The impact of late payments on SMEs

A few late payments here and there may not seem like a big deal. But, when you’re a small to medium enterprise (SME), these late payments can make or break your business. Especially when it’s a larger payment as this affects their cash flow at a greater rate. Just last year, 37% of SMEs in the UK applied for credit to manage their cash flow due to late payments.

We’ll explore how these delays affect small businesses, share some tips on managing and reducing late payments effectively, and discuss ways in which SMEs can adapt to this common challenge.

Late payments can have a domino effect on SMEs, causing a cascade of problems. Let’s take a closer look at some of the most significant ways they impact small businesses:

Cash flow crunch: When payments from clients or customers are delayed, it can disrupt your cash flow. This makes it challenging to pay your own bills, employees and suppliers on time, potentially leading to financial strain.

Limited growth: Late payments can hinder your business’s growth potential. Without a consistent and reliable inflow of funds, it’s difficult to invest in expanding your operations, hiring new talent or launching new products and services.

Increased borrowing: To cover operational expenses during cash flow gaps, SMEs might resort to borrowing money, often in the form of high-interest loans. This, in turn, can lead to increased debt and financial stress.

Strained supplier relationships: If you’re unable to pay your suppliers promptly due to late payments from customers, it can strain your relationships with these critical partners, potentially affecting the quality and availability of your products or services.

Wasted time and resources: Chasing down late payments consumes valuable time and resources that could be better spent on growing your business. It’s frustrating to have to play the role of a debt collector.

Now that we understand the negative impact of late payments, let’s explore some strategies to manage and reduce them effectively:

Clear payment terms: Set clear and concise payment terms from the beginning of any business relationship. Ensure your customers understand when and how they should make payments.

Invoicing automation: Use invoicing software that automates the invoicing process and sends reminders for overdue payments. This can save you time and reduce the chances of payments slipping through the cracks.

Offer incentives: Consider offering early payment discounts to encourage customers to pay on time. Conversely, you can charge interest on late payments to create a financial incentive for timely settlement.

Credit checks: Before engaging with new clients or customers, perform credit checks to assess their financial stability. This can help you identify potential late payment issues in advance.

Communication: Maintain open lines of communication with your customers. If they’re experiencing financial difficulties, they may be more likely to inform you if they feel you understand their situation and are willing to work with them.

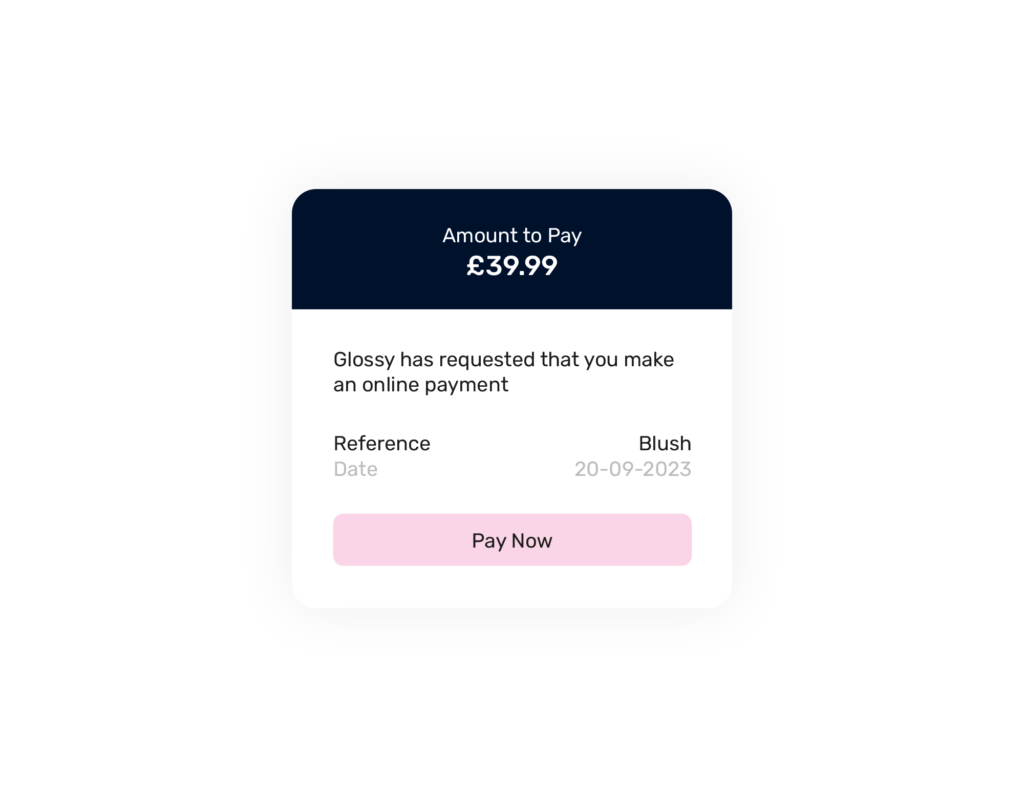

Invest in the right payment service provider: A PSP can have all the tools you need to implement these tips. Finding the right one can help you increase timely payments as well as reconcile any that slip through the cracks.

Adaptation is the key to survival in the world of SMEs, and late payments are no exception. Here are some ways small businesses can adapt to this common challenge:

Build a cash reserve: Establish an emergency cash reserve to help you weather periods of late payments. This buffer can cover essential expenses and prevent you from resorting to costly borrowing.

Diversify your client base: Don’t rely too heavily on a single client or industry. Diversifying your customer base can help reduce the impact of late payments from a single source.

Flexible payment options: Offer flexible schedule options to your customers. This can make it easier for them to manage their transactions and reduce the risk of late payments.

Legal recourse: If all else fails, be prepared to take legal action as a last resort. Consult with a legal professional to understand your rights and options in pursuing overdue payments.

So, we’ve established timely payments to help maintain a healthy business, but how do you achieve it? That’s where we come in. With our recurring payment solution, we offer a range of features to make sure your revenue keeps coming in, including:

To find out more about each feature, head to our recurring payments page for all the information you need.

To conclude, late payments can be a significant headache for SMEs, but with the right strategies and a proactive approach, you can minimise their impact and keep your business on a steady path to growth. Remember that adaptability and effective communication are your allies in managing late payments and ensuring your business thrives.

Our payment specialists are ready to help you tackle this issue, so get in touch.