Trustly

What Is Trustly?

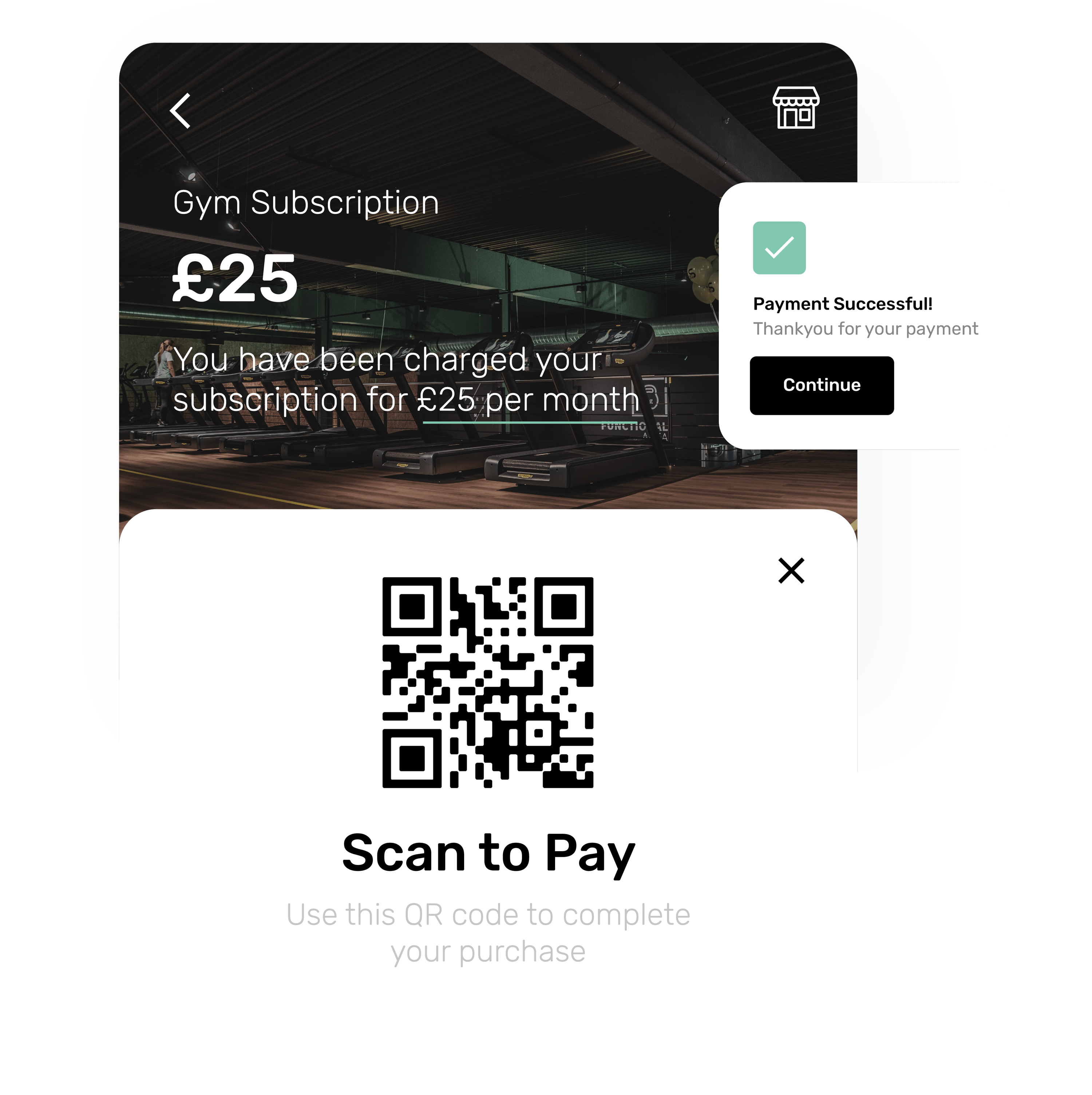

Take payments online securely with direct bank transfers facilitated by Trustly. Widely used in both the B2C and B2B sectors, Trustly is a secure and simple way to make e-commerce payments in travel, online gaming and gambling services.

View More In Our Developer Documentation

| Payment Type | Commerce Channel | Chargebacks | Recurring | Refunds |

|---|---|---|---|---|

Payment TypeBank Transfer |

Commerce ChannelE-commerce |

ChargebacksNo |

RecurringNo |

Refunds |

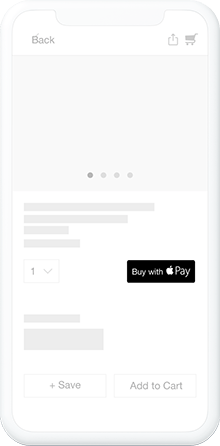

How Does It Work?

Ready To Start Accepting Payments?

The all-in-one solution for your business. Get a quote or schedule a call to demo our powerful suite of features.

Frequently Asked Questions

To get a merchant account, all you need to do is send us an application. You’ll be partnered with one of our banking partners in order to provide you with the best merchant account options that are cost-effective and suit your business best.

A merchant account is a business bank account. It’s used to receive payments from debit and credit cards for your products or services. Payments are held in your merchant account until they are settled into your bank account.

The cost of your merchant account will depend on various factors such as the type of industry and/or the level of risk involved in your business. For example, a high-risk merchant account would cost more than a low-risk merchant account.