How to prevent fraud in business

Internet shopping in the UK and around the world has become increasingly popular. As online transactions rise, so does the risk. Due to the heightened authorisation processes, sometimes a genuine transaction can get declined, and therefore, the merchant will miss out on a legitimate sale – very frustrating for both the merchant and the customer!

That’s why it’s important to keep on top of the risk protocols and have efficient tools and techniques for the prevention of fraud, like fraud scrubbing.

Let’s take a look at what tools are needed and how they can help you decipher between fraud, friendly fraud and a real customer.

Fraud scrubbing is the verification process that makes online payments via e-commerce sites safe and secure. The process will check the customer’s IP address, as well as IP blacklists, and whether the IP geolocation matches the billing address. If anything appears suspicious, the transaction will be declined.

A study found that 61% of online merchants say credit cards are the leading payment method for committing scams, so having the right tools in place for credit card fraud prevention.

Friendly fraud, also known as chargeback fraud, is when a customer claims a chargeback despite not having a legitimate reason to do so. But, why is it called ‘friendly’ fraud? More often than not, they don’t realise they’re committing fraud. They are simply a disgruntled customer wanting their money back as soon as possible, when in fact, disputes can often quickly be managed by simply contacting the merchant. It’s interesting to know that 23% of consumers admit to asking for a chargeback even though they were satisfied with the purchase!

However, a legitimate chargeback can only be claimed if they’ve not received the service or product they paid for, whether that’s down to fraudulent activity and the cardholder did not authorise the payment or the product didn’t arrive or is not as expected, and the merchant is unhelpful or unresponsive.

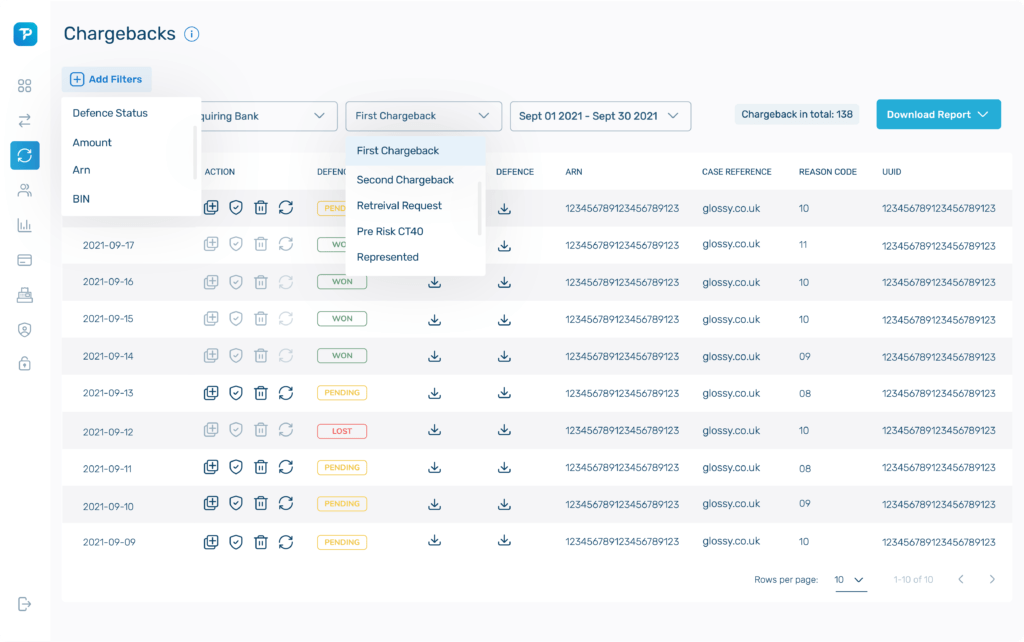

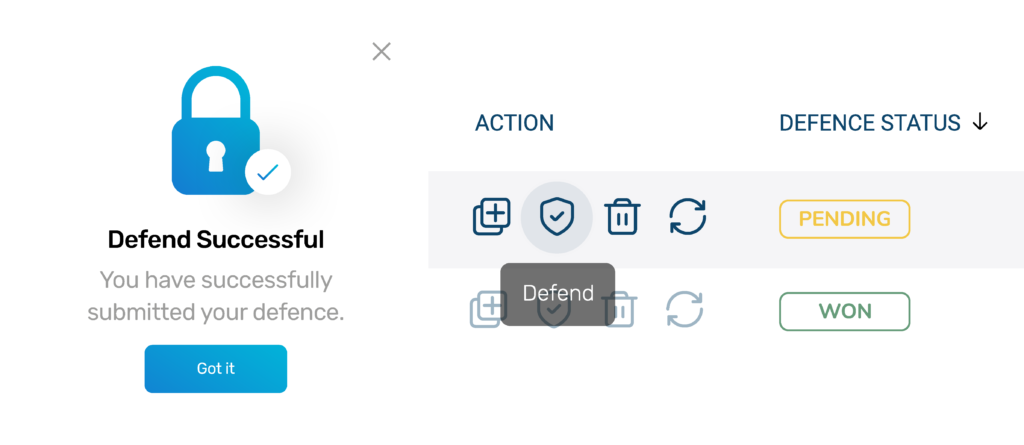

It’s pretty clear that customers misunderstanding when they should use a chargeback is the cause of friendly fraud being on the rise, but that doesn’t help out merchants. That’s why it’s important to be able to manage chargebacks so that you can tackle them head-on.

Before, we delve into fraud prevention solutions, it’s important to understand the impact if you fail to prevent fraud. So many areas of your business can be impacted: financial losses, damaged reputation and customer trust, additional fees and, worst case scenario, your merchant account could get closed down. So, the consequences can be detrimental to your business. But with the right defence, you can prevent fraud from tearing down your hard work.

As a merchant, to prevent fraud and chargebacks where possible, you need to have software in place that can detect and take action against suspicious activity. If you don’t, you could lose a lot of revenue unnecessarily. So, let’s take a look at the e-commerce fraud prevention tools that can make a huge difference to your business.

Since cart abandonment rates can be pretty high, a frictionless checkout is so important these days. That’s why the updates in security protocols, like the European Union’s Payment Services Directive (PSD2) are set to help merchants.

Its aim is to further reduce fraudulent activity with increased requirements needed for customer authentication online. The multiple-factor authorisation required for transactions are less likely to be flagged as suspicious. However, these additional steps aren’t always necessary, but when they are, they are so seamless these days that they often don’t hinder the customer experience.

In April 2023, Visa is set to update its requirements around reporting fraud. Why? To reduce the amount of friendly fraud chargebacks and help merchants retain more of their revenue. Merchants will have more scope to dispute a claim if they have evidence to contradict the cardholder’s claim. Visa’s upcoming Compelling Evidence 3.0 (CE3.0) initiative seeks to ‘level the playing field’ to create a fairer ecosystem for sellers, issuers and cardholders.

Here at Total Processing, our payment solutions implement advanced software to complete these fraud checks efficiently and smoothly, without impacting the customer’s experience. Get in touch to find out more about our fraud suite.