Are payment links secure?

Payment links are a quick and easy method to get paid and are just as quick and easy for the consumer. Since speed and convenience is all consumers want these days, it’s a great option to choose.

Which is why they’re particularly popular within the hospitality sector. But, since they are a good way to chase payments, they’re also a useful method when it comes to payment collections too.

But are pay by links secure?

We’ll take a look at the risk and security measures in place so that you can comfortably integrate this type of payment request.

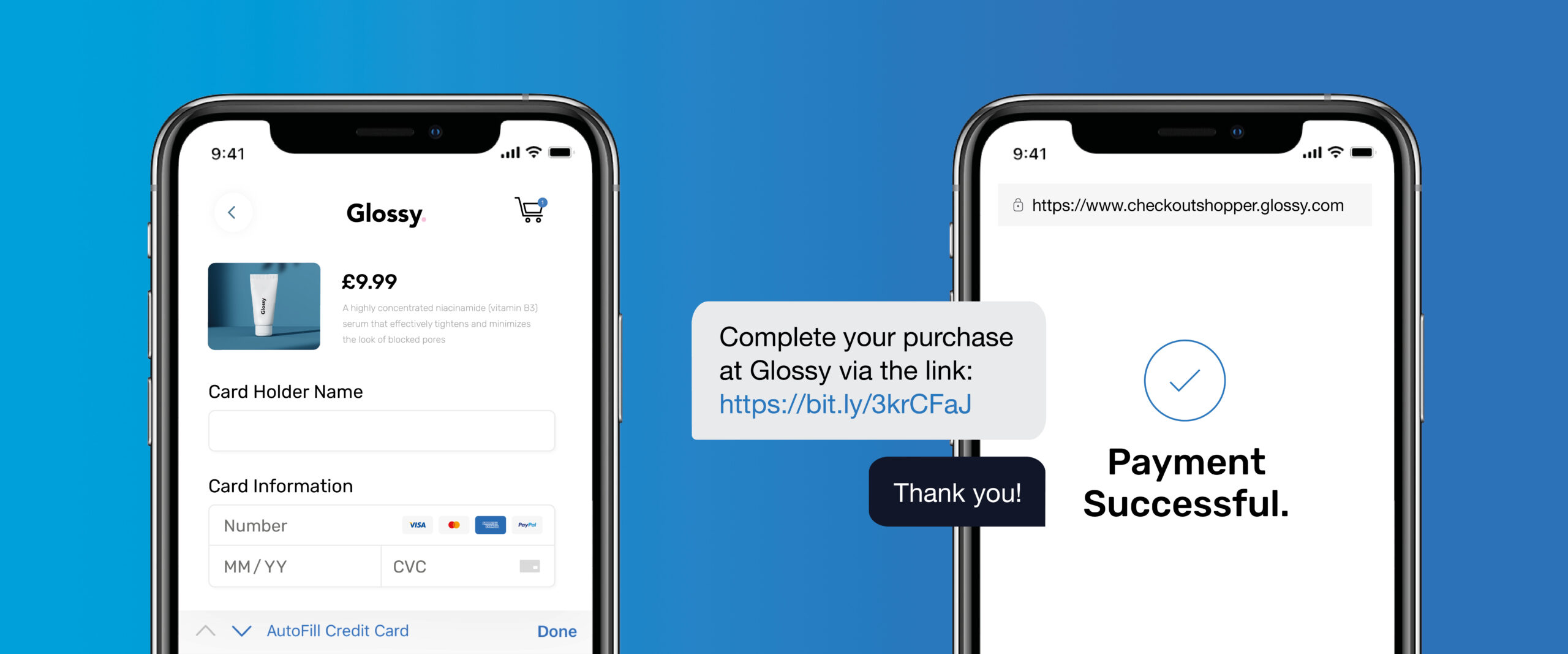

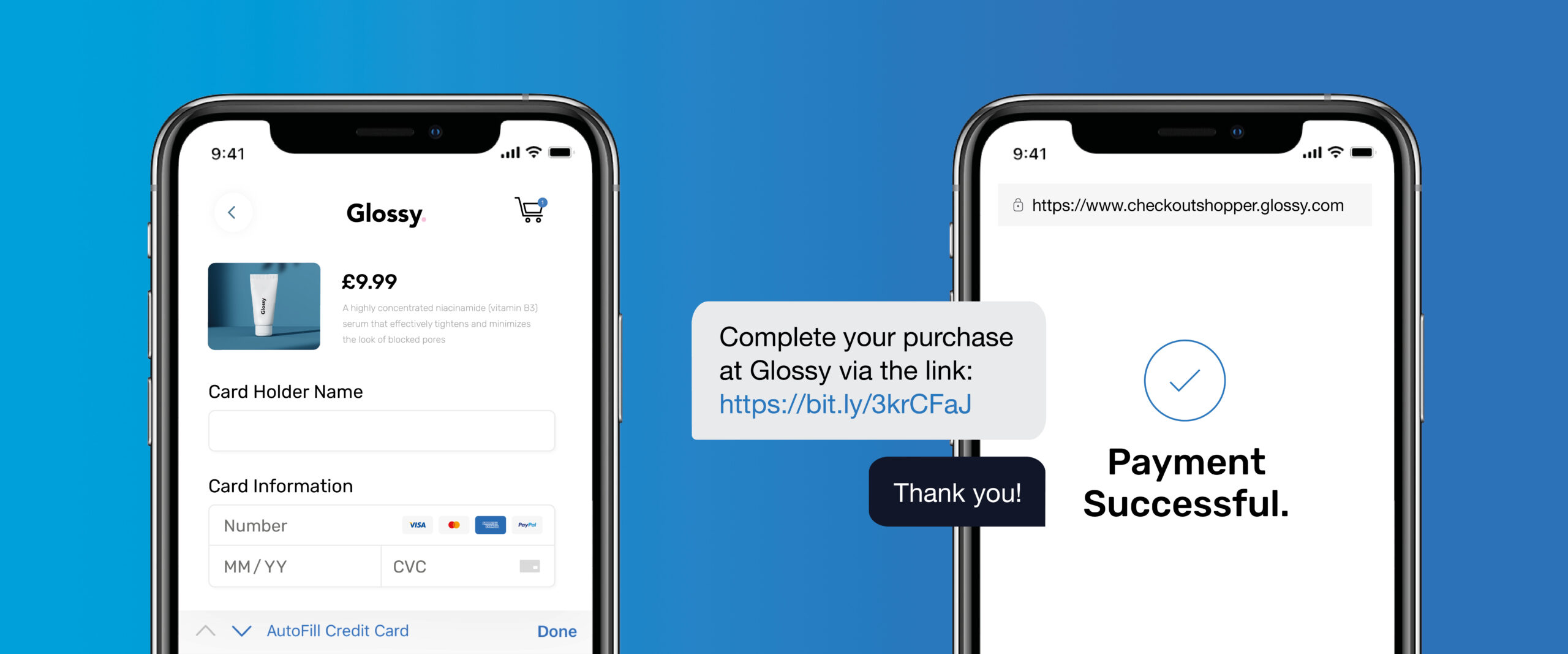

A pay by link is exactly what it says it is; a link you can send to your customers so that they can easily pay for your goods or services. It’s a type of pay invoice which can be sent in a number of ways, most commonly via an email link or SMS link.

The link will direct the customer to a payment page where they can make the payment when and how they want for ultimate convenience, removing any friction that may have prevented them from completing the transaction.

They can also be used for both one-time payments or recurring payments making them adaptable for any business!

Payment links are sent via a secure payment gateway, making them just as safe as any other channel. Just like when paying via a website, there’s also the option to tokenise the customer’s card details (the process of securely storing the card information by replacing the details with a unique code called the ‘token’), making it an ideal option for subscription-based models.

But what makes pay by links so secure?

A secure online payment link is always fully authenticated and sensitive data will remain encrypted since it must be compliant with the PCI DSS standards.

Being a 3D Secure payment portal, strong customer authentication (SCA), like a one-time passcode or facial recognition, is also enforced to protect both the merchant and the consumer from fraudulent transactions.

Some of your more security-conscious customers may ask themselves this question and feel dubious about clicking the link. Especially since it’s been ingrained in us not to click any links! So how do you convince them that it’s completely safe? Here are a few tips:

There are many benefits of a secure pay by link for both you, the merchant, and the consumer. Including:

Just like any payment method, there’s always an element of risk. Fraudsters use smart techniques to gain access to a customer’s details and will attempt to use any form of payment. However, again like with any method, if you follow the security regulations and implement the relevant protocols you can lessen the risk.

Using additional tools to stay on top of your transactions and any suspicious activity will lower the risk even more. Check out our fraud suite to see all the tools we can provide to keep your pay by links secure.