Interchange fees explained

Interchange fees can be confusing, but they affect all businesses that accept card payments, so it’s important to understand what it is, how they’re calculated and why you have to pay it.

After reading this blog you’ll be in the know and have a better understanding of the fees you’re paying.

Whenever a customer purchases something from your business using a credit card or debit card, a small percentage of that transaction will be used as a fee to pay the issuing bank (the customer’s bank). This fee is called an interchange fee. They can cover:

Interchange fees aren’t the only type of fee you need to be aware of either. There are also acquirer markup fees and card scheme fees. Here’s a quick round-up of all three processing fees for comparison:

Good to know:

Of the three fees, the most significant chunk is usually down to the interchange fees, estimated to be around 70-90% of the total fees. Don’t worry about having to keep track of the three different fees either, they’re all a part of the interchange++ pricing structure. Wondering what the ++ stands for? Well, that’s just referring to the acquirer markup fee and the card scheme fee.

You may be wondering why these fees are necessary. Well, without the issuing bank providing the customer with their form of payment, i.e. the card, as well as performing a number of checks to determine whether to accept or reject the payment, and without the payment provider supplying the payment gateway and the methods of payment, such as a card reader, the transaction would not be possible. So, they take a small cut so that they can continue to provide the merchant with the support and the software needed for a successful business.

Also, when it comes to credit cards, the issuing banks are actually putting themselves at risk. They cover that risk by charging the merchant.

You’d think it was the issuing bank that would set the rates since they receive the fees, right? Wrong. They are actually set by the card schemes.

They won’t be the same for every merchant because they vary on region and what card scheme is being used, as well as a number of other reasons that we will go into later. On average, they range between 0.3-0.4% for European transactions or considerably higher at 2% in the United States.

The fees aren’t set in stone either and are regularly updated. For example, both Visa and Mastercard change and publish their new rates every April and October. So it’s a good idea to keep up to date on the latest rates via the card network websites so you know how much you’ll be charged.

Here are the two most popular card schemes:

The cost of the fee can also change due to a range of transactional factors. Here are the different scenarios that can affect the calculation of the interchange fee:

As you can see, there are many transactional factors that can impact the interchange fee, so no business will be charged exactly the same.

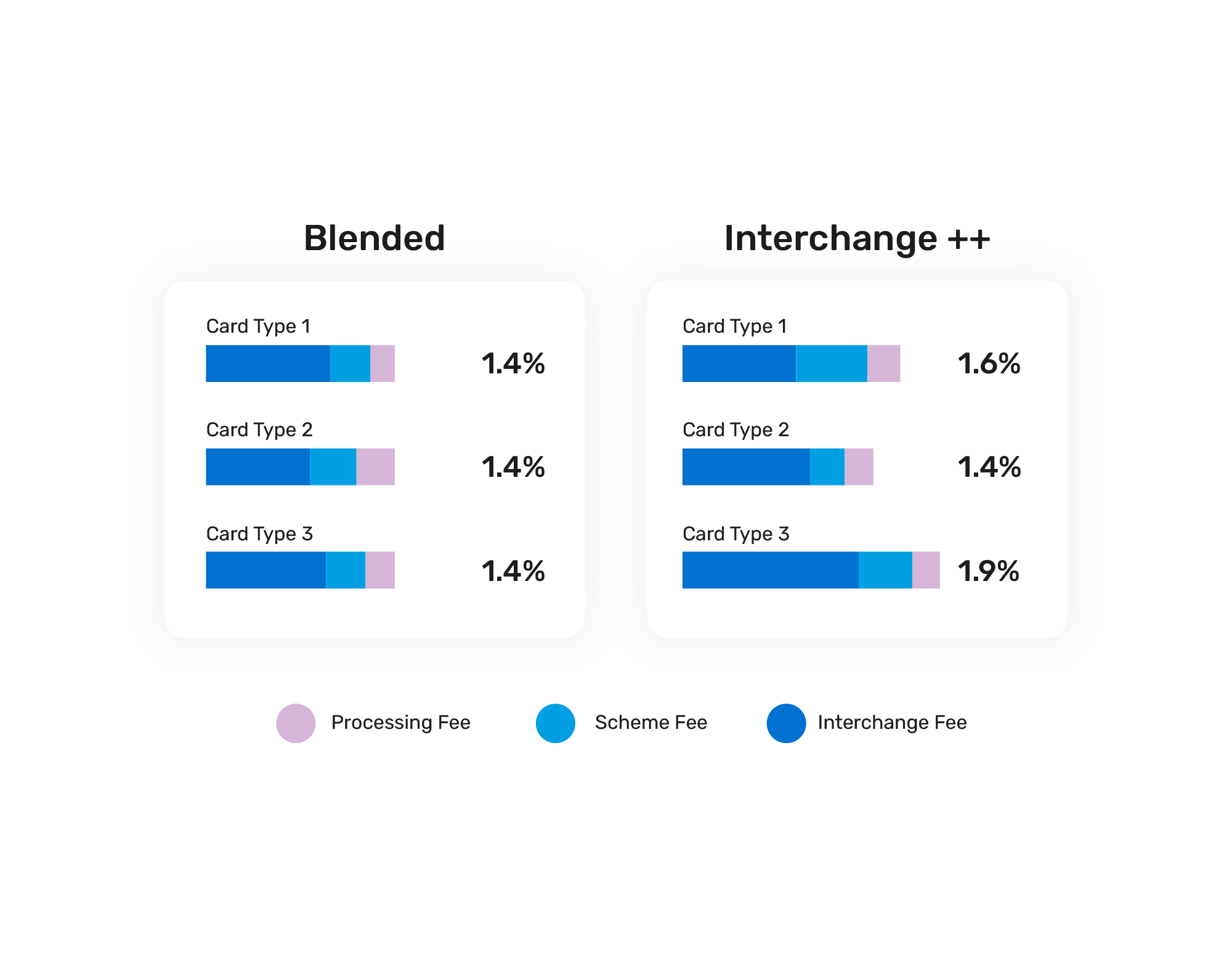

Just to confuse matters even more, when joining a payment provider you won’t just be presented with one pricing model. The alternative to interchange++ pricing is blended pricing. But, what’s the difference between the two? Let’s take a look at the benefits of interchange++ pricing versus blended pricing.

Larger businesses or businesses that have been around for a while and understand the fees are more likely to go for this option because you’ll get the true cost of payments.

Although Blended is much simpler to understand, sometimes they can work out more expensive than interchange++.

Want to know more? Then check out our blog about interchange pricing versus blended pricing.

It’s hard to believe that interchange fees weren’t always regulated. This led to controversy, including how large businesses could use their clout to negotiate lower rates, leaving smaller businesses to pay the full amount.

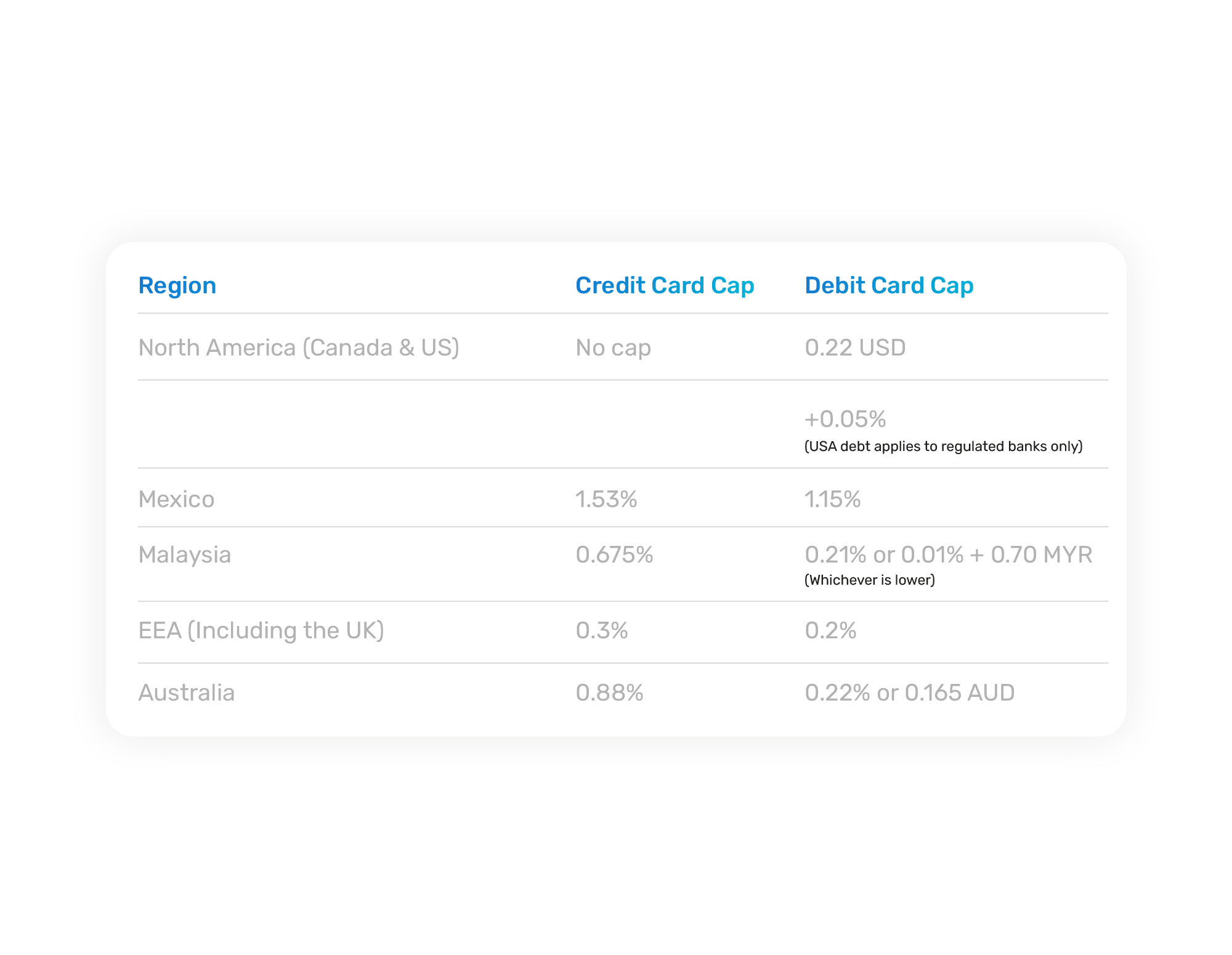

Thankfully, progress has been made to better regulate interchange fees across the world, including the introduction of fee caps and stricter rules to enforce them.

Global interchange fees, including in Europe, USA, Canada and India will vary quite a bit but, on average, the fee is approximately 0.99%.

At the time of writing, these are the average caps for credit cards and debit debits across the different regions. But remember, they do change bi-yearly, so be sure to use the links above to find out the most accurate rates.

These may just be averages but there are some exceptions to keep in mind:

Brexit has affected many areas of business, interchange fees being one of them. Initially, the UK government decided to stick to the EU regulation on these fees with caps of 0.2% (debit) and 0.3% (credit) and, domestically, not much has changed since.

However, in October 2021 Mastercard and Visa revised the interchange fees for cross-border transactions between the UK and EEA. This has led to cost increases for UK businesses. They now have to pay interregional capped consumer rates. But the way both card networks have gone about it is slightly different.

Mastercard has made changes that specifically affect card-not-present transactions. The changes only affect UK businesses buying things across-regions. It does not impact EEA businesses, who can continue to make purchases from outside the EEA in the UK at the old rates.

Visa has announced even more changes than Mastercard. More specifically, Visa’s changes will impact cross-region card-not-present transactions, consumer refund transactions and commercial transactions.

Unlike Mastercard, Visa will demand that EEA markets also have to pay increased rates to deal with UK businesses. So it won’t just be a one-way street.

Although there are some differences, the changes in the rates are currently the same. For both Visa and Mastercard, the interchange fees have risen from 0.2% pre-Brexit to 1.15% post-2021 for debit transactions. For a credit transaction, the fees will increase even further from 0.3% to 1.5%

Hopefully, we’ve helped you gain a better understanding of interchange fees. But, if you’re still unsure and need some guidance on which pricing structure is suitable for your business, then get in touch. We’ll be more than happy to help.