Set up your payment link in just a few clicks! Everything you need is pre-built within one platform, giving you complete control over the payment journey.

Create, send and track payment links

Simplify getting paid with a quick and easy pay by link. Let your customers securely pay when and how they want with any device.

Convenient payments

Allow your customers to pay at a time that suits them and with 198+ payment methods.

Customisable branding

Build trust by customising your payment links with your own branding and chosen currency.

Real-time

reporting

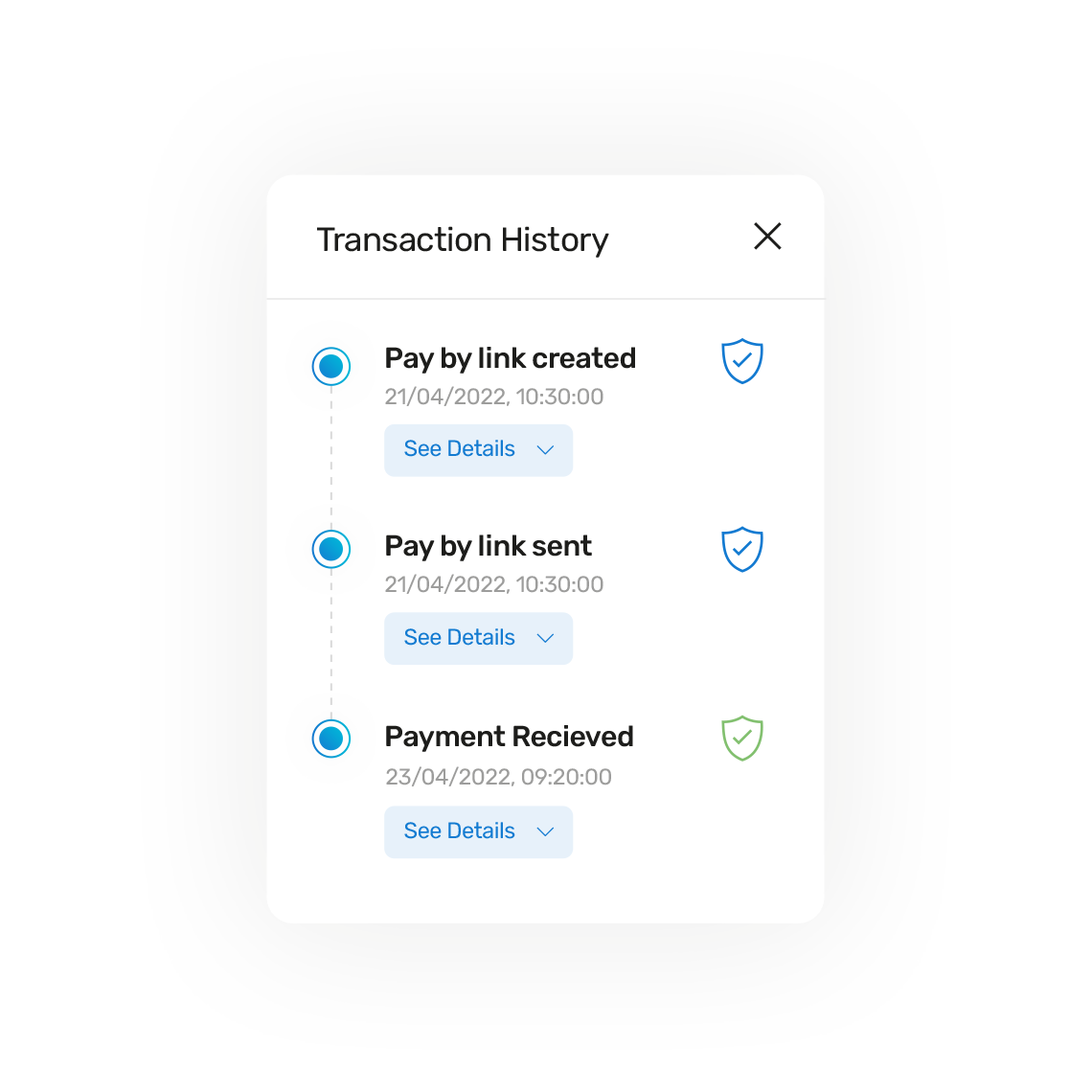

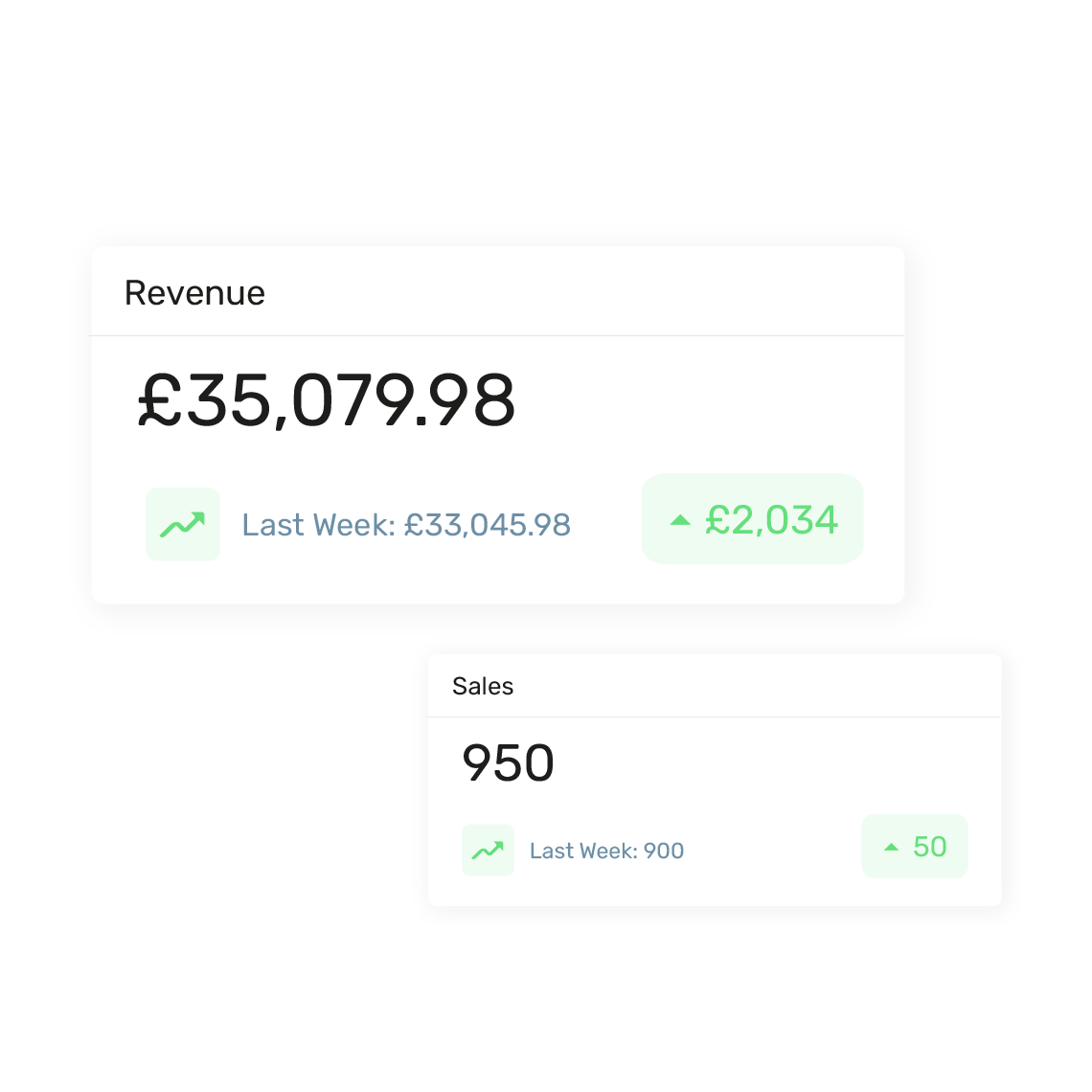

The payment status is updated in real-time with notifications to make tracking a breeze.

Secure

processing

Tokenised payment data is protected with PCI-DSS compliant data security to minimise fraud.

Payments made easy

One-time or recurring payments couldn’t be easier for both the merchant and the consumer with pay by links.

Create a pay by link in 3 steps

Send a pay by link request quickly, easily and effortlessly.

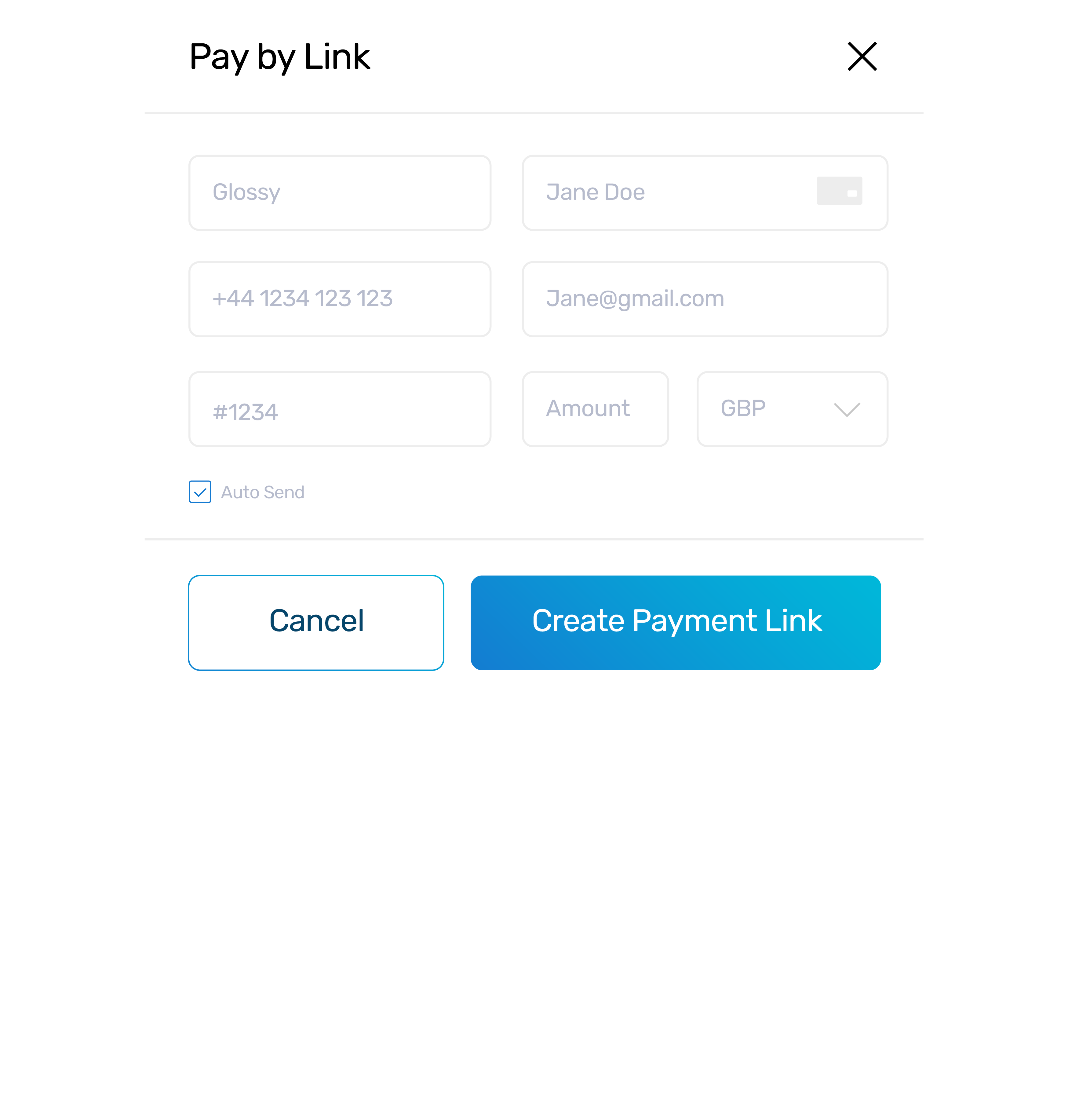

Step 1 - Create the link

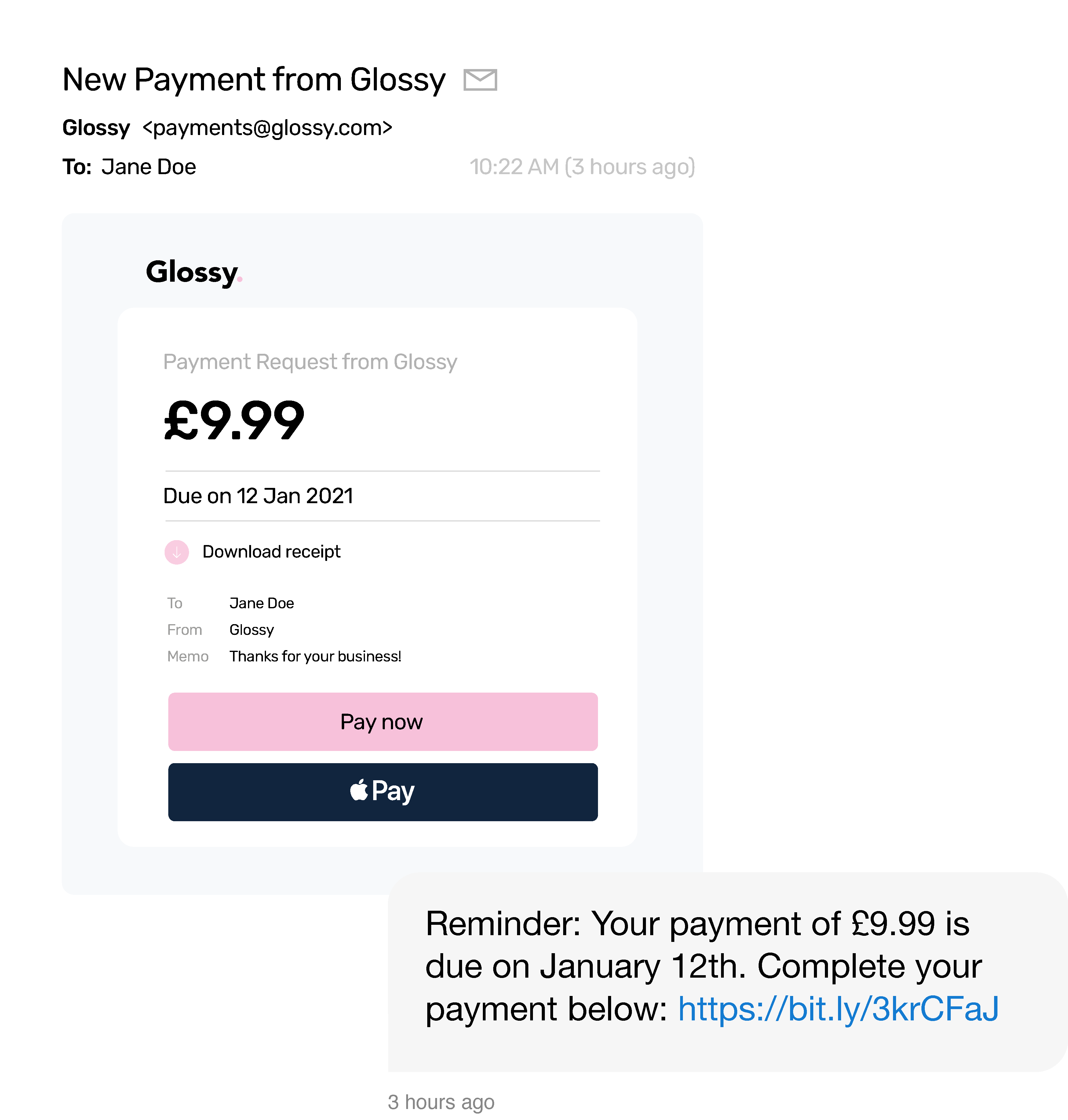

Step 2 - Share the link

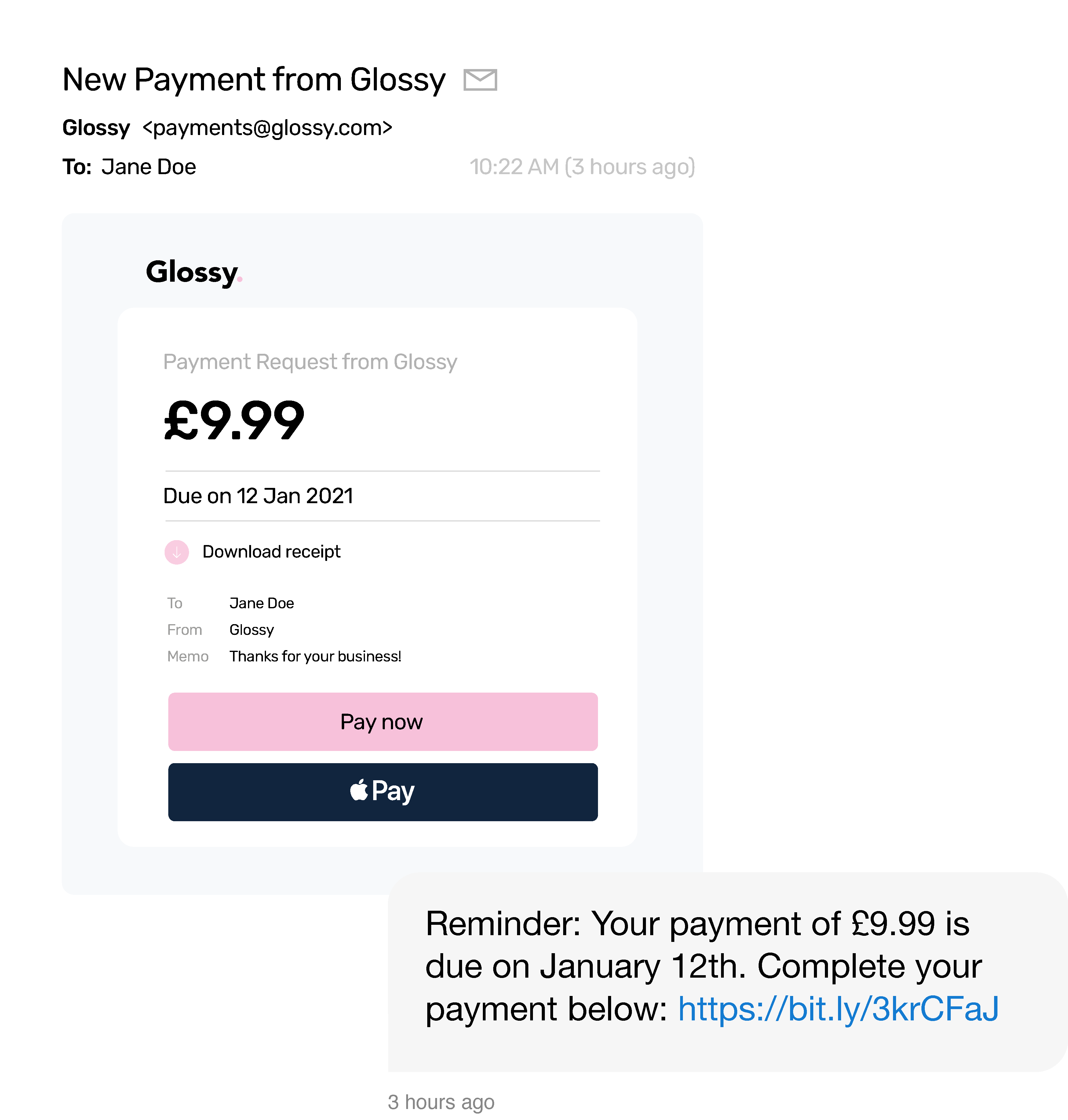

Send the secure payment link directly to customers via SMS or email from Total Control. These are fulfilled within a smart checkout that matches your brand.

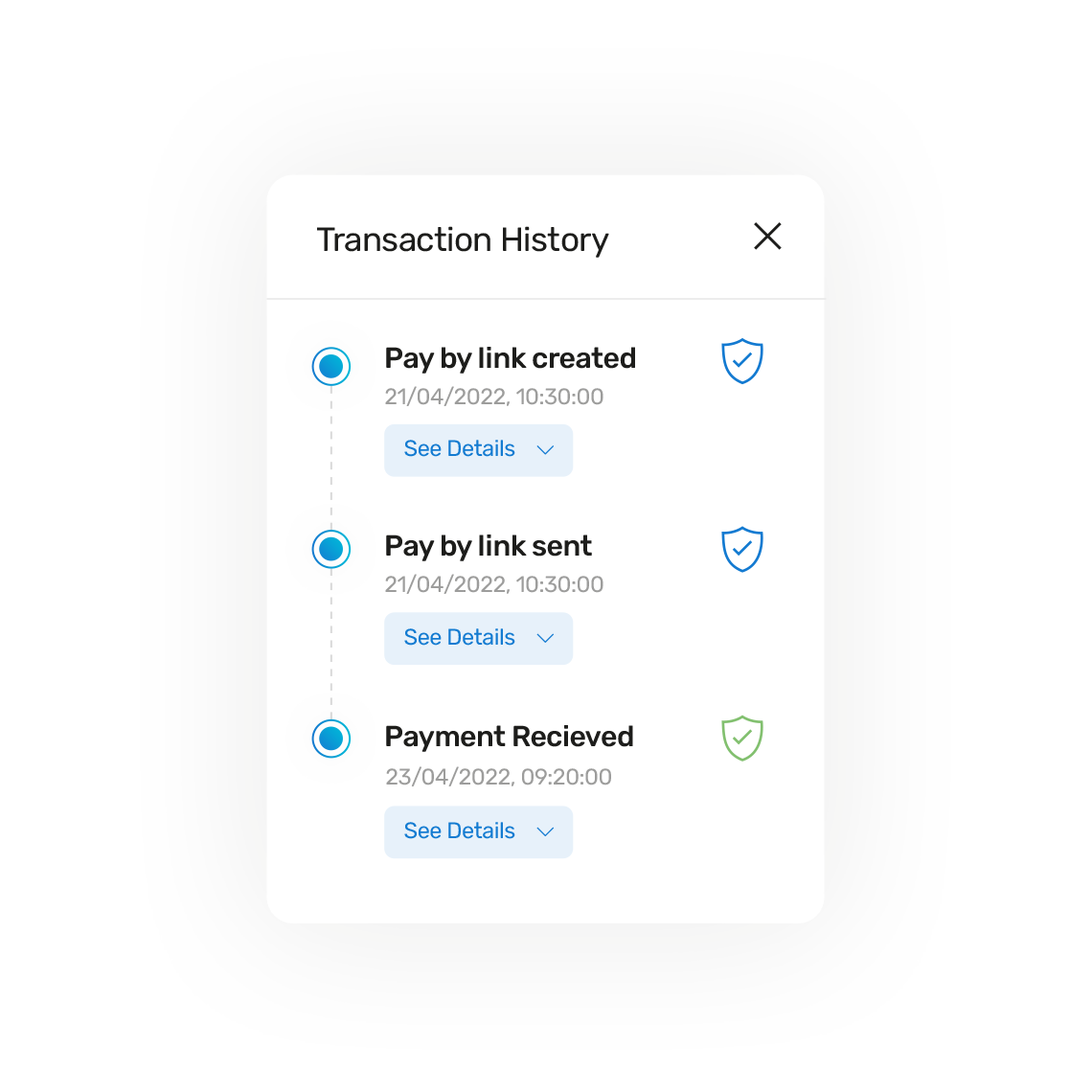

Step 3 - Receive payment

Track the status of a payment request link with notifications that update in real-time on your transactions timeline and watch your customer retention grow.

Send a payment link in multiple ways

Send global pay by links to the customer via a variety of applications for a more convenient and secure way to receive payments.

SMS and email payment links

The most popular forms of pay by links are commonly used within the hospitality and ecommerce sector or for sending digital invoices.

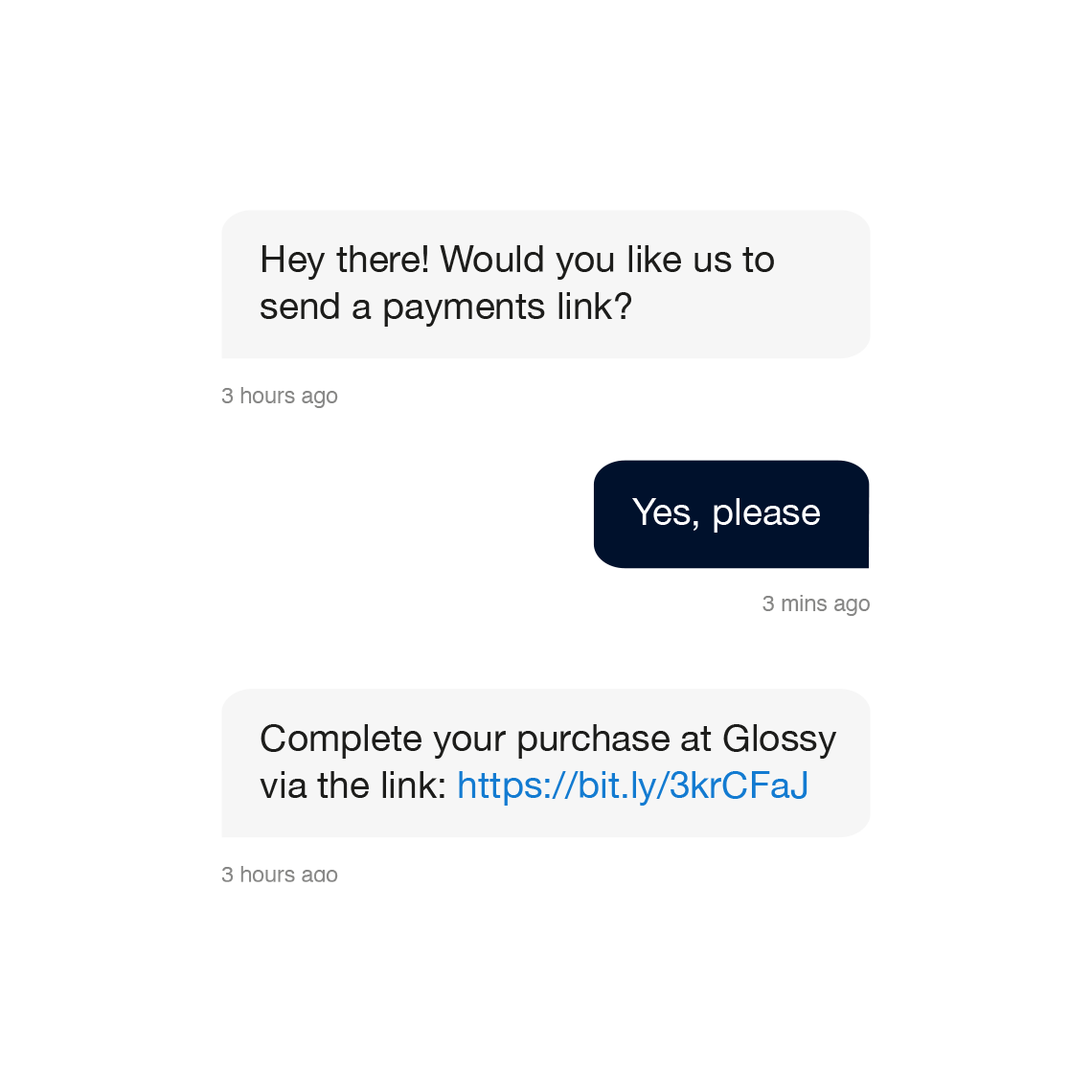

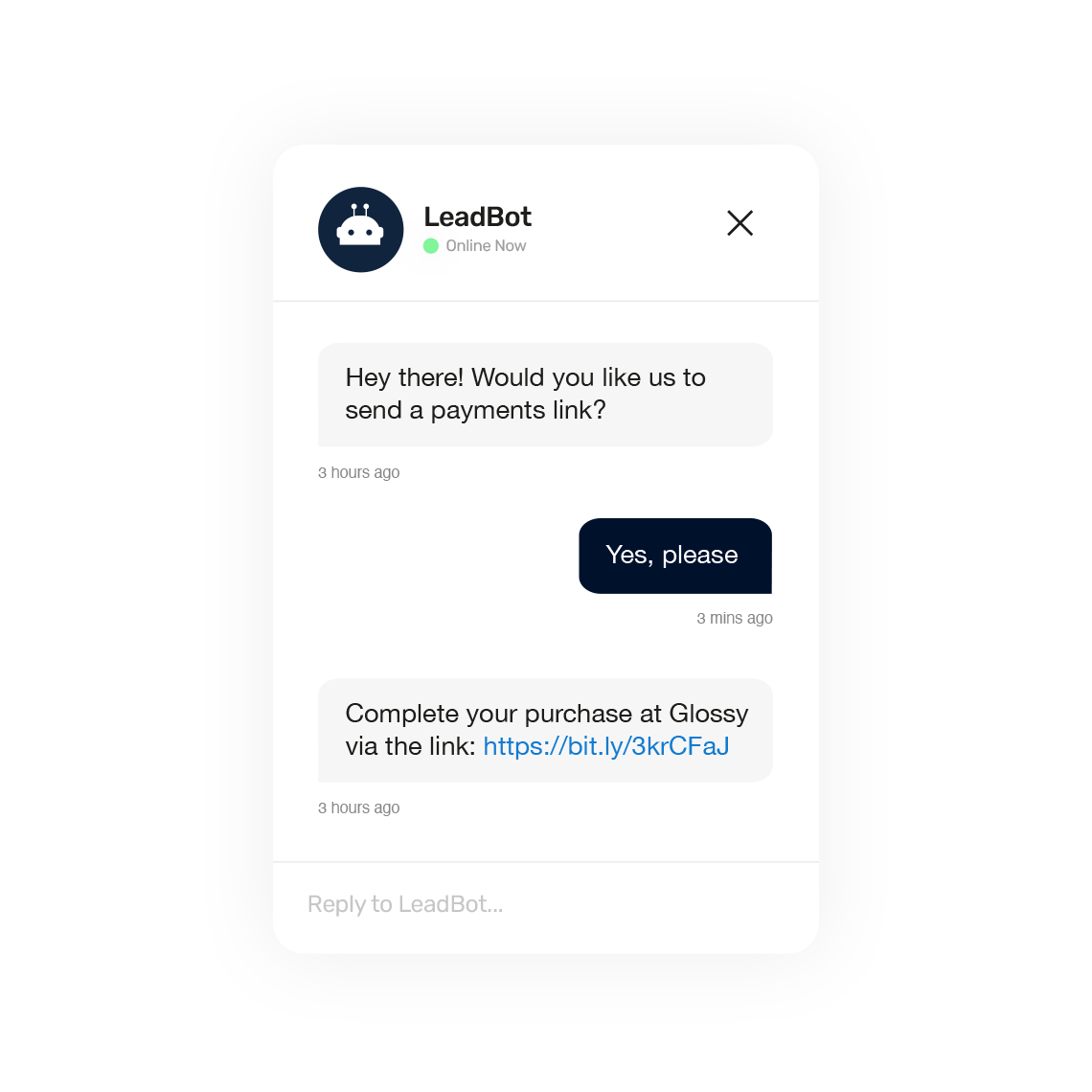

Chatbots and social media links

A more secure way to accept payments in a customer service situation is to send payment links via chatbots or messenger, or even via social media, rather than asking for details over the phone.

Manage your payments with Total Processing

Learn more about our pay by link solutions

The benefits of pay by links

Boost revenue – By offering a smooth payment experience with the flexibility that consumers desire your conversion rates and customer satisfaction will increase.

Reduce churn – Re-engage with consumers who abandoned their shopping cart or chase missed or late payments with multiple payment options to entice your customers back into making that transaction.

Increase trust – Alongside being PCI-DSS compliant, by removing the risk of manually taking details over the phone you’re making the transaction more secure and putting your customer’s mind at ease.

Payment Request

Management

- Follow up on missed payments with 'resend', 'copy' or 'disable' features across single or consolidated payment links within Total Control.

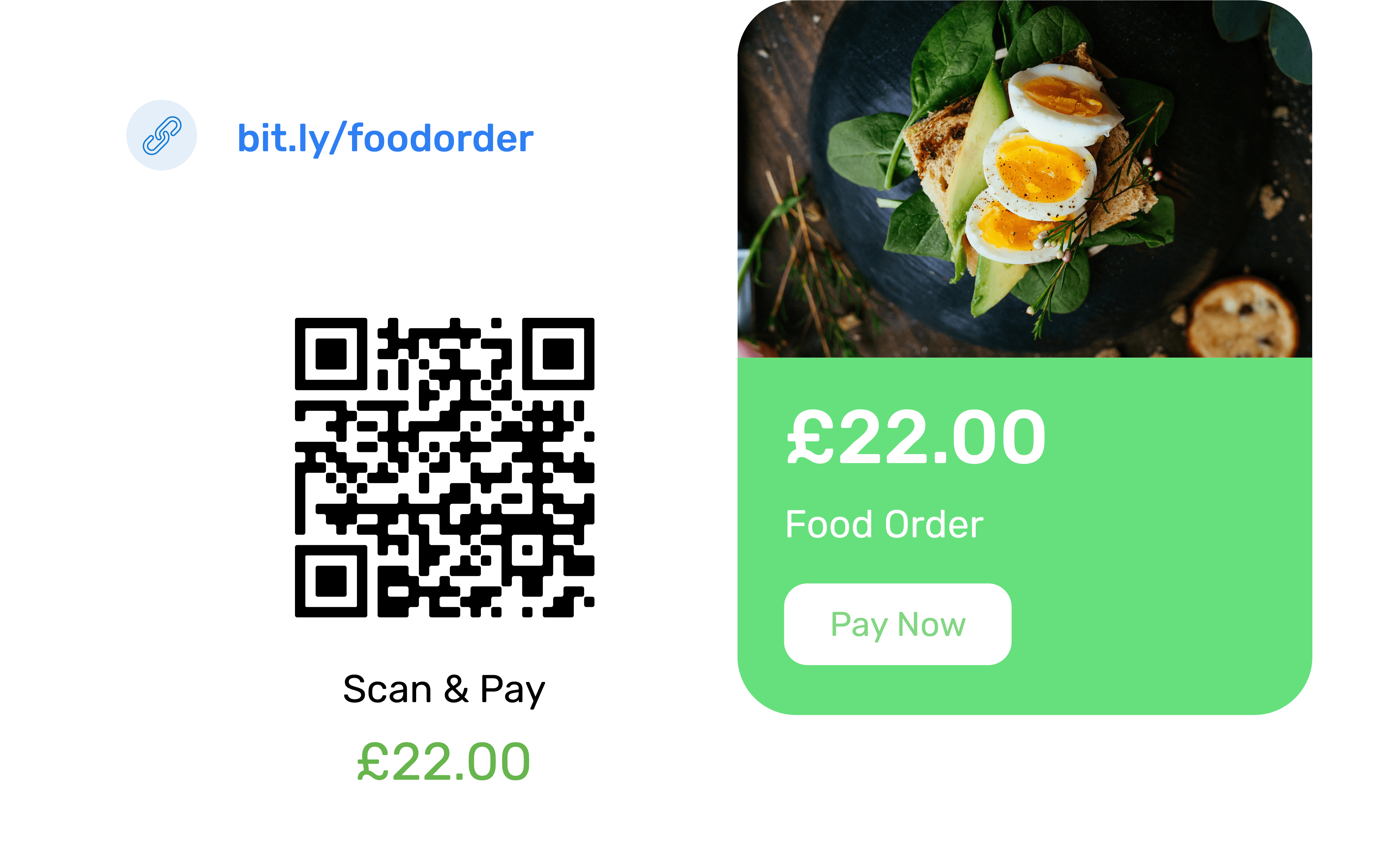

- Extend the reach of your request by embedding payment links directly into social media or QR codes.

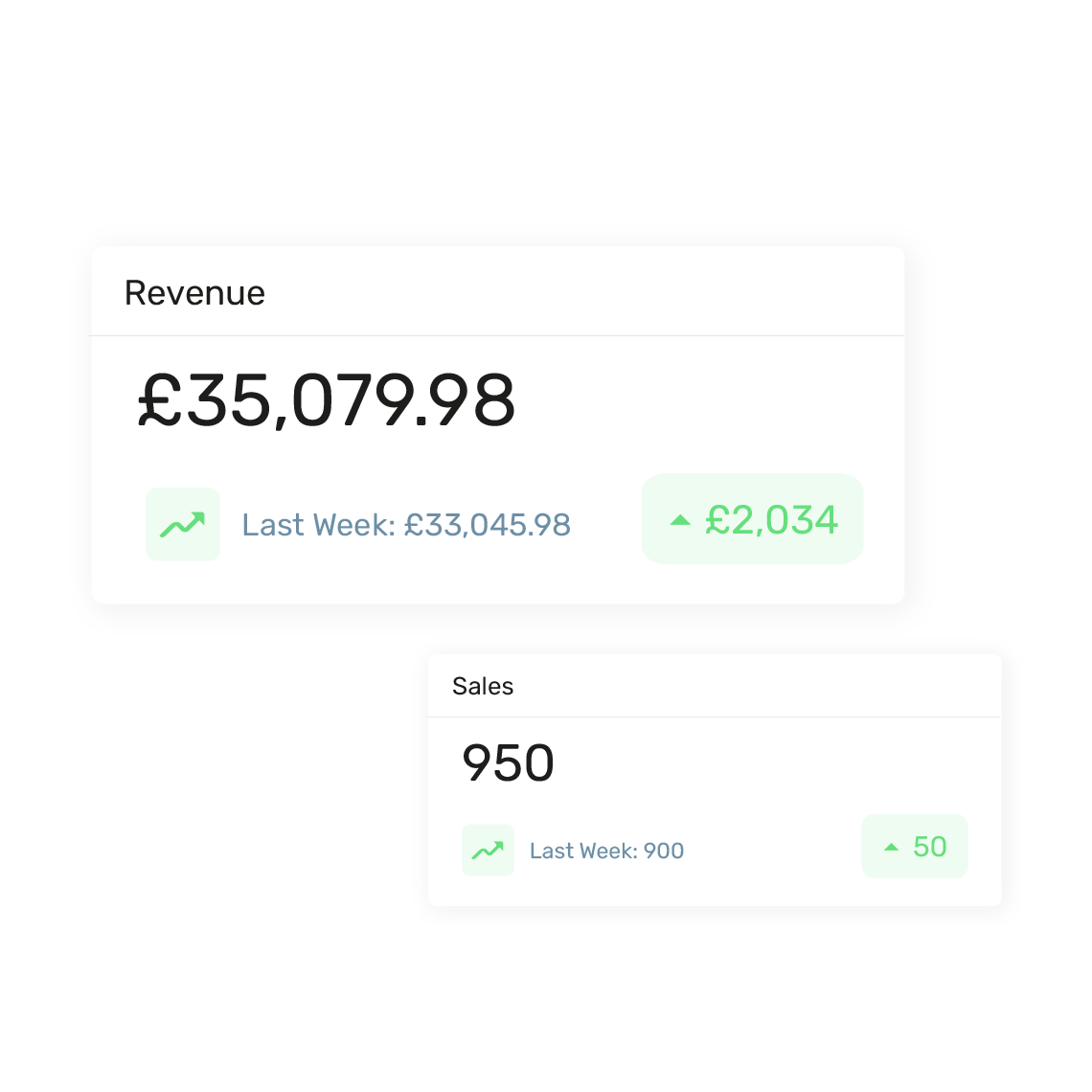

- Monitor the efficacy of your payment link solution with revenue insights in Total Control.

Discover Our Solutions

Frequently Asked Questions

A pay by link service can work in a number of ways. It allows customers to make payments whenever and wherever is convenient by sending them a link that takes them to the payment page. You can either schedule when the links are sent or it can be done while they're on the phone, chat or social media, meaning card details do not have to be shared over the phone or via text message for added security. Like other methods, the payment will be processed via a secure payment gateway. Once the payment has been made, Total Control will be updated in real time so that you can easily track your transactions.

As a pay by link provider, you can manage all of your payments via our Total Control platform. To create a new payment request, click on ‘New Pay By Link’ within the Pay by Link dashboard, enter all the relevant information and click ‘Create Payment Link’. It’s that simple. You can also send reminders via the platform if your customers need a nudge to make the payment.

The Pay by Link dashboard will provide an overview of all your pay by link transactions as well as view details on specific transactions so you can easily review the status of your requests.

Yes, you can turn any payment link into a QR code. You can manage all payment links in any form including creating, sending and tracking the links in Total Control.

Yes, you can send a pay by link to remind customers of their due payment. You can view all of your transaction statuses to easily see which payments are outstanding, then create and send a pay by link all via the Total Control platform.

No, you don't need a website to use pay by links. In fact, this payment method is ideal for those who don't have a website, helping businesses who don't have a checkout or POS terminal to accept payments.

Yes, you can customise your pay by links. You can amend the language and currency for your international customers and offer a range of payment methods. You can also personalise the links by adding branding, such as your business's logo. The more you customise the links to match your brand and your customer's preferences, the more you increase your customer's trust.

Pay by links is a very safe payment method. They are processed via a secure payment gateway and comply with PCI DSS regulations and 3D Secure 2.0 authentication. The customer's details are also tokenised to keep their payment information protected.