Chargebacks vs hospitality – How to ‘check-out’ friendly fraud

As a merchant, when we say chargebacks we’re sure a headache, a nuisance and unwanted costs are a few things that come to mind. But what do you think consumers think about? A high-value item that never turned up? Or a random transaction from overseas that definitely doesn’t belong to the cardholder? Although these are up there with the most used chargeback types, you’d be surprised to know that there’s a more common reason for a chargeback.

In fact, chargebacks have found a prime market within an industry that is left openly vulnerable to attacks due to the nature of its operation…The hospitality industry.

It may be considered to be one of the fastest-growing contributors within the payment solutions market, but a study found that in the US, 55% of all card fraud takes place within this industry. So it goes to show that without the right fraud management, the rise of chargeback culture can act as a considerable catalyst to this movement.

But why is this the case and what different types of chargebacks are causing the industry these costly issues?

Hospitality businesses have a whole host of issues to contend with when it comes to payments and tackling fraud. With various booking channels and modes of payments used to drive revenue, these are exactly the avenues in which chargebacks accumulate.

Here are the key challenges within the industry:

One of the easiest ways for a fraudster to test the balance of a stolen card is to place a reservation with it and charge it back to the bank. As chargebacks are notoriously hard to defend, and still not without cost (as we’ll get into) it is only one particular area of chargebacks that are successfully defended most of the time.

Customers may book a room and at the last minute make a decision not to turn up. If the cancellation policy doesn’t allow this, it can be easy for them to file a chargeback instead. Regardless of the reason, the loss of revenue will fall back on the hotel. Over in the US in 2021, 49% of consumers who had cancelled reservations, claimed their money back via a chargeback.

Similar to no-shows, guests may make a reservation in which they will pay a deposit – or even pay for the cost of a room upfront – only to book another room at a better cost. But when they notice that they are charged for the first booking because they forgot to cancel it, a chargeback will be filed to resolve the issue.

Failure to properly authorise payments can lead to chargebacks. In the instance where either the merchant is at fault or friendly fraud has been committed, failure to verify the identity of the cardholder so that a booking is placed without the cardholder’s knowledge can lead to these claims.

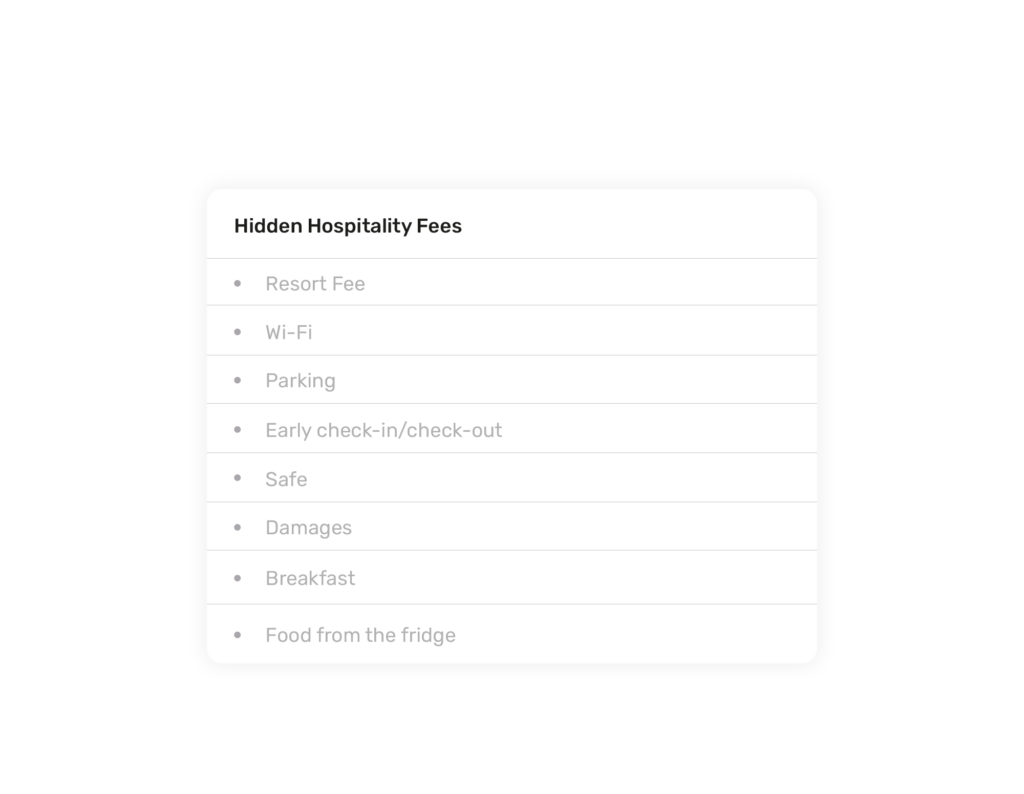

Deposits or additional fees that the customer is not aware of may lead to chargebacks.

Hotels may not take payments straight away. However, a delay in charging guests can be both frustrating and confusing to the customer who had previously allocated funds. Since it’s being taken at an unexpected time, the customer may either not recognise the charge or might not be able to afford it at that time, leading to a chargeback.

Hotels are often owned under a larger organisation or chain so can appear under a different name on a bank statement. This results in an onslaught of chargebacks that can either be intentional or cases of friendly fraud, wherein the customer did not intend to go past their initial enquiry of ‘cardholder does not recognise’ with the bank.

Whilst defending a chargeback is often a lost cause, this is probably one of the easier claims for a merchant to win as long as they can provide evidence to prove their identity. However, despite recovering their lost revenue, hotels will not recover the chargeback fine charged by the bank, nor the mark against their processing record which, down the line, can ultimately affect their right to process at all.

With no 3D Secure elements in place in the checkout flow, fraudulent or multiple transactions can be accepted. Two-factor authentication is essential to prevent this from happening. As soon as the genuine cardholder notices the transaction, the merchant will receive a chargeback.

When a guest makes a booking, they may forget or not realise that it is not inclusive and a movie-on-demand, mini bar or other hotel services they have used have been added to their bill. Additionally, if the hotel determines that there are damages to be paid, this can incur even more costs that they do not recognise.

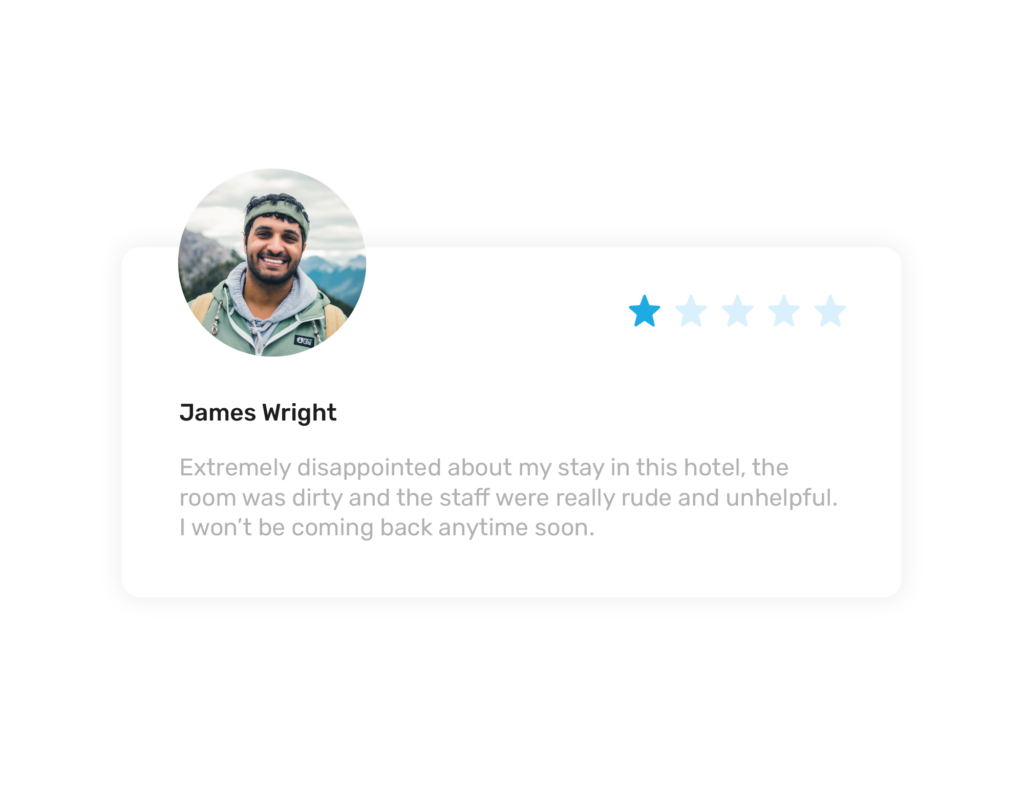

Filing a chargeback for customer dissatisfaction can often fall under the reason code 4853 (MasterCard), otherwise known as a ‘not as described’ chargeback claim.

As chargebacks are often filed by 96% of dissatisfied customers who fail to raise a complaint with merchants, there is a significant call for resolutions. However, within this sector, a chargeback is more likely to be claimed out of convenience.

The time in which customers have to file a chargeback can extend up to 6 months, depending on the service provided. Considering a hotel’s revenue, this can lead to a whole new threat to the industry in false positives and perishability – where fraudsters also take up reserved spaces meant for valid bookings.

Whilst new measures have been taken to protect against chargebacks and fraud across e-commerce, the unshakeable business model for the hospitality sector means that large and small chains alike still lay vulnerable to attack. But here are a few solutions to minimise this!

Offering alternative payment methods such as Apple Pay and Google Pay ensures that a payment will be two-factor authenticated and identifiable. Also, using card terminals can instantly detect out-of-date cards and financial discrepancies. These compliant payment tools are implemented to negate chargebacks in the industry.

Used in card-not-present (CNP) transactions, an address verification check is used at the time of purchase to verify whether the address details entered match those registered with the issuing bank. This is a common fraud-preventative tool.

A refund always carries fewer consequences than a chargeback. So, if you get the chance to issue a refund instead, take it.

Uninterrupted access to customer services to resolve customer issues may help prevent chargebacks from being raised in the first place.

Making sure a hotel is clearly identifiable on a bank statement will help reduce the number of ‘do not recognise’ chargeback claims.

Clear policies on what a guest is charged for and at what stage of their stay should be clearly stated in the booking confirmation.

Hotels should keep clear records in order to fight any chargeback claims or manage any issues before they can escalate to a chargeback.

Total Processing’s payment gateway offers customisable fraud parameters to allow hotels to take payments tailored to specific authentication elements. With our smart fraud suite, you can manage and prevent chargebacks to limit the amount coming through and decrease the cost on your business.

Get in touch today to find out more about it!