Should you go global with cross-border e-commerce?

Cross-border shopping has become common practice for shoppers worldwide. Most consumers won’t even think twice about whether a purchase is being made locally or not; it’s just the norm to be able to shop internationally.

But does that mean expanding into the cross-border e-commerce market is the next step for your business? There are many things to consider that we’ll take you through to help you decide.

Cross-border e-commerce, also referred to as cross-border shopping and touristic shopping, describes the buying and selling of goods and services across international borders. For example, you’re a small business based in the UK selling personlised t-shirts and you have consumers all across Europe buying your goods; this is cross-border e-commerce.

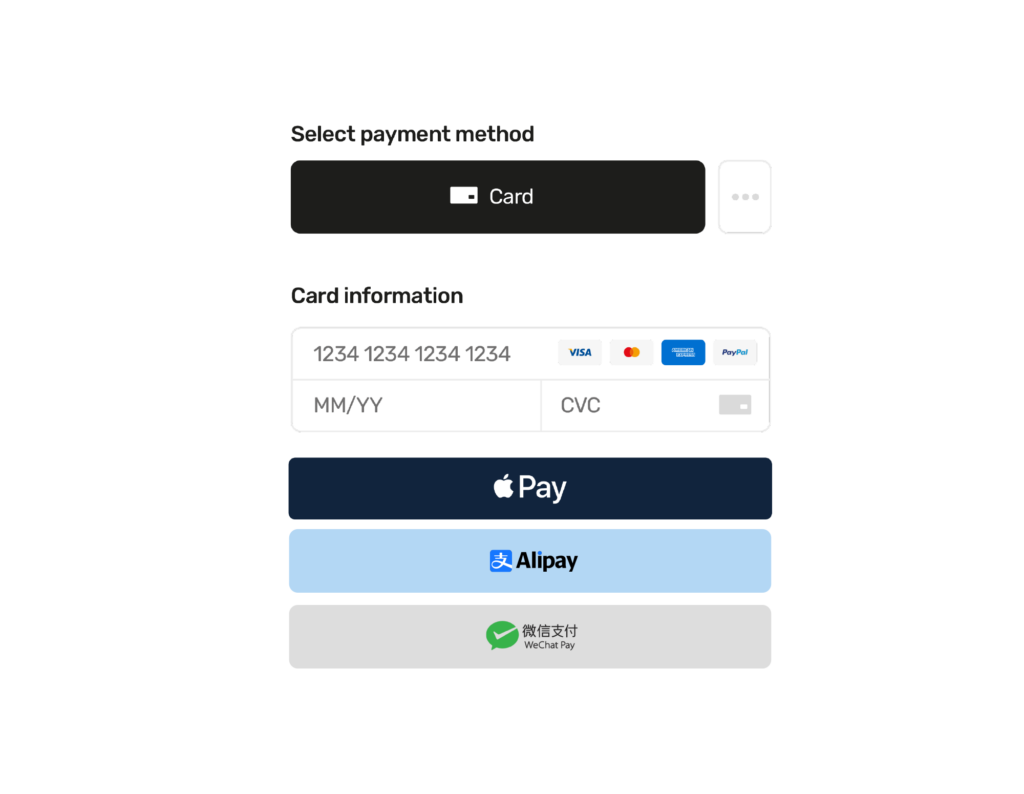

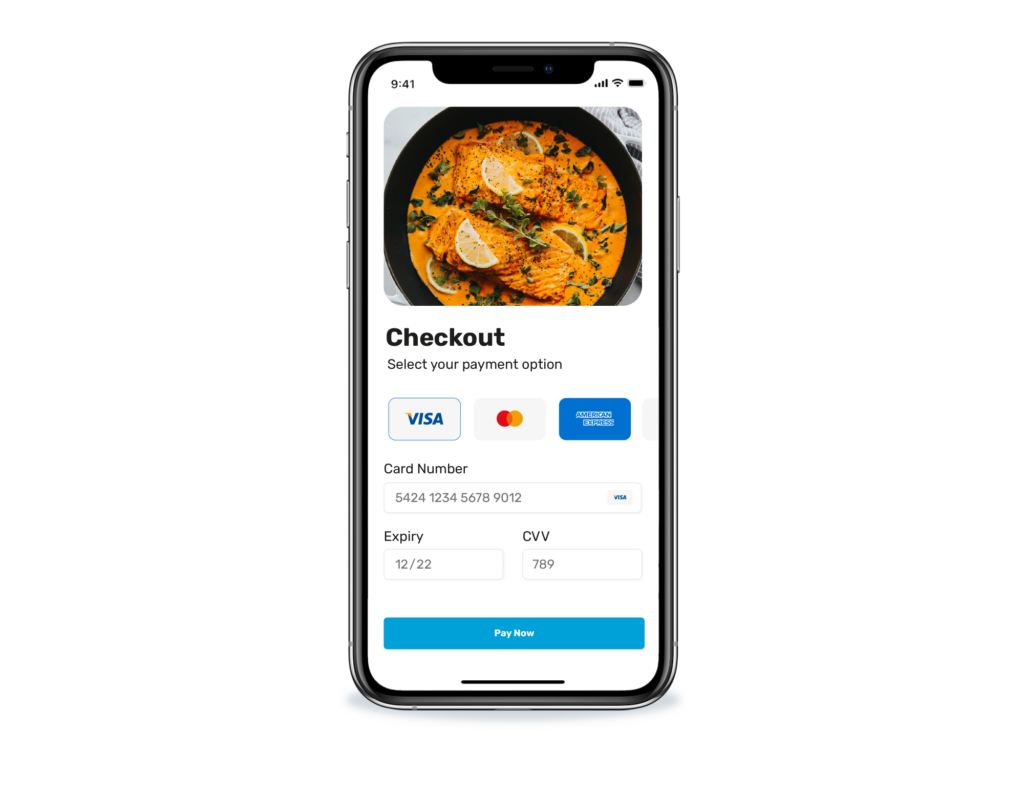

This type of e-commerce is easily facilitated by implementing globally reaching alternative payment methods (APM) and local acquirers, combined with best practices for checkout conversions. If you fail to offer local payment methods, research shows that 20% of consumers will abandon their purchase.

For example, merchants in the UK can cater to APMs that are popular in other countries, such as Alipay and WeChat which are widely used in China to fulfil consumer demand met by Chinese consumers when shopping for items they cannot find in their own country. Chinese shoppers can shop across borders in order to purchase certain items to avoid accidentally purchasing counterfeit goods domestically or find items that aren’t available in their country.

By opening your business up to cross-border online shopping, your audience reach becomes international rather than just national – done right, can be a huge success.

The perks don’t end there! Here are some more benefits as to why consumers like to shop internationally, and in turn, why it could be good for your business:

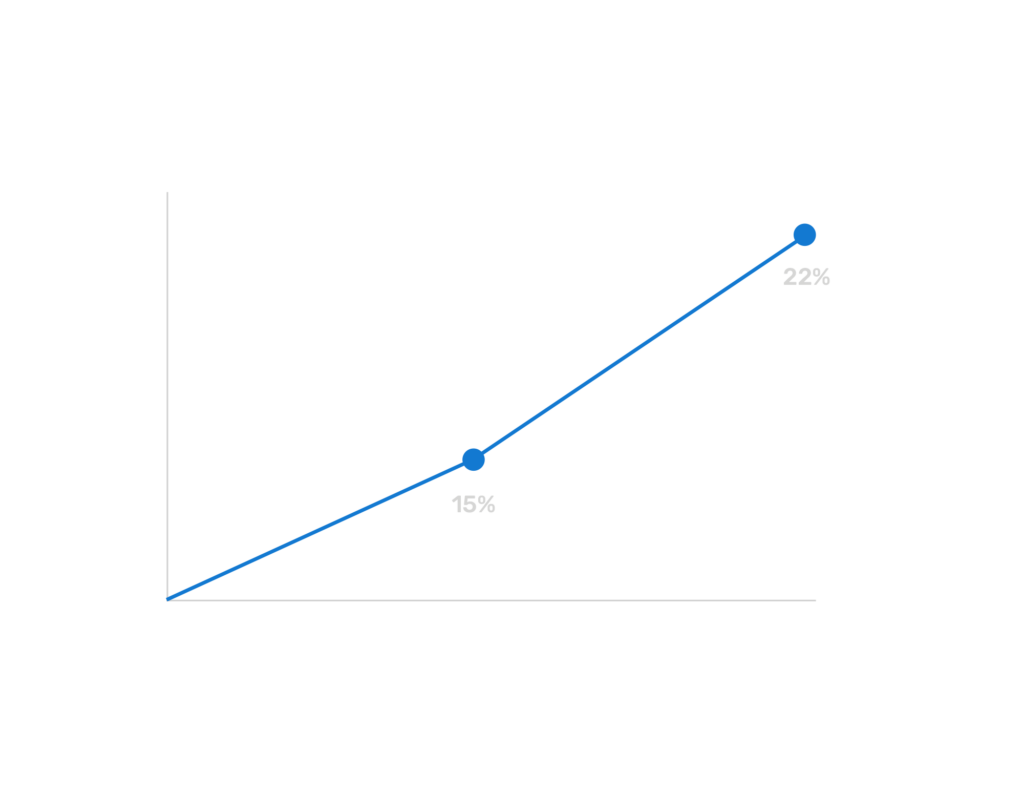

Accounting for nearly a quarter of online transactions worldwide, cross-border e-commerce plays a big part in global trading. Since 2016, the percentage of online sales increased from 15% to 22% in 2022, and is showing no sign of slowing down as the implementation, availability and security becomes even more seamless.

Popular merchants for cross-border consumers in Europe include Ikea, H&M, Nespresso and Zalando. Their credibility as global merchants were ranked by their ability to cater to consumers in their native language and currencies, as well as seamlessly provide a variety of payment methods.

So, we’ve covered why cross-border shopping is on the rise, but what, as a merchant, should you consider before you make a decision? Take a look at the adaptions needed and challenges of cross-border e-commerce:

The UK is actually the third-largest market for international online purchases, with the USA and China taking the top two spots. But what’s the location of these international shoppers? Well, for the UK, the largest consumer base comes from the UAE (30%), China (28%) and India (27%).

It’s important to know this so that you know which markets to target, for example, which alternative payment methods to launch first.

Regulations around compliance can be confusing since they are often updated and can vary by country, so it can be hard to keep up causing friction for a lot of merchants.

So, you’ll need to make sure you have a dedicated team in place who are aware of the regulations of the region you want to expand to.

When supplying goods or services to a global audience, you need to offer relevant payment methods to each audience to cover consumer demand. In making these offerings, a merchant needs to understand which payments are most commonly used in which countries (and regions) and why.

Naturally, this can come with added costs to cover integration and risk assessments which your payment provider should help mitigate, but the potential for an increase in revenue can make it worth it.

When shopping online, do you prefer it if the site uses your native language and currency? It’s not surprising that most people do. So, in becoming a global merchant, you should consider optimising your customer journey by allowing consumers to shop in their native language and offering not only a preferred payment method but a local currency for them to pay in.

The main way of facilitating this is to enable IP recognition on your site to boost conversions.

Offering different payment methods may require numerous checkout flows and redirects which can add to your business’s internal efforts. It’s important to weigh up the manpower needed to make it happen and any potential friction it can cause the consumer. But with the right payment provider, they can help to facilitate the process to make it as seamless as possible.

Even though mobile commerce is on the rise, the majority of cross-border shopping still happens on the desktop. But that doesn’t mean you should ignore m-commerce, you may just want to consider where you spend your time when it comes to optimising the checkout flow.

Whilst nothing changes on your end when facilitating a cross-border service, your customers may be subject to tax and customs handling when receiving their goods – resulting in a loss in retention and loyalty – and possibly disputes.

It’s important to have access to multiple acquires to ensure that you can accept payments all over the world. If you’re limited to one acquirer, the chance of having a high decline rate will increase. Thankfully, with Total Processing, you’ll have access to more than 300 acquiring banks.

To be able to implement alternative payment methods, scalability to adapt to your international growth and connect to a range of local acquirers to accept payments worldwide, you’ll need the right payment gateway that allows this.

Going global is more than your payment method. It can be a balancing act between a potential increase in conversions, your brand authority and the additional costs and resource needed for your business. Considering them all is important before you make your decision.

While there are many societal threats that can affect the rise in cross-border shopping, such as global pandemics and Brexit, the right strategy could allow the majority of businesses to scale globally with finesse.

At Total Processing, we can help you do that. With a wide range of acquiring banks, more than 198 alternative payment methods to choose from with multiple currency options and in-depth reporting to manage optimisation, we can help you scale your business worldwide.

So, if you’re ready to expand your business, get in touch with us today to start implementing the right approach to global cross-border e-commerce.