Merchant accounts vs payment gateways

The world of online payments can be confusing at times. Common questions we are often asked include:

Fortunately, we can answer these questions quickly. No, they aren’t the same thing. And yes, you will need both of them to receive payments from your customers — because they both serve different essential purposes.

This is how they are different:

It’s also not uncommon for our customers to ask why the merchant account needs to exist at all. After all, why can’t the money just jump straight from the client’s bank account to your business bank account? Unfortunately, that’s just not how it works for online merchants.

With that out of the way, let’s take a look at both merchant accounts and payment gateways one-by-one.

What’s in this article?

We’ll tell you what it isn’t first. A merchant account is not the same as a business bank account.

The function of a merchant account is to hold your customer’s money after they’ve made a purchase from your physical store or online store. The merchant account only holds this money for a small amount of time, usually one to seven working days depending on the business model, while the debit or credit card is processed and verified to make sure that everything is in order.

After the card is successfully processed, the merchant account then deposits the funds into your business bank account.

Sometimes your merchant account will keep some money locked inside in case of any fraudulent activity or to pay a refund. This is called a rolling reserve and is usually between 5-10% of the funds.

Merchant accounts do have some important benefits. Let’s take a look at them:

They tend to group large amounts of transactions together, depositing all of them in your business bank account in one go. This makes it much easier for merchants to keep track of the transactions processed.

The rolling reserve makes things much smoother and easier should a refund for a customer purchase have to be made.

Merchant accounts also allow for fraud checks to be more readily carried out. So if anything suspicious takes place — such as a dodgy-looking payment — it can be identified and dealt with before it lands in your business bank account.

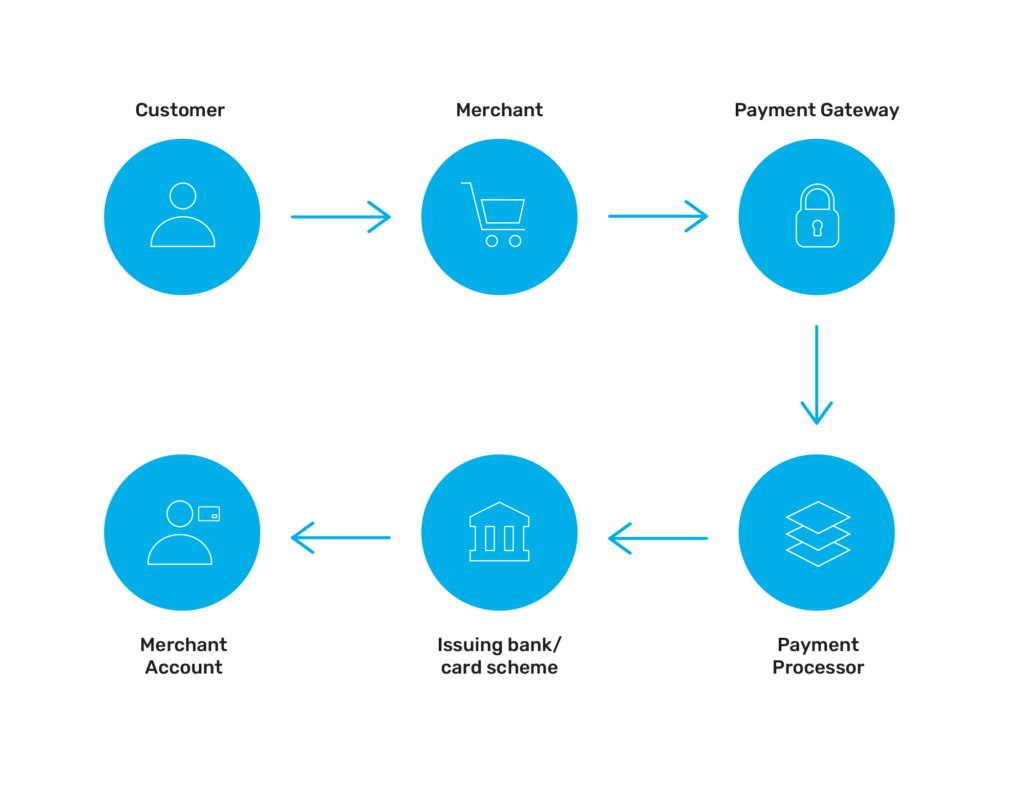

Think of a payment gateway as a bridge that connects your merchant account to your customer’s bank. The role of the payment gateway is to allow your merchant account to receive money from your paying customers.

It passes your customer’s card details to the acquiring bank for them to be verified. The gateway will then send the communication of whether the transaction has been approved or declined. If it has been approved, it will allow the transfer of funds.

Again, it’s a common question to ask why a payment gateway needs to exist at all when, theoretically, the money could just move straight from the customer’s bank account to your merchant account.

But payment gateways are very important for security purposes and to enable smooth transactions.

For example, a payment gateway collects and encrypts your customer’s card details, protecting them from potential hackers or fraudsters. If it detects an issue during this collection process, such as lack of funds, you as the merchant are then given the ability to either proceed or abort the transaction (or suggest that an alternative payment method be used instead).

People also sometimes confuse payment gateways with payment processors. The two are not the same.

A payment gateway, as we discussed above, is what allows a card transaction to either go through or be rejected. A payment processor is what then actually makes the transaction happen once the payment gateway has allowed it.

So it can be helpful to think of a payment gateway as a middle-man. With that in mind, what kind of middle-man do you want overseeing your transactions? Some payment gateways out there are very limited, which could in turn limit your business’s ability to accept payments and to grow.

The best kind of payment gateway, on the other hand, can handle 100s of different alternative payment methods alongside credit and debit card purchases.

There are a few different types of merchant accounts available depending on your business model that your payment service provider can offer you.

The standard merchant account can be called a dedicated account. This type of account can give you a lot of flexibility, offering the ability to customise and control your account with all the perks you need. Including flexible credit limits and cost structures, chargeback protection and multi-currency payment acceptance options.

Businesses who are classed as ‘high-risk’, such as cryptocurrency, gambling and adult sectors, will require a high-risk merchant account. Due to the nature of the business model, the payment processor, card network and acquirer will need to ensure more precautions are in place. This can prolong the set up process as more documents will need to be filled out and the cost can be higher.

But it does mean that despite the risk your business holds, you can still be approved for a merchant account.

Depending on the nature of your business, usually one type will be a much better fit for you over the other.

You also need to be aware that some companies may charge a lot of extra or hidden fees. Standard fees include conversion fees, processing fees and chargeback fees. While hidden fees could include:

You will also need to research their anti-fraud protection tools, too to see if they are up to scratch.

It’s also worth checking if the merchant account you’re considering allows for payments in lots of different currencies. Especially if you are looking to take your business global at some point.

Similar to a merchant account, there are a range of payment gateways more suitable than others depending on your type of business.

The main areas to consider when choosing a payment gateway are:

While you shop around for a payment gateway provider, make sure to ask the following probing questions:

At Total Processing, the payment gateway we use offers all of the above. Along with the versatility and protections to support high-transaction volumes and high-risk businesses on a customisable level — and at very competitive rates.

The payment gateway we provide offers PCI security parameters and 3D secure fraud prevention software to fend off any malicious breaches during the transaction of sensitive customer information.

And we don’t just work with one acquiring bank. Our merchant services has access to more than 300 acquiring banks to ensure that transactions are processed with the best possible rates for your business.

You asked: “What is a payment gateway versus a merchant account?” Hopefully by now the picture is a little clearer. To beat fraud and stay ahead of the competition, you’ll need a great payment gateway AND merchant account.

They are two different things, but equally important to the handling of payment transactions online and in-store. That’s why it’s crucial to get both a payment gateway and a merchant account that will help your business succeed.

At Total Processing, we can offer an all-in-one payment provider service — effectively a payment gateway and a merchant account combined — for a convenient, secure and streamlined service with an unbeatable, dedicated 24/7 customer support.

But we can also offer separate payment gateway provider services and merchant accounts to help you master your online payments. Just get in touch, and we’ll get to work on your online payment solutions for your business.