Processing High-Risk Businesses

Are you classed as a high-risk business? Then we completely understand the struggles you may be experiencing when on the search for the right payment provider. However, do not fear, you’re in the right place. Starting from the beginning, let’s run through everything there is to know about payment processing for high-risk businesses.

In short, a high-risk business is one that’s more likely to face potential risks due to various factors, including fraud and high chargeback rates. But, here’s the thing, this label is mostly used by payment providers to evaluate your level of risk as a client. So, don’t worry, it doesn’t mean that your business is bound to fail or has no potential, it’s more likely that you just fall under a high-risk business sector. However, it’s good to understand why this classification exists and what it means for you.

In our rapidly evolving digital society, the transition to an online world comes with a new and ever-increasing number of risks. The process of accepting online payments is sadly not excluded from this, and payment providers constantly have to monitor the increasing prevalence of cases of fraud which they’ll usually have to take liability for.

For this reason, minimising risks when taking on new merchants is becoming more of a priority. So, when it comes to applying for a merchant account to accept online payments, you may find that your business is categorised as high-risk after an initial assessment, and, therefore, you will need to open a high-risk merchant account.

A high-risk merchant account exists so payment providers can accept businesses that are considered more of a risk to take on, rather than rejecting the merchant account application altogether. This gives payment providers the ability to offer high-risk businesses the flexibility to handle multi-currency transactions whilst also protecting against fraud.

We hate to be the bearers of bad news, but opening a high-risk account will always mean higher fees than a typical merchant account. There’s no way around it. These are necessary to compensate for the increased risks the payment provider is taking on and will generally consist of:

These added fees exist to protect payment providers against charges from customers and fraud. They will usually amount to either a portion of your revenue over your business operations or an upfront fixed bond that covers all your costs.

If you’re uncertain whether you’ve got a ‘high-risk business’, we’ve created a clear checklist for you to go over. There are two main reasons why you’d fall under a high-risk label:

Let’s break this down a little further. Your company is classed under the first reason due to one or more of the following:

Now let’s go through a list high-risk business examples based on industry (it’s more than you may think!):

Now you know if you’ll need a high-risk merchant account, let’s go through the process of actually getting one. First of all, you’ll need to set up a merchant account via a payment service provider. Unfortunately, it’s no secret that if your business meets the high-risk checklist it’s more likely your application may be rejected by some providers.

However, this does not mean you should just go along with the first provider that accepts you! Ensure you choose a provider that’ll negotiate the best rates for you, like Total Processing. Through our relationships with multiple acquiring banks, it’s possible to negotiate fairer pricing for:

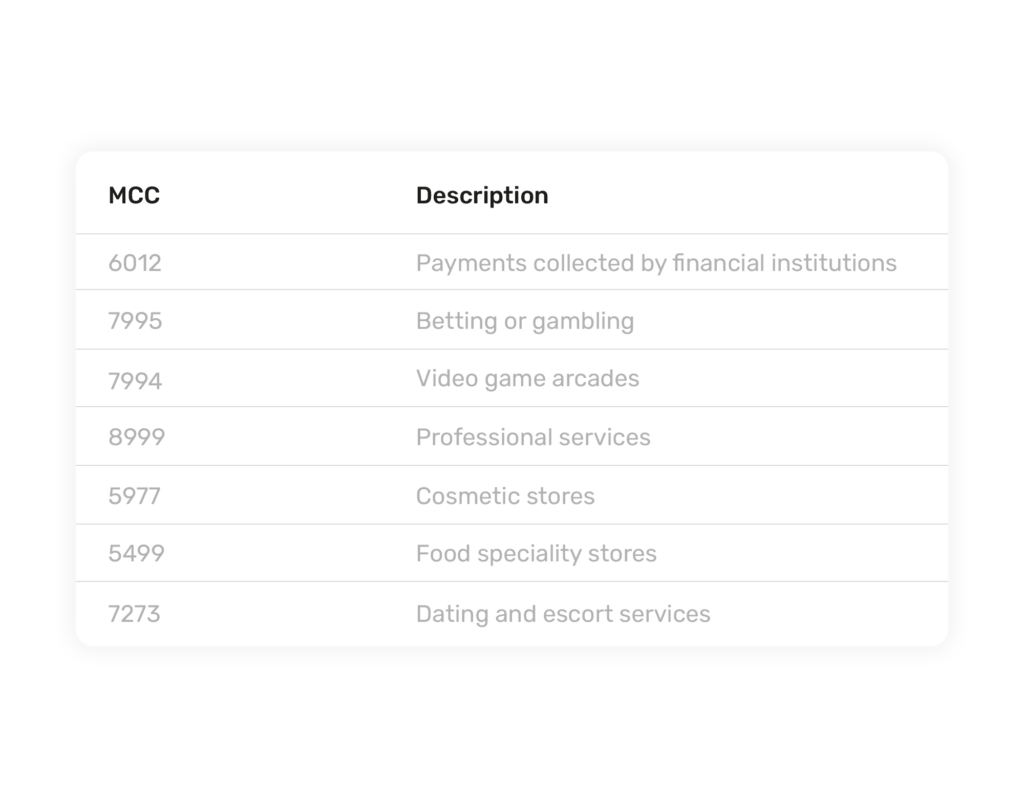

Merchant Category Codes (MCCs) sound complicated but are simply a way payment providers identify businesses with merchant accounts based on what type of service they provide to consumers.

Your high-risk business will fall under one of the following MCCs:

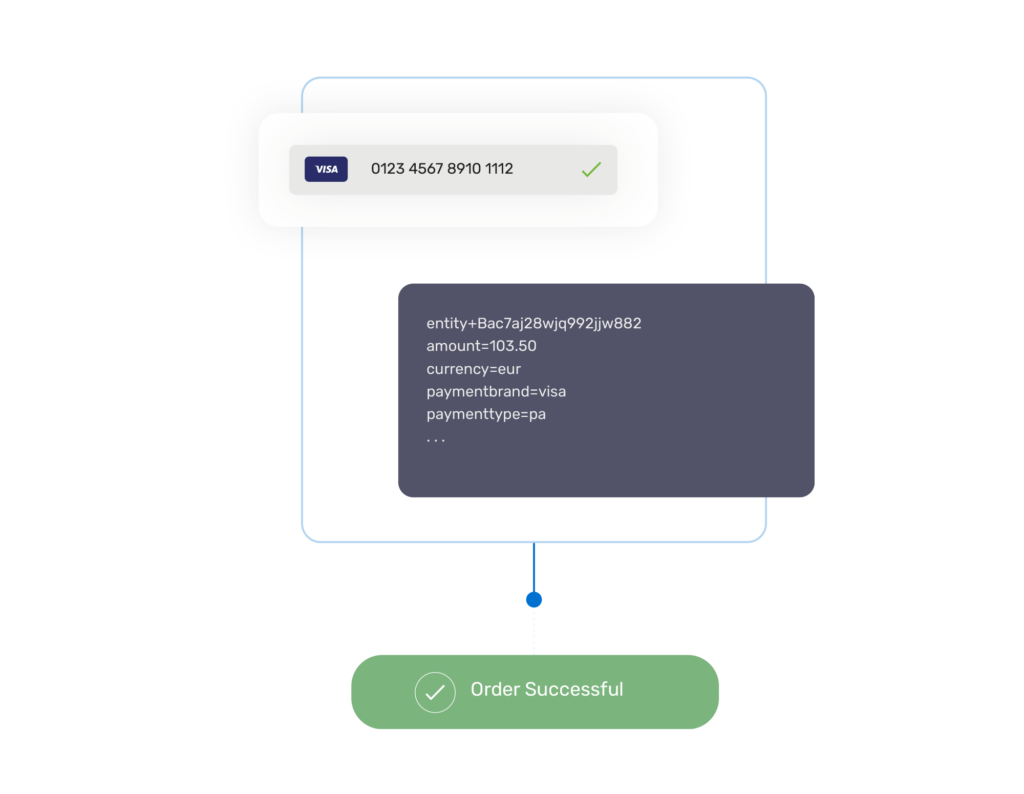

Next up is to find a payment gateway for your high-risk business.

It’s important to note that when a customer is making a transaction from a high-risk merchant, their issuing bank will often require additional information that verifies the customer’s explicit consent in making the transaction. This is to the benefit of you, the merchant, in preventing fraud and damaging chargeback claims.

Some payment gateways may find it difficult to process high-risk businesses due to these additional security authentication and fraud screening parameters that are set in place.

That is why, when choosing your payment provider, you’ll want to ensure they can provide your high-risk merchant account with a payment gateway strongly equipped with solutions to protect against chargebacks and credit card fraud. Let’s quickly run through a few key features to look out for:

And that’s it! You’re all equipped with the essential need-to-know information when looking to set up your high-risk merchant account. So, if you’re ready to get set up with a payment processor for high-risk business, get in touch with our payment specialists to kickstart the application process. Or, if you want to dig a little deeper first we’ve got you covered with even more insights into MCC’s and high-risk merchant accounts here!