enters their card details. These details are then sent from your website to your payment gateway.

2. Payment gateway authentication

The payment gateway receives the details, including transaction amount, currency, cardholder name, address, order number and other transactional information.

Before contacting the customer’s bank, the payment gateway will do some initial checks via the card networks and payment provider including checking if the card is active and whether the merchant accepts customers from their country, etc.

As soon as the gateway gets the go-ahead, it will continue to authenticate the payment by contacting the customer’s bank to confirm the details are correct and that the customer has enough funds.

Payment gateways make the authentication process much easier, as all these checks are done instantly in a matter of seconds.

3. Payment accepted or declined

The bank sends a response to the gateway’s query. This response is then interpreted by the payment gateway and the transaction is either accepted or declined. The customer will be informed on the checkout page and the merchant will also be informed whether a transaction was successful or not, allowing them to dispatch products and services.

4. Transaction complete

If accepted, the funds will be transferred to your merchant account where they will sit for the agreed settlement period, before being sent to your nominated business bank account.

When choosing a payment gateway for your website, you will need to consider your business model and goals to work out which one is right for you. For example, what you need for a gateway for an e-commerce website may differ for those needing a gateway for a Forex website. Here are a few things to think about.

The price of the service you choose will always be an important consideration, whether your business is small or large. It’s important to remember that fees will vary depending on your business model – businesses in high-risk industries will usually have to pay more due to the increased risk of chargebacks and fraudulent activity. Other factors will also play a part, for example, the size of your business, the price of the items you sell and the delivery times for your products.

All businesses can expect to pay a setup fee, transactional fees and a monthly fee for payment gateway services. Beware of chargebacks, as these can also incur an additional fee. However, the best payment gateways will guard against risky transactions that could result in these disputes, which is why you should choose a quality solution that is equipped with high-level fraud prevention technology.

Security is absolutely essential when taking payments online, for the safety of both the merchant and the consumer. Payment gateways must comply with the Payment Card Industry Data Security Standard (PCI DSS), which requires all card data to be stored and processed in a secure environment. There are several levels of PCI compliance, depending on your business model and the number of payments you process in a year. For high-risk merchants, such as those looking for a CBD payment gateway, increased safety authentication is invaluable.

This is to ensure that customer data and card information are protected and that your business is not susceptible to a data breach. If you don’t ensure you are PCI compliant, not only could you face huge fines, but you could risk your reputation. Therefore, choosing a secure payment gateway with a high level of encryption will help to keep customer data safe.

When looking at the security of your payment gateway, fraud prevention is a big part of that. Online payments are widely susceptible to credit card fraud, including card-not-present fraud, fraudulent chargebacks and cyberattacks which can incur huge costs to businesses globally.

E-commerce sites are particularly vulnerable to fraud, simply because the customer doesn’t have to be physically present to make a purchase. There’s been a rise in ‘digital shoplifting’, where customers order an item, have it delivered and then use a chargeback to recover the money they’ve spent – often by claiming the item never arrived. In fact, in 2022, 23% of consumers admitted to unnecessarily disputing purchases!

With this in mind, it’s essential that you safeguard your business against fraudulent transactions. A payment gateway needs to come equipped with a fraud protection suite to give you extra security against this growing problem.

Here are some features you should look for in a gateway that will help to prevent fraud from impacting your bottom line:

If you want to expand your business internationally, you’ll need to be able to accept various local payment methods and currencies, as well as have access to local acquirers. If this is a goal, make sure you’re choosing a gateway that’s able to do this. Ideally, you’ll also want one that offers multi-language support too.

Bear in mind that fees may be higher for international payments.

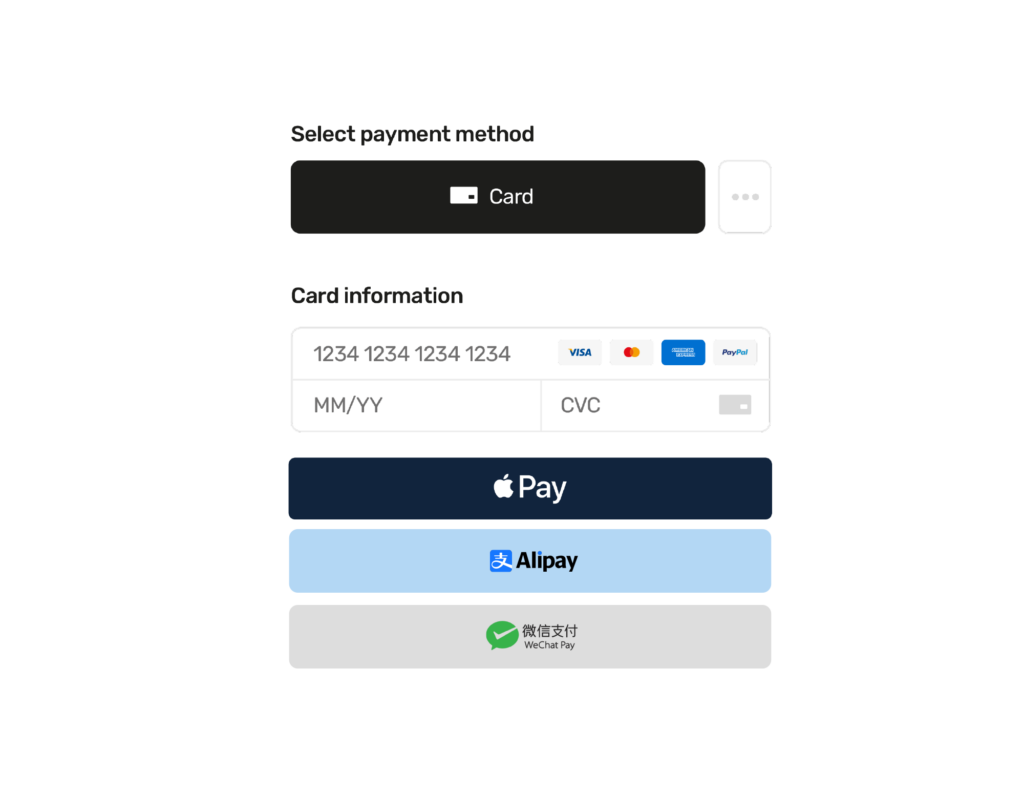

To offer your customers the best possible experience, you’ll want to offer as many payment options as you can. Customers are far less likely to abandon their carts if they can use their chosen payment method.

Most payment gateways will accept VISA, Mastercard and American Express. However, with an increasing range of online payment methods available – and customers using them more and more – you don’t want to neglect these. Make sure to find a payment gateway that offers the best flexibility in payment methods, including digital wallets like Paypal and Apple Pay.

As a business owner, you want real-time updates on transactions so you know exactly where your finances are up to. Enhanced reporting in a payment gateway is, therefore, an instrumental feature, allowing you to monitor revenue, check profit margins and even forecast sales. This will not only help you to plan your business’s growth and ensure you’re meeting targets but will also make accounting far more streamlined and easy to track.

Issues with your payment gateway can jeopardise revenue, so you want a reliable solution. With this in mind, think about customer support carefully. You’ll want to be sure that your provider will be responsive and solve any issues that arise as quickly as possible.

For more details and additional tips, check out our blog on things to consider when choosing a payment gateway.

Most importantly, you want a payment gateway that is tailored to your needs, and that integrates seamlessly with your website and the rest of your payment processing.

Our team at Total Processing are experts in the industry and can work closely with your development team to integrate a secure payment gateway and help you start taking payments as soon as possible.

Take a look at what our payment gateway solution has to offer or get in touch with us today to learn more, and get a quote.